Italie: la Juventus Turin écoeure la Roma et reprend des couleurs

Pour son dernier match de l’année à domicile, la Juventus Turin a offert samedi à ses tifosi un beau cadeau, une victoire contre la Roma (2-1) porteuse d’espoirs de qualification pour la Ligue des champions, voire mieux.En l’absence de l’Inter, leader avec 33 points, de l’AC Milan, son dauphin (32 pts), de Naples (3e, 31 pts) et de Bologne (6e, 25 pts), mobilisés pour la Supercoupe d’Italie en Arabie saoudite, la Juve pouvait réaliser une belle opération au classement.Et l’équipe de Luciano Spalletti, reléguée à la 8e place après la 8e journée, n’a pas tremblé. Elle a dominé la Roma grâce au Portugais Francisco Conceiçao (44e) et au Belge Loïs Openda (70e) pour son premier but en championnat depuis son arrivée en provenance de Leipzig.Sans son gardien Mile Svilar, décisif devant Openda (22e), Andrea Cambiaso (54e) et sauvé par un poteau (80e), l’addition aurait pu être plus lourde pour une Roma inhabituellement timorée.A la 75e minute, Tommaso Baldanzi a sonné son réveil, trop tardif.Si elle reste 5e de la Serie A (29 points), la Juventus est revenue sur les talons de son adversaire du jour, 4e (30 pts), et ne compte plus que deux points de retard sur le podium.”Notre victoire est méritée, c’était un match important après celui à Bologne (victoire 1-0, NDLR), mais il ne faut pas s’emballer”, a souligné Conceiçao.La Roma, battue pour la troisième fois lors des quatre dernières journée, a en revanche confirmé son incapacité à inquiéter les autres cadors du championnat: elle s’était déjà inclinée face à l’Inter, l’AC Milan et Naples.”On est un cran en-dessous de ces équipes, c’est évident (…) mais mon équipe réussit des matches de haut-niveau”, a analysé Gian Piero Gasperini.Dans la seule autre rencontre du jour, la Lazio Rome (8e, 23 pts) a été tenue en échec à domicile (0-0) par la Cremonese, promu sans complexes (11e, 21 pts).Cette 16e journée se limite à six rencontres ce week-end en raison de la Supercoupe d’Italie, dont la finale opposera lundi, toujours à Ryad, Naples à Bologne, vainqueurs respectivement de l’AC Milan et de l’Inter en demi-finales.

