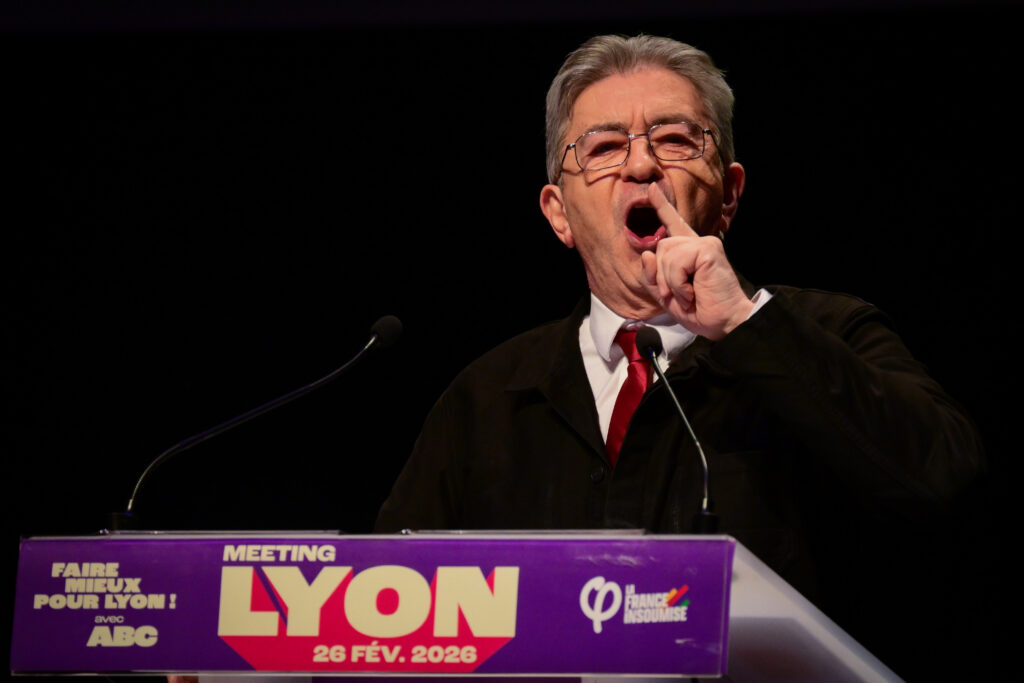

“Epstine”: Mélenchon à nouveau accusé d’antisémitisme

Le leader de la France insoumise Jean-Luc Mélenchon a réveillé le procès latent en antisémitisme qui lui est fait, après avoir ironisé sur la prononciation du nom “Epstein” jeudi à Lyon. Ce qu’il a vigoureusement réfuté, accusant ses contempteurs de nourrir “délibérément la violence contre LFI”.Au cours d’un meeting de soutien à la candidate insoumise aux municipales à Lyon, Anaïs Belouassa-Cherifi, le triple candidat à la présidentielle s’est fendu, entre attaque des médias et défense du groupe anti-fasciste Jeune Garde, d’une incidente sur l’affaire du criminel sexuel new-yorkais Jeffrey Epstein, qui éclabousse responsables politiques et économiques du monde entier. “Je voulais dire +Epstine+ pardon, ça fait plus russe +Epstine+”, a-t-il lancé. “Alors maintenant, vous direz Epstine au lieu d’Epstein, Frankenstine au lieu de Frankenstein”, a-t-il poursuivi avant d’ajouter: “eh bien voilà, tout le monde comprend comment il faut faire”, devant une salle hilare.Ce n’était pas la première fois que Jean-Luc Mélenchon ironisait en meeting sur la prononciation du nom du criminel sexuel depuis la publication des dossiers Epstein.Mais cette fois, les condamnations ont immédiatement fusé.Le président du Crif, Yonathan Arfi, a rappelé sur X qu'”un élève de 5ème sait qu’en anglais, +Epstein+ se prononce +Epstine+. Les journalistes ne font donc que prononcer un nom américain… à l’américaine”. “Voir dans cette prononciation une manipulation est un délire complotiste aux vrais relents antisémites”, a-t-il ajouté. “Toutes les limites ont été franchies par Jean-Luc Mélenchon (…) L’antisémitisme est une monstruosité”, a dénoncé l’ancien Premier ministre et patron du parti présidentiel Renaissance Gabriel Attal, tandis que le ministre de l’Intérieur Laurent Nuñez, qui vient de classer LFI à l’extrême gauche pour les prochaines municipales, a dénoncé des “propos abjects”.”C’était il y a 15 jours”, a pour sa part réagi Emmanuel Macron en repartageant un de ses discours tenu au milieu du mois où il ciblait “l’antisémitisme d’extrême gauche”. Le président du Rassemblement national Jordan Bardella, dont le parti s’est engagé dans une dédiabolisation au détriment des Insoumis qui multiplient les polémiques, a dénoncé un meeting “brutal, qui fait froid dans le dos, aux relents ouvertement antisémites”. – “Dégoût” -Même chez les anciens alliés de gauche de LFI au sein du