Miss France 2026: à Amiens, 30 prétendantes pour une couronne

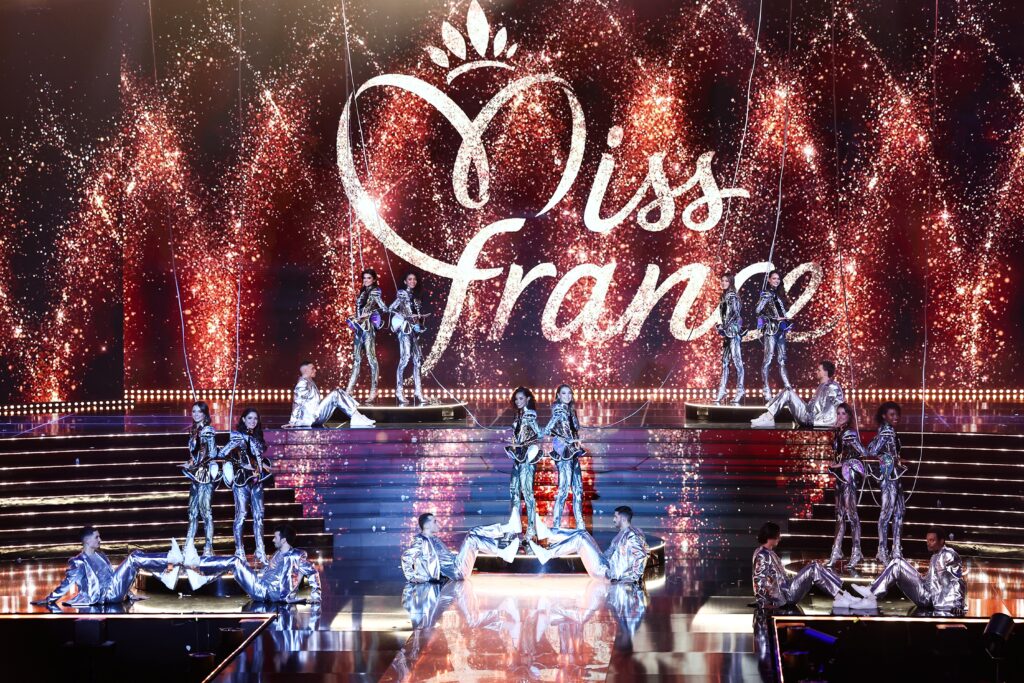

Trente candidates âgées de 18 à 30 ans tentent samedi soir à Amiens de décrocher la couronne de Miss France 2026, lors d’un concours suivi chaque année par des millions de téléspectateurs, malgré des critiques récurrentes sur sa représentation des femmes.”C’est un rêve. J’aime tout: l’assurance des femmes, les paillettes, le maquillage, les strass… C’est magique”, s’enthousiasme Marine Antoine, 25 ans, infirmière, venue assister à l’émission en direct au Zénith d’Amiens. “Cela représente la féminité. Je suis fan depuis toute petite. Les filles s’acceptent, elles sont heureuses, ça nous donne un peu de magie, un peu de légèreté”, renchérit Eloïse Ucar, 34 ans, commerciale.La cérémonie, placée sous le thème du voyage, “l’Asie, le futur, l’Histoire ou les rêves”, à nouveau présentée par Jean-Pierre Foucault, 78 ans, s’est ouverte à 21H10. Les trente candidates ont lancé la soirée par une chorégraphie en robes de soirée pailletées. Le traditionnel tableau régional mobilise cette année la Garde républicaine.Les candidates issues des comités régionaux seront départagées par un vote mêlant public et jury, présidé cette année par la comédienne Michèle Bernier, entourée notamment de la chanteuse lyrique Axelle Saint-Cirel, du journaliste Bruce Toussaint et de l’influenceuse Sally.Côté règlement, 12 demi-finalistes seront désignées cette année, contre 15 auparavant. Les finalistes seront départagées à 50/50 par les téléspectateurs de TF1 et le jury. En cas d’égalité, le public tranchera.Selon Frédéric Gilbert, président de la société Miss France, certaines expressions jugées datées, comme “pleine de charme” ou “charme à la française”, sont désormais proscrites. “On parle “d’élégance, d’assurance, pas de sensualité forcée”, a-t-il affirmé dans Le Parisien.Depuis plusieurs années, des associations féministes, dont Osez le féminisme!, réclament la suppression du concours, dénonçant une “société de la femme-objet”.La gagnante succédera à la Martiniquaise Angélique Angarni-Filopon, 35 ans, la plus âgée de l’histoire du concours. Victime de cyberharcèlement en raison de son âge et de son origine, la Miss France 2025 avait un temps envisagé de renoncer à son titre.L’institution avait signalé à la justice “ces commentaires injurieux”, qui “n’ont pas leur place dans notre concours, pas plus que dans notre société”.Cette édition introduit un accompagnement inédit: pour la première fois, Miss France sera épaulée par une ancienne lauréate, une mission confiée cette année à Camille Cerf (Miss France 2015).- “Patrimoine télévisuel” -Les candidates de cette 96e élection affichent des profils variés. La doyenne, Miss Guadeloupe, Naomi Torrent, 30 ans, est analyste financière, Miss Poitou-Charentes, Agathe Michelet, est chirurgienne-dentiste, Miss Nouvelle-Calédonie, Juliette Collet, 23 ans, ingénieure en gestion des risques naturels et technologiques. Les benjamines, Miss Bretagne, Ninon Crolas, élève infirmière, et Miss Roussillon, Déborah Adelin-Chabal, danseuse professionnelle et étudiante en espagnol, ont 18 ans.Les critères d’admission ont été élargis ces dernières années: si la taille minimum demeure (1m70), l’élection est désormais ouverte à toutes les femmes majeures, sans limite d’âge, y compris mariées ou mères. Malgré les controverses, le programme continue d’attirer un large public: en 2024, l’émission avait réalisé 45% de part d’audience.”Etre populaire, ce n’est pas être aimé partout. Il y a des polémiques, mais bad buzz is still buzz”, observe la sémiologue et analyste des médias Virginie Spies.Selon elle, le succès tient autant à la dimension de divertissement qu’à l’ancrage historique du programme, “une madeleine de Proust” inscrite dans “notre patrimoine télévisuel”. L’émission alimente les conversations, en famille, entre amis ou sur les réseaux.Pour elle, Miss France reflète aussi “une société de critères et de clichés”, comme l’a montré l’élection de Miss France 2024, Eve Gilles, aux cheveux courts, “ça a été le sujet de l’année”. “On est encore dans le règne de Barbie”, estime l’analyste des médias.Le cabinet de conseil Avisia, spécialisé en data et intelligence artificielle, a mobilisé l’IA pour pronostiquer la lauréate. Selon son modèle de prédiction, Miss Nord-Pas-de-Calais, Lola Lacheré, 21 ans, étudiante en techniques de commercialisation et volleyeuse de haut niveau, aurait les plus fortes chances de décrocher l’écharpe. Le modèle de calcul croise des données hétérogènes: notoriété sur les réseaux sociaux, démographie des régions, composition du jury ou encore résultats des années précédentes.