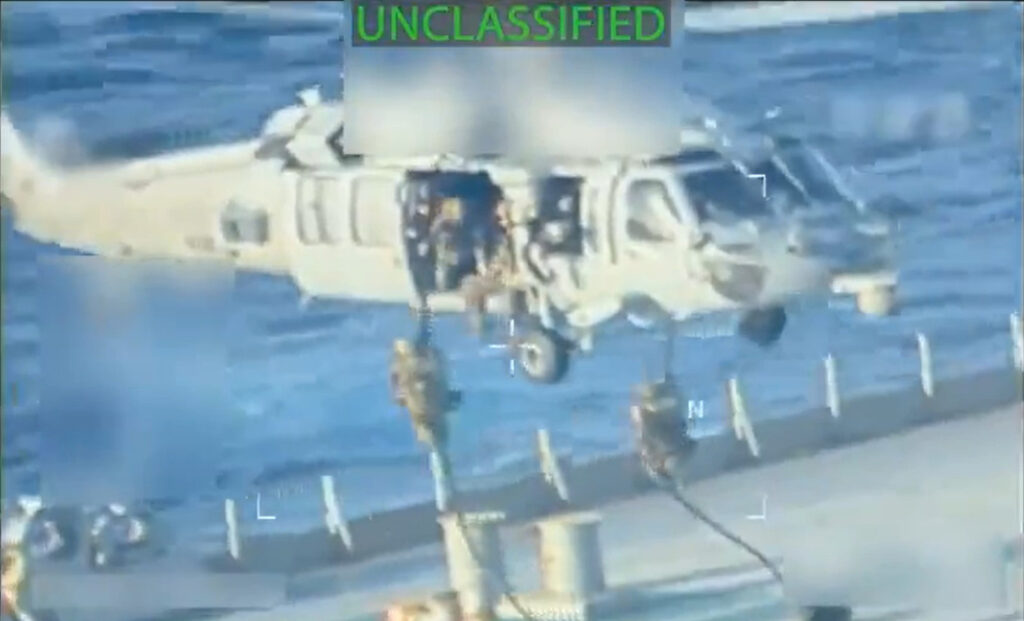

US intercepts oil tanker off coast of Venezuela

The United States “apprehended” an oil tanker off Venezuela on Saturday, the latest salvo in a pressure campaign against Caracas, the US government said Saturday.It was the second time in two weeks that US forces have interdicted a tanker in the region, and comes days after President Donald Trump announced a blockade of “sanctioned oil vessels” heading to and leaving Venezuela.”In a pre-dawn action early this morning on Dec. 20, the US Coast Guard with the support of the Department of War apprehended an oil tanker that was last docked in Venezuela,” US Homeland Security chief Kristi Noem said in a post on X.The post was accompanied by a nearly eight-minute video of aerial footage that showed a helicopter hovering just above the deck of a large tanker at sea. “The United States will continue to pursue the illicit movement of sanctioned oil that is used to fund narco terrorism in the region. We will find you, and we will stop you,” Noem added.The New York Times, citing an unnamed US official and two people inside Venezuela’s oil industry, reported that the vessel was a Panamanian-flagged tanker carrying Venezuelan oil that had recently left Venezuela and was in Caribbean waters.Noem did not share any identifying information of the tanker, and it was not immediately clear if the interdicted vessel was under US sanctions.The Pentagon referred questions to the White House, which did not immediately respond to an AFP request for comment Saturday.- ‘Waging a battle against lies’ -On December 10, US forces seized a large oil tanker off the coast of Venezuela, which the attorney general said was involved in carrying sanctioned oil from Venezuela to Iran.The United States has for months been building a major military deployment in the Caribbean with the stated goal of combatting Latin American drug trafficking, but taking particular aim at Venezuela.Venezuelan Defense Minister Vladimir Padrino Lopez voiced defiance in comments at a public event in Caracas broadcast Saturday on state TV — although he made no mention of the interdicted ship.”We are waging a battle against lies, manipulation, interference, military threats, and psychological warfare,” the defense minister said, adding “that will not intimidate us.”There are currently 11 US warships in the Caribbean: the world’s largest aircraft carrier, an amphibious assault ship, two amphibious transport dock ships, two cruisers and five destroyers.There are US Coast Guard vessels deployed in the region as well, but the service declined to provide figures on those assets “for operational security reasons.”Caracas views the operation as a campaign to push out leftist strongman Nicolas Maduro — whom Washington and many nations view as an illegitimate president — and to “steal” Venezuelan oil.The US military has also conducted a series of air strikes on alleged drug trafficking boats in the Caribbean Sea and eastern Pacific Ocean since September. Critics have questioned the legality of the attacks, which have killed more than 100 people.