NFP, la sortie a indigné. “Est antifasciste celui qui combat le fascisme, pas celui qui en réutilise les ressorts les plus dangereux”, a tweeté le premier secrétaire du PS Olivier Faure. Il faisait référence dans le même temps aux prises de positions de Jean-Luc Mélenchon qui a continué jeudi soir à défendre son député Raphaël Arnault pourtant fondateur du groupe antifa “La Jeune Garde” impliqué dans le meurtre du militant d’extrême droite radicale Quentin Deranque à Lyon. “Non mais ça va pas non ! Vraiment, rien ne va dans ces propos. Rien. Ça suffit maintenant”, s’est encore exclamé la cheffe des Ecologistes Marine Tondelier, quand l’eurodéputé Place publique Raphaël Glucksmann estimait que “Jean-Luc Mélenchon et ses sbires s’essuient les pieds sur tous les principes qui ont structuré la gauche républicaine française”.Devant cette avalanche de condamnations, le leader insoumis a réagi en réfutant tout antisémitisme et en renvoyant l’attaque sur ses adversaires. “J’ai ironisé sur la volonté de vouloir faire avec +Epstine+ un nom pour +russifier+ le problème. Consternante réaction de ceux qui y voient de l’antisémitisme”, a-t-il déclaré sur X, y notant une manière de “susciter délibérément la violence contre LFI”. Pour lui, “l’antisémitisme est du côté de ceux qui veulent tout ramener à ce sujet”. “Au contraire j’ai longuement expliqué dans mon discours pourquoi il fallait tenir la religion loin de la politique”, a-t-il insisté.”Les Insoumis ont, les premiers, dénoncé les instrumentalisations antisémites de l’affaire Epstein”, a abondé son premier lieutenant Manuel Bompard qui a dénoncé “une cabale” contre le mouvement de gauche radicale. Les accusations d’antisémitisme, ou d’ambivalence sur la question, se multiplient contre Jean-Luc Mélenchon, notamment depuis les attaques du 7-Octobre en Israël.Comme quand il avait estimé que l’antisémitisme était “résiduel” en France en 2024 alors que les attaques contre la communauté juive étaient en très nette augmentation dans le pays. Il avait alors fait valoir la polysémie du mot, qui dans un sens figuré veut aussi dire “persistant”. Ou comme quand il avait ciblé son ancien protégé, le député socialiste Jérôme Guedj, issu d’une famille juive séfarade, en évoquant de manière ambiguë “la laisse de ses adhésions”.Jean-Luc Mélenchon a plusieurs fois fermement nié ces accusations. Les Insoumis rappellent régulièrement qu’aucun élu de leur mouvement n’a été condamné par la justice pour des propos antisémites.