Un homme armé d’un couteau tué par la police dans le centre-ville d’Ajaccio

Un homme armé d’un couteau, menaçant des passants en plein cœur d’Ajaccio samedi midi, a été tué par la police, le procureur écartant à ce stade un acte terroriste.Une enquête a été ouverte pour “homicide volontaire aggravé” à l’encontre du policier auteur des coups de feu, et “tentative d’homicide aggravé” contre l’assaillant, selon le procureur Nicolas Septe.L’homme de 26 ans, de nationalité sénégalaise selon le parquet, a été mortellement touché par un ou plusieurs tirs effectués par la police nationale samedi dans le centre-ville d’Ajaccio (Corse-du-Sud), selon le procureur de la République, confirmant une information de France 3 Viastella.La police a d’abord fait usage d’un pistolet à impulsion électrique, sans succès. L’un des policiers a alors fait feu à plusieurs reprises sur l’homme, qui est décédé. L’IGPN, la police des polices, n’est pas saisie à ce stade, a précisé à l’AFP le procureur samedi soir, mais est “en observation”.Sur des vidéos diffusées sur les réseaux sociaux, on voit l’homme avancer rapidement à pied sur le cours Napoléon, tandis que des policiers le mettent en joue. On entend un policier crier “taser, le taser!” puis “tase-le!”.”Je peux écarter à ce stade un attentat terroriste puisqu’à aucun moment l’individu n’aurait proféré des menaces en ce sens”, a précisé à la presse Nicolas Septe, sur les lieux de l’homicide samedi à la mi-journée.- plusieurs altercations -Selon le procureur, l’homme, titulaire d’un visa étudiant, aurait “entamé une déambulation à trottinette en partant de la rocade, puis se serait dirigé vers le cours Napoléon”. Il aurait eu “une première altercation dans un bar”, au cours de laquelle une personne aurait pu être blessée, puis il aurait été refoulé du bar, “alors qu’il exhibait un couteau”.C’est après une deuxième altercation dans un autre bar du cours Napoléon cette fois que la police est intervenue, toujours selon Nicolas Septe. Dans un communiqué samedi en fin de journée, le procureur expliquait que l’homme “refusait d’obéir aux injonctions et jetait sur les policiers sa trottinette, sans les atteindre”. La police a ensuite cherché à le maîtriser “avec a priori un et deux coups de taser, sans succès”. L’homme aurait ensuite brandi “un couteau en direction d’un des policiers, en le menaçant”. “L’un des policiers de la patrouille voyant son collègue menacé, faisait alors usage de son arme de service neutralisant ainsi l’agresseur”, selon le parquet.Une autopsie sera prochainement pratiquée sur l’assaillant, pour voir s’il était “sous l’emprise de stupéfiants, et ou d’alcool et ou d’une autre substance”.En janvier 2025, il avait déjà été mis en cause pour des faits de menaces en Seine-Saint-Denis, selon le parquet. Lors de son interpellation, il portait un couteau et avait résisté au moment de son menottage. “Sa garde à vue avait été déclarée incompatible, le médecin requis ayant préconisé une hospitalisation d’office”, a relayé le procureur.- “un couteau au-dessus de la tête” -“J’étais assis en terrasse avec mon employé”, a témoigné auprès de l’AFP Anthony Bezard, propriétaire d’une pâtisserie du cours Napoléon, “je vois un monsieur avec un couteau qui me passe au-dessus de la tête, j’ai réussi à le pousser un peu et en allant là-bas y’a un monsieur qui l’a pris à coups de chaise, il est tombé par terre et il s’est fait abattre”.Sur le cours Napoléon en début d’après-midi, bondé de passants en ce dernier weekend avant les fêtes de Noël, de nombreuses personnes ont applaudi les policiers.Le maire d’Ajaccio, Stéphane Sbraggia, a indiqué que l’homme venait du quartier Sainte-Lucie, où “nous avons d’ailleurs organisé une réunion avec la population (…) pour sensibiliser sur les questions d’errance et les questions d’individus qui, de par leur santé mentale, constituent un risque”.Le ministre de l’Intérieur, Laurent Nuñez, a commenté cette affaire sur X, assurant d’une vigilance “maximale” : “J’ai demandé aux préfets et directeurs de renforcer les patrouilles de voie publique: merci aux policiers d’#Ajaccio pour leur réactivité, leur action a permis de mettre un terme à la menace”.Le procureur d’Ajaccio a expliqué que “l’enquête aura pour objectif de préciser les contours de la personnalité de cet individu apparemment instable”, “et de préciser les raisons de son comportement agressif et velléitaire”.cor-mk-mc-jp/pcl

Un homme armé d’un couteau tué par la police dans le centre-ville d’Ajaccio

Un homme armé d’un couteau, menaçant des passants en plein cœur d’Ajaccio samedi midi, a été tué par la police, le procureur écartant à ce stade un acte terroriste.Une enquête a été ouverte pour “homicide volontaire aggravé” à l’encontre du policier auteur des coups de feu, et “tentative d’homicide aggravé” contre l’assaillant, selon le procureur Nicolas Septe.L’homme de 26 ans, de nationalité sénégalaise selon le parquet, a été mortellement touché par un ou plusieurs tirs effectués par la police nationale samedi dans le centre-ville d’Ajaccio (Corse-du-Sud), selon le procureur de la République, confirmant une information de France 3 Viastella.La police a d’abord fait usage d’un pistolet à impulsion électrique, sans succès. L’un des policiers a alors fait feu à plusieurs reprises sur l’homme, qui est décédé. L’IGPN, la police des polices, n’est pas saisie à ce stade, a précisé à l’AFP le procureur samedi soir, mais est “en observation”.Sur des vidéos diffusées sur les réseaux sociaux, on voit l’homme avancer rapidement à pied sur le cours Napoléon, tandis que des policiers le mettent en joue. On entend un policier crier “taser, le taser!” puis “tase-le!”.”Je peux écarter à ce stade un attentat terroriste puisqu’à aucun moment l’individu n’aurait proféré des menaces en ce sens”, a précisé à la presse Nicolas Septe, sur les lieux de l’homicide samedi à la mi-journée.- plusieurs altercations -Selon le procureur, l’homme, titulaire d’un visa étudiant, aurait “entamé une déambulation à trottinette en partant de la rocade, puis se serait dirigé vers le cours Napoléon”. Il aurait eu “une première altercation dans un bar”, au cours de laquelle une personne aurait pu être blessée, puis il aurait été refoulé du bar, “alors qu’il exhibait un couteau”.C’est après une deuxième altercation dans un autre bar du cours Napoléon cette fois que la police est intervenue, toujours selon Nicolas Septe. Dans un communiqué samedi en fin de journée, le procureur expliquait que l’homme “refusait d’obéir aux injonctions et jetait sur les policiers sa trottinette, sans les atteindre”. La police a ensuite cherché à le maîtriser “avec a priori un et deux coups de taser, sans succès”. L’homme aurait ensuite brandi “un couteau en direction d’un des policiers, en le menaçant”. “L’un des policiers de la patrouille voyant son collègue menacé, faisait alors usage de son arme de service neutralisant ainsi l’agresseur”, selon le parquet.Une autopsie sera prochainement pratiquée sur l’assaillant, pour voir s’il était “sous l’emprise de stupéfiants, et ou d’alcool et ou d’une autre substance”.En janvier 2025, il avait déjà été mis en cause pour des faits de menaces en Seine-Saint-Denis, selon le parquet. Lors de son interpellation, il portait un couteau et avait résisté au moment de son menottage. “Sa garde à vue avait été déclarée incompatible, le médecin requis ayant préconisé une hospitalisation d’office”, a relayé le procureur.- “un couteau au-dessus de la tête” -“J’étais assis en terrasse avec mon employé”, a témoigné auprès de l’AFP Anthony Bezard, propriétaire d’une pâtisserie du cours Napoléon, “je vois un monsieur avec un couteau qui me passe au-dessus de la tête, j’ai réussi à le pousser un peu et en allant là-bas y’a un monsieur qui l’a pris à coups de chaise, il est tombé par terre et il s’est fait abattre”.Sur le cours Napoléon en début d’après-midi, bondé de passants en ce dernier weekend avant les fêtes de Noël, de nombreuses personnes ont applaudi les policiers.Le maire d’Ajaccio, Stéphane Sbraggia, a indiqué que l’homme venait du quartier Sainte-Lucie, où “nous avons d’ailleurs organisé une réunion avec la population (…) pour sensibiliser sur les questions d’errance et les questions d’individus qui, de par leur santé mentale, constituent un risque”.Le ministre de l’Intérieur, Laurent Nuñez, a commenté cette affaire sur X, assurant d’une vigilance “maximale” : “J’ai demandé aux préfets et directeurs de renforcer les patrouilles de voie publique: merci aux policiers d’#Ajaccio pour leur réactivité, leur action a permis de mettre un terme à la menace”.Le procureur d’Ajaccio a expliqué que “l’enquête aura pour objectif de préciser les contours de la personnalité de cet individu apparemment instable”, “et de préciser les raisons de son comportement agressif et velléitaire”.cor-mk-mc-jp/pcl

Lula et Milei aux antipodes face au risque de conflit au Venezuela

Le président brésilien Lula a mis en garde contre une “catastrophe humanitaire” en cas de conflit armé au Venezuela, samedi lors du sommet du Mercosur à Foz do Iguaçu au Brésil, où son homologue argentin Javier Milei a salué “la pression” des Etats-Unis sur Caracas.Les deux dirigeants sud-américains, aux antipodes sur l’échiquier politique, ont tenu ces propos diamétralement opposés après que le président américain Donald Trump n’a pas écarté la possibilité d’une guerre contre le Venezuela lors d’un entretien à la chaîne NBC diffusé vendredi.Samedi, le bloc sud-américain était censé sceller l’accord de libre-échange avec l’Union Européenne (UE), mais les réticences de la France et de l’Italie ont reporté la signature au dernier moment.Et Lula a tenu à évoquer face à ses homologues sud-américains le sujet brûlant de l’escalade des tensions entre les Etats-Unis et le Venezuela.Washington a déployé un important dispositif militaire dans les Caraïbes depuis cet été, et mené une série de frappes visant des embarcations de trafiquants de drogue présumés dans les Caraïbes et le Pacifique.Au moins 104 personnes ont été tuées dans ces frappes depuis le début de ces opérations, sans que le gouvernement américain n’ait jamais fourni la moindre preuve que les navires visés étaient effectivement impliqués dans un quelconque trafic.En parallèle, le président américain agite depuis des semaines la menace d’une intervention terrestre.Samedi, les Etats-Unis ont saisi un nouveau pétrolier au large du Venezuela, ont rapporté samedi plusieurs médias américains.Les forces américaines avaient déjà saisi la semaine passée un pétrolier au large des côtes du pays, une opération qui avait été dénoncée comme de la “piraterie navale” par le président vénézuélien Nicolas Maduro.”Quatre décennies après la guerre des Malouines, le continent sud-américain est à nouveau hanté par la présence militaire d’une puissance” étrangère, a affirmé Lula à Foz do Iguaçu.”Une intervention armée au Venezuela serait une catastrophe humanitaire pour l’hémisphère (sud) et un précédent dangereux pour le monde”, a-t-il insisté.M. Milei a au contraire salué “la pression des États-Unis et de Donald Trump pour libérer le peuple vénézuélien”.”La dictature atroce et inhumaine du narco-terroriste Nicolas Maduro projette une ombre sombre sur notre région. Ce danger et cette honte ne peuvent pas continuer d’exister sur le continent, sinon ils finiront par nous entraîner tous avec eux”, a lancé le dirigeant ultralibéral. – Accord UE-Mercosur signé en janvier? -Les présidents du Brésil et de l’Argentine sont en revanche alignés au sujet de l’accord entre l’UE et le Mercosur.”Sans volonté politique et sans courage de la part des dirigeants, ce ne sera pas possible de conclure une négociation qui traîne depuis 26 ans”, a déclaré Lula.”Hier, j’ai reçu une lettre des présidents de la Commission européenne et du Conseil européen, dans laquelle tous deux expriment l’espoir de voir l’accord approuvé en janvier”, a-t-il ajouté.L’Argentine, le Brésil, le Paraguay et l’Uruguay espéraient initialement parapher le traité ce samedi, tout comme la présidente de la Commission européenne, Ursula von der Leyen, et la plupart des pays de l’UE.Mais cette signature a finalement été reportée, face à la colère des agriculteurs européens, notamment en France et en Italie.Au sujet de la réticence de la Première ministre italienne Giorgia Meloni, qui a jugé une signature samedi “prématurée”, Lula a affirmé qu’elle lui avait assuré au téléphone qu’elle serait “prête” à l’accepter début janvier.”Si elle est prête à signer et qu’il ne manque plus que la France, Ursula von der Leyen et António Costa (président du Conseil européen, ndlr) m’ont assuré que la France ne pourra pas, à elle seule, bloquer l’accord”, a-t-il ajouté.L’accord UE-Mercosur permettrait aux européens d’exporter davantage de véhicules, machines, vins et spiritueux en Amérique du Sud. Dans le sens inverse, il faciliterait l’entrée en Europe de viande, sucre, riz, miel et soja sud-américains, ce qui alarme les filières concernées.Samedi, des barrages sont toujours en place sur des axes routiers et autoroutiers du sud-ouest de la France, au premier jour des vacances scolaires dans le pays.

Angleterre: City met la pression sur Arsenal, Liverpool enchaîne, Chelsea patine

Alors que les rumeurs sur le possible départ de Pep Guardiola en fin de saison ont pris de l’ampleur ces derniers jours, Manchester City reste imperturbable, avec une nouvelle victoire obtenue samedi contre West Ham (3-0) lors de la 17e journée du Championnat d’Angleterre.Les Citizens alignent leur septième succès de rang, toutes compétitions confondues, ce qu’ils n’avaient plus réalisé depuis avril-mai 2024, lors de la course finale vers leur dernier titre de champion d’Angleterre.Ils passent provisoirement devant Arsenal en tête du championnat, avec un point d’avance, en attendant le déplacement des Gunners à Everton dans la soirée (21h00).Erling Haaland a été impliqué sur les trois buts, avec une ouverture du score dès le début du match (5e), une passe pour Tijani Reijnders à la conclusion d’un mouvement collectif initié par Rayan Cherki (38e) puis un but de rôdeur des surfaces (69e). Avec 19 buts en 17 rencontres, le Norvégien reste loin devant Igor Thiago, 11 buts, au classement des buteurs.- Liverpool s’en sort péniblement – Un an quasiment jour pour jour après une victoire éblouissante (6-3) au même endroit, Liverpool n’a décidément plus grand chose en commun avec l’équipe qui allait finir championne d’Angleterre. La victoire obtenue à onze contre dix, puis onze contre neuf, sur le terrain de Tottenham (2-1) permet à la formation d’Arne Slot de se repositionner en cinquième position. Mais elle n’est guère rassurante, tant les Reds ont souffert, même en supériorité numérique après les exclusions contestées de Xavi Simons (33e) et Cristian Romero (90+3).Entré en début de seconde période, Alexander Isak a délivré son équipe en marquant à la 56e minute, mais a été blessé au genou gauche sur l’action à cause d’un tacle dangereux de Micky van de Ven. Hugo Ekitiké a doublé la mise dix minutes plus tard (66e, 2-0, avant que Richarlison ne fasse trembler Liverpool dans une fin de match très tendue (83e, 1-2). Tottenham glisse en 13e position. – Répit pour Maresca -De son côté, Chelsea avait auparavant obtenu un nul plutôt heureux à Newcastle (2-2), après une belle réaction en seconde période. Celle-ci n’a toutefois pas fait oublier une entame de rencontre calamiteuse (les Magpies menaient 2-0 à la 20e minute, doublé de l’Allemand Nick Woltemade), ni l’incapacité des joueurs d’Enzo Maresca, très critiqué depuis quelques semaines, à développer un jeu collectif cohérent.Ce bon résultat sur le papier éloigne un peu plus Chelsea de la course au titre (huit points de retard sur le leader provisoire Manchester City, peut-être dix en fin de soirée si Arsenal l’emporte à Everton). Ce n’est pas non plus une bonne affaire pour Newcastle, qui reste dans la deuxième partie de tableau (11e à 6 points de la première place qualificative pour la prochaine Ligue des champions).Porté par un duo offensif Anthony Gordon-Nick Woltemade intenable dans les vingt premières minutes, Newcastle a cru s’être mis à l’abri avec deux buts de l’avant-centre allemand (4e, 20e), qui a raté de peu la balle du 3-0 avant la pause.Alors que Reece James avait réduit le score d’un coup franc parfait (2-1, 49e), Chelsea a remis de l’intensité et profité d’une glissade de Malick Thiaw pour égaliser assez miraculeusement par Joao Pedro (66e), alors qu’une faute grossière de Trevoh Chalobah sur Anthony Gordon dans la surface n’avait pas été sanctionnée quelques minutes plus tôt.Les Magpies ont également raté une balle de match, une reprise de volée d’Harvey Barnes passant de peu à côté (85e).Sunderland, privé de six joueurs partis à la Coupe d’Afrique des nations pour plusieurs semaines — dont Noah Sadiki et Reinildo Mandava –, n’a quant à lui pu faire mieux qu’un match nul sur le terrain de Brighton (0-0). Un résultat honorable pour le promu, actuellement sixième, mais qui le met sous la menace directe de Crystal Palace et Manchester United, qui ont un match à disputer d’ici dimanche.