Matisse tué à Châteauroux en 2024: le procès de la mère du meurtrier s’est ouvert

Le procès de la mère de l’adolescent condamné à huit ans de prison pour le meurtre de Matisse, tué à 15 ans de plusieurs coups de couteau en avril 2024, s’est ouvert à huis clos vendredi à Châteauroux, où elle est jugée pour violences volontaires.Le fils de la mise en cause, également âgé de 15 ans au moment des faits, de nationalité afghane en situation régulière, a été reconnu coupable en mai dernier d’avoir porté les coups mortels à Matisse à la suite d’une bagarre causée par une battle de rap le 27 avril 2024.Il s’était alors rendu chez lui pour s’emparer d’un couteau puis était revenu, accompagné de sa mère, asséner plusieurs coups à l’adolescent, dont l’un avait atteint le cœur.L’adolescent a été condamné à huit ans de prison ferme par le tribunal pour enfants de Châteauroux, le 28 mai 2025, à laquelle s’ajoute notamment une injonction de soins de quinze ans.Sa mère, âgée de 39 ans, est de son côté soupçonnée d’avoir également mis des gifles et porté des coups au jeune Matisse.Elle est arrivée au palais de justice vers 8H45, seule et le visage caché par un foulard, une heure avant la mère du jeune Matisse, accompagnée de ses avocats, a constaté un journaliste de l’AFP.Le procès s’est ouvert à huis clos vers 10H00, avec une haute présence policière. Plusieurs barrières barrent l’accès du palais de justice.Le procureur de la République de Châteauroux David Marcat avait précédemment justifié auprès de l’AFP la mise en place de ce dispositif très important, “compte tenu des risques de prise à partie, déjà constatés” à l’occasion du procès du meurtrier, à l’issue duquel des échauffourées avaient entraîné l’exfiltration de la mère.Elle comparaît vendredi pour “violences sur personne vulnérable sans ITT (incapacité totale de travail)”.Une qualification juridique qui “s’explique par le fait que des coups ont été portés sur le jeune homme alors qu’il était en train de décéder, d’où l’état de vulnérabilité, mais sans ITT, car ce ne sont pas ces coups qui ont entraîné sa mort”, avait précisé le procureur de la République de Châteauroux, David Marcat. Elle risque trois ans de prison.Prévue initialement fin septembre, l’audience avait été renvoyée à la demande de la défense.La nationalité afghane de l’accusé et de sa mère avait donné lieu à de violentes polémiques, des responsables politiques de droite et d’extrême droite appelant notamment le gouvernement à durcir sa politique migratoire.Le meurtre de Matisse avait causé une émotion considérable dans sa ville natale et au-delà.Quelque 8.000 personnes avaient défilé dans les rues de Châteauroux dans les jours suivant sa mort et 2.000 environ avaient assisté à la cérémonie tenue en sa mémoire.

Jeux de société: à Cannes, le sacre du jeu à deux

L’année écoulée a confirmé la croissance des ventes de jeux de société en France, une vitalité portée par l’explosion du format à deux, comme l’illustrent les As d’or, équivalent ludique de la Palme d’or, décernés au festival international des jeux (FIJ) de Cannes qui s’ouvre vendredi.Sur les quatre récompenses remises jeudi soir sur la Croisette lors de la soirée inaugurale du festival, trois ont récompensé des jeux qui se jouent exclusivement à deux: “Toy Battle” pour la catégorie tout public, “Zenith” pour la catégorie “initiés” et “l’Ile des Mookies” pour la catégorie “enfants”.Pour le scénariste de BD belge Michel Dufranne, membre du jury de l’As d’or, “le palmarès reflète vraiment cette grande tendance de 2025”, a-t-il affirmé à l’AFP. “Les gens jouent de plus en plus en couple, et le Covid y a probablement contribué”, estime également une autre jurée, Bérangère Prevost, de la chaîne de critique de jeux Penelope Gaming.Depuis 2020, le public du jeu de société n’a cessé de s’élargir, et le chiffre d’affaires du secteur avec: il s’est porté à 624 millions d’euros en 2025 selon le cabinet Circana, 4% de plus qu’en 2024 et autour de 20% de plus qu’en 2019.Ce qui fait de la France le deuxième marché européen derrière l’Allemagne, longtemps pionnière dans le secteur.- Droits de douane et déflation -Fabriqués à 80% en Chine, les jeux de société des éditeurs européens ont toutefois subi en 2025 l’effet des droits de douane instaurés par Donald Trump sur les importations américaines. “Beaucoup d’éditeurs ont vu leurs commandes reportées voire annulées”, rapporte Christian Molinari, président de l’Union des éditeurs de jeux. “Les Américains ne pouvaient pas se permettre de payer deux fois le prix des jeux parce qu’ils étaient fabriqués en Asie.””Les éditeurs y ont perdu un peu, mais les auteurs probablement beaucoup plus”, s’inquiète-t-il.L’auteur Bruno Cathala (7 Wonders Duel) a estimé auprès de l’AFP à 20% ses pertes en 2025 en lien avec les droits de douane.D’autant que, pour auteur comme éditeur, la hausse ininterrompue du nombre de joueurs ces dernières années s’est accompagnée d’une explosion du nombre de sorties, renforçant encore plus la concurrence entre les jeux et la difficulté à faire perdurer les rentrées d’argent.”L’année dernière avait vraiment été au paroxysme de la quantité”, a relevé Bérangère Prévost, qui perçoit toutefois pour le début d’année 2026 “une légère décélération dans la production, avec une envie de faire moins, mais mieux.”Cette concurrence accrue a notamment eu pour effet “une pression pour tirer les prix des jeux pour les joueurs initiés à la baisse”, a noté le consultant pour les éditeurs Benoît Stella, “ce qui amène pas mal de sacrifices pour les éditeurs”, déplore-t-il.- Des ventes propulsées -Pour se distinguer parmi les 1.200 sorties annuelles, la récompense de l’As d’or décernée à Cannes tombe à pic. Pour l’auteur italien Paolo Mori, lauréat cette année avec “Toy Battle”, “depuis cinq ans, l’As d’or s’est vraiment hissé au même niveau que le Spiel des Jahres”, son pendant allemand longtemps le plus prestigieux dans le domaine, s’est-il ému auprès de l’AFP.La plupart des jeux récompensés sont sortis depuis plusieurs mois: apposer le logo “As d’or jeu de l’année” relance généralement les ventes, en témoigne par exemple “Trio” dont les ventes avaient été multipliées par 3 après l’obtention du prix en 2024.Pour sa 39e édition, le jury du FIJ a décidé de récompenser “Toy Battle” plutôt que le phénomène commercial “Flip 7”, déclinaison nerveuse du blackjack.Toy Battle, dont le but est de faire avancer des tuiles pour envahir le camp ennemi, est une “leçon de game design”, résume Michel Dufranne pour expliquer le choix du jury.”Il y a un petit côté jeu d’échecs, mais complètement simplifié, et extrêmement addictif”, s’enthousiasme également Bérangère Prévost.Pour la catégorie “jeux experts”, le jury a décerné l’As d’or à “Civolution” de l’auteur allemand Stefan Feld, un jeu complexe avec une action parmi 22 différentes à choisir, mais “absolument fou quand on est amateur de jeux de société”, explique Bérangère Prévost.

Soupçons de traite des femmes: la justice sur les traces des Al-Fayed, du Ritz à la Côte d’Azur

Derrière le faste du Ritz époque Mohamed Al-Fayed et le clinquant des yachts, le piège? La justice française enquête depuis l’été dernier sur un vaste système présumé de traite de femmes, dont les ressorts rappellent, selon des avocates, l’affaire Epstein.Plusieurs femmes ont été auditionnées à Paris, dont Kristina Svensson, employée par l’hôtel 5 étoiles Le Ritz, à Paris, pour être l’assistante en France de Mohamed Al-Fayed de 1998 à 2000. “A chaque fois qu’il me voyait, il m’agressait”, affirme-t-elle dans un entretien avec l’AFP.L’Egyptien Mohamed Al-Fayed, décédé en 2023, détenait le grand magasin de luxe londonien Harrods, le club de football londonien de Fulham et le Ritz. Il n’a jamais été poursuivi de son vivant.Mi-février, “154 victimes” avaient témoigné, selon la police londonienne. Mais le travail des Britanniques sur ces agissements, qui auraient duré plus de 35 ans, entre 1977 et 2014, est vivement critiqué par des plaignantes.Et des femmes ont récemment décidé de placer leurs espoirs dans la justice parisienne, pour faire la lumière sur ce réseau qui se serait aussi étendu en France.Rachael Louw avait 23 ans quand elle a été envoyée sur la Côte-d’Azur – dans le sud-est de la France – sur le yacht de Salah Fayed, frère de Mohamed Al-Fayed, décédé en 2010. Elle a été entendue le 10 février dernier par l’office français spécialisé dans la répression de la traite des êtres humains, l’OCRTEH.Cette mère de famille de 54 ans confie à l’AFP son “soulagement”: “La justice française avance beaucoup plus vite et ne minimise pas ce qui nous est arrivé, à la différence des enquêteurs au Royaume-Uni.” En ouvrant notamment, à l’été 2025, une enquête pour traite d’êtres humains aggravée, proxénétisme et viols, le parquet de Paris “montre qu’il considère les agressions dans leur ensemble et qu’il n’a pas peur de s’attaquer à un système organisé”.- “Bonne à consommer” – Rachael Louw était vendeuse chez Harrods quand Mohamed Al-Fayed l’a “repérée” dans les rayons.A l’été 1994, Rachael Louw a une visite “préalable à (son) recrutement au bureau du président de Harrods”. Examen pelvien, frottis, “contrôle mammaire approfondi”, test VIH: le rendez-vous a largement excédé l’examen classique.Et n’est pas resté confidentiel. Dans son compte rendu adressé à Harrods que l’AFP a pu consulter, le médecin a précisé que Rachael avait récemment perdu sa mère, prenait la pilule, avait un petit ami, que son hygiène personnelle était “excellente”…”C’est un médecin qui accepte d’envoyer des renseignements confidentiels pour donner des armes au violeur”, accuse l’ancienne juge d’instruction et aujourd’hui avocate Eva Joly, qui assiste Rachael Louw et Kristina Svensson, avec ses consoeurs Caroline Joly et Agathe Barril. “Ces jeunes femmes étaient comme de la viande, dont on veut savoir si elle est bonne à consommer”, abonde Caroline Joly.Pour Rachael Louw, la justice française “a posé les mots justes” sur ces examens, en les considérant comme de possibles viols.Après ce criblage médical, plusieurs rencontres ont été organisées avec Salah Fayed dans sa résidence londonienne de Park Lane. Rachael Louw affirme qu’il l’y a droguée une fois, avec “un mix de crack et de cocaïne”, et agressée sexuellement.Rachael Louw s’est alors sentie “piégée”. Mais “comme Salah Fayed n’a pas recommencé”, elle a “cru que cela irait” et a accepté une offre: devenir son assistante en France. – “Comme une torture” -Quand elle y est envoyée en avion privé, son passeport lui est confisqué. Sur le yacht du milliardaire, “rien” ne ressemble alors au travail d’assistante pour lequel elle a signé.”Je m’attendais à organiser les journées de Salah Al-Fayed, mais on attendait juste de moi que je sois constamment avec lui”. Rachael Louw figure notamment, auprès de Salah Fayed, lors de dîners. Avec des invités, âgés et fortunés, accompagnés de “jeunes filles”. “Il y avait beaucoup de contacts physiques”.Isolée sur ce yacht, où le personnel avait “interdiction de lui parler”, elle parvient à contacter son petit ami, employé chez Harrods. “Ils l’ont su et il a été licencié”, affirme-t-elle.Une nuit, Salah Fayed “entre dans son lit”. “Je me suis réveillée et j’ai dit: +Que faites-vous?+ Et il m’a répondu: +Je me sens seul.+ Je suis restée pétrifiée toute la nuit, sans dormir. C’était comme une torture. J’étais terrifiée qu’il puisse interpréter un mouvement comme une invitation à me toucher.”Un autre jour, Salah Fayed l’a emmenée au large de Saint-Tropez, sur le yacht de Mohamed. “Il y avait une fille rousse, qui avait l’air plus jeune que moi. Mohamed l’a embrassée. Il m’a demandé d’arrêter de les regarder et je ne me souviens plus de rien après. Si j’ai été droguée ou non, je ne peux pas l’affirmer avec certitude”, frissonne Rachael Louw.La jeune femme a senti l’étau se refermer encore davantage quand Salah Fayed lui a annoncé qu’il comptait l’emmener sur un nouveau hors-bord. “Il n’y avait qu’une seule chambre… J’ai su que si j’allais sur ce bateau, rien de bon n’arriverait.”Paniquée, elle appelle Air France pour réserver un siège sur le premier vol. Salah Fayed manifeste “une grande colère” quand elle réclame son passeport, mais ce dernier lui est rendu. “Il a su que j’avais prévenu mes colocataires.”De retour, Rachael Louw “bloque” ses souvenirs pour “survivre”.- “Il riait” -Pourquoi témoigner, trente ans plus tard ? Elle qui pensait être réduite au silence par un accord de confidentialité signé à l’embauche, a été bouleversée par un documentaire de la BBC sur les Al-Fayed, diffusé en septembre 2024. “J’ai pris conscience de ce dont j’avais fait partie, et comme cela aurait pu être pire, si je n’avais pas eu la chance de pouvoir fuir… Je parle car il doit y avoir un coût pour les criminels, pour ne plus encourager les suivants.””Si nous les femmes ne dénonçons pas, nous devenons complices de notre propre oppression”, insiste Rachael Louw. “Les hommes puissants ne changeront jamais un système qui les avantage.”Après la mort de Mohamed et de Salah, les plaignantes espèrent que la justice puisse retrouver des complices qui auraient permis à ce système d’exister. Qui organisait les transports? L’hébergement?”Il n’y a pas de petite information. Chaque élément est utile pour l’enquête”, estime Kristina Svensson, invitant “victimes et témoins” à se manifester aux enquêteurs parisiens, “très à l’écoute”.Cette Suédoise, arrivée en 1993 en France, avait été placée par une agence d’intérim au Ritz, bijou parisien situé juste à côté du ministère de la Justice français sur la célèbre place Vendôme, et détenu par Mohamed Al-Fayed. Elle était censée l’aider, comme assistante, à gérer ses affaires, après la mort de son fils Dodi Al-Fayed et de la princesse Diana. Une mission prestigieuse.Sauf qu’à l’entretien d’embauche au Ritz, les questions sont restées “focalisées” sur son apparence. On lui a même fait remarquer qu’elle était le “sosie” de l’épouse d’Al-Fayed. Le Ritz l’a ensuite envoyée à Londres. “J’avais apporté mon CV.” Mohamed Al-Fayed “n’était pas intéressé par ça. Il ne m’a posé que des questions personnelles”. “J’ai aussi subi un examen gynécologique obligatoire, où je pense avoir été droguée.”S’en sont suivies plusieurs rencontres avec Mohamed Al-Fayed, au schéma répétitif. Elle était placée de longues heures sans instruction, dans une pièce. Puis Mohamed Al-Fayed entrait.Aujourd’hui, Kristina Svensson décrit des agressions sexuelles et des tentatives de viols au cours desquelles “il riait”.- “Micros et caméras” – Pourquoi être restée? “J’espérais qu’avec le temps, il allait voir que je n’étais pas intéressée par lui et qu’il allait me prendre au sérieux”, a-t-elle expliqué à la police. “J’étais étrangère, sans famille ni réseau dans le pays, ni aucune connaissance de droit du travail, et je n’avais personne sur qui compter financièrement si je démissionnais.”A posteriori, Kristina Svensson se compare à “un produit de luxe parmi d’autres”, que Mohamed Al-Fayed voulait posséder. “Une poupée sur une étagère”, bien surveillée. Le personnel “l’avertissait” qu’il y avait “micros et caméras partout au Ritz”, tandis que dans la villa de Saint-Tropez, elle affirme qu’une gouvernante lui avait recommandé de bloquer la porte de sa chambre la nuit.Sollicité, le Ritz s’est dit “profondément attristé par les témoignages et les allégations d’abus” qu’il “considère avec le plus grand sérieux, et se tient prêt à coopérer pleinement avec les autorités judiciaires”.”La sécurité et le bien-être de nos collaborateurs, visiteurs et clients constituent notre priorité absolue”, ajoute le palace parisien.De son côté, Harrods a salué “le courage de toutes les femmes qui prennent la parole”, dont “les témoignages mettent en lumière l’ampleur des abus commis par Mohamed Al-Fayed et soulèvent à nouveau de graves allégations à l’encontre de son frère”.Le grand magasin les “encourage” à présenter des demandes d’indemnisation dans le cadre du dispositif qu’il a mis en place – “plus de 50 survivantes” ont, à ce jour, été dédommagées.La police londonienne a aussi assuré à l’AFP avoir “considérablement changé” ses “méthodes de travail” et “placer” désormais “les victimes au coeur de (son) action” et notamment des investigations, “en cours”, sur ceux qui auraient pu aidé Mohamed Al Fayed.Pour les avocates des deux femmes, les témoignages dessinent les contours encore obscurs d’un “système puissant”, ressemblant en de “nombreux points” à celui mis en place, à la même époque, par le criminel sexuel Jeffrey Epstein entre Paris et les Etats-Unis.”Comme chez Epstein, il y a chez les Fayed une consommation frénétique de jeunes femmes et un système organisé pour se les procurer. Le schéma est le même: sélection de jeunes femmes vulnérables, transport, hébergement, isolement et l’argent, qui sert à intimider ou à noyauter”, explique Eva Joly.Si les faits pourraient être prescrits, des enquêtes sont parfois ouvertes pour rechercher d’éventuelles victimes non prescrites. Et l’avocate d’assurer: “On n’en est qu’au début de la reconstitution du puzzle en France.”

Soupçons de traite des femmes: la justice sur les traces des Al-Fayed, du Ritz à la Côte d’Azur

Derrière le faste du Ritz époque Mohamed Al-Fayed et le clinquant des yachts, le piège? La justice française enquête depuis l’été dernier sur un vaste système présumé de traite de femmes, dont les ressorts rappellent, selon des avocates, l’affaire Epstein.Plusieurs femmes ont été auditionnées à Paris, dont Kristina Svensson, employée par l’hôtel 5 étoiles Le Ritz, à Paris, pour être l’assistante en France de Mohamed Al-Fayed de 1998 à 2000. “A chaque fois qu’il me voyait, il m’agressait”, affirme-t-elle dans un entretien avec l’AFP.L’Egyptien Mohamed Al-Fayed, décédé en 2023, détenait le grand magasin de luxe londonien Harrods, le club de football londonien de Fulham et le Ritz. Il n’a jamais été poursuivi de son vivant.Mi-février, “154 victimes” avaient témoigné, selon la police londonienne. Mais le travail des Britanniques sur ces agissements, qui auraient duré plus de 35 ans, entre 1977 et 2014, est vivement critiqué par des plaignantes.Et des femmes ont récemment décidé de placer leurs espoirs dans la justice parisienne, pour faire la lumière sur ce réseau qui se serait aussi étendu en France.Rachael Louw avait 23 ans quand elle a été envoyée sur la Côte-d’Azur – dans le sud-est de la France – sur le yacht de Salah Fayed, frère de Mohamed Al-Fayed, décédé en 2010. Elle a été entendue le 10 février dernier par l’office français spécialisé dans la répression de la traite des êtres humains, l’OCRTEH.Cette mère de famille de 54 ans confie à l’AFP son “soulagement”: “La justice française avance beaucoup plus vite et ne minimise pas ce qui nous est arrivé, à la différence des enquêteurs au Royaume-Uni.” En ouvrant notamment, à l’été 2025, une enquête pour traite d’êtres humains aggravée, proxénétisme et viols, le parquet de Paris “montre qu’il considère les agressions dans leur ensemble et qu’il n’a pas peur de s’attaquer à un système organisé”.- “Bonne à consommer” – Rachael Louw était vendeuse chez Harrods quand Mohamed Al-Fayed l’a “repérée” dans les rayons.A l’été 1994, Rachael Louw a une visite “préalable à (son) recrutement au bureau du président de Harrods”. Examen pelvien, frottis, “contrôle mammaire approfondi”, test VIH: le rendez-vous a largement excédé l’examen classique.Et n’est pas resté confidentiel. Dans son compte rendu adressé à Harrods que l’AFP a pu consulter, le médecin a précisé que Rachael avait récemment perdu sa mère, prenait la pilule, avait un petit ami, que son hygiène personnelle était “excellente”…”C’est un médecin qui accepte d’envoyer des renseignements confidentiels pour donner des armes au violeur”, accuse l’ancienne juge d’instruction et aujourd’hui avocate Eva Joly, qui assiste Rachael Louw et Kristina Svensson, avec ses consoeurs Caroline Joly et Agathe Barril. “Ces jeunes femmes étaient comme de la viande, dont on veut savoir si elle est bonne à consommer”, abonde Caroline Joly.Pour Rachael Louw, la justice française “a posé les mots justes” sur ces examens, en les considérant comme de possibles viols.Après ce criblage médical, plusieurs rencontres ont été organisées avec Salah Fayed dans sa résidence londonienne de Park Lane. Rachael Louw affirme qu’il l’y a droguée une fois, avec “un mix de crack et de cocaïne”, et agressée sexuellement.Rachael Louw s’est alors sentie “piégée”. Mais “comme Salah Fayed n’a pas recommencé”, elle a “cru que cela irait” et a accepté une offre: devenir son assistante en France. – “Comme une torture” -Quand elle y est envoyée en avion privé, son passeport lui est confisqué. Sur le yacht du milliardaire, “rien” ne ressemble alors au travail d’assistante pour lequel elle a signé.”Je m’attendais à organiser les journées de Salah Al-Fayed, mais on attendait juste de moi que je sois constamment avec lui”. Rachael Louw figure notamment, auprès de Salah Fayed, lors de dîners. Avec des invités, âgés et fortunés, accompagnés de “jeunes filles”. “Il y avait beaucoup de contacts physiques”.Isolée sur ce yacht, où le personnel avait “interdiction de lui parler”, elle parvient à contacter son petit ami, employé chez Harrods. “Ils l’ont su et il a été licencié”, affirme-t-elle.Une nuit, Salah Fayed “entre dans son lit”. “Je me suis réveillée et j’ai dit: +Que faites-vous?+ Et il m’a répondu: +Je me sens seul.+ Je suis restée pétrifiée toute la nuit, sans dormir. C’était comme une torture. J’étais terrifiée qu’il puisse interpréter un mouvement comme une invitation à me toucher.”Un autre jour, Salah Fayed l’a emmenée au large de Saint-Tropez, sur le yacht de Mohamed. “Il y avait une fille rousse, qui avait l’air plus jeune que moi. Mohamed l’a embrassée. Il m’a demandé d’arrêter de les regarder et je ne me souviens plus de rien après. Si j’ai été droguée ou non, je ne peux pas l’affirmer avec certitude”, frissonne Rachael Louw.La jeune femme a senti l’étau se refermer encore davantage quand Salah Fayed lui a annoncé qu’il comptait l’emmener sur un nouveau hors-bord. “Il n’y avait qu’une seule chambre… J’ai su que si j’allais sur ce bateau, rien de bon n’arriverait.”Paniquée, elle appelle Air France pour réserver un siège sur le premier vol. Salah Fayed manifeste “une grande colère” quand elle réclame son passeport, mais ce dernier lui est rendu. “Il a su que j’avais prévenu mes colocataires.”De retour, Rachael Louw “bloque” ses souvenirs pour “survivre”.- “Il riait” -Pourquoi témoigner, trente ans plus tard ? Elle qui pensait être réduite au silence par un accord de confidentialité signé à l’embauche, a été bouleversée par un documentaire de la BBC sur les Al-Fayed, diffusé en septembre 2024. “J’ai pris conscience de ce dont j’avais fait partie, et comme cela aurait pu être pire, si je n’avais pas eu la chance de pouvoir fuir… Je parle car il doit y avoir un coût pour les criminels, pour ne plus encourager les suivants.””Si nous les femmes ne dénonçons pas, nous devenons complices de notre propre oppression”, insiste Rachael Louw. “Les hommes puissants ne changeront jamais un système qui les avantage.”Après la mort de Mohamed et de Salah, les plaignantes espèrent que la justice puisse retrouver des complices qui auraient permis à ce système d’exister. Qui organisait les transports? L’hébergement?”Il n’y a pas de petite information. Chaque élément est utile pour l’enquête”, estime Kristina Svensson, invitant “victimes et témoins” à se manifester aux enquêteurs parisiens, “très à l’écoute”.Cette Suédoise, arrivée en 1993 en France, avait été placée par une agence d’intérim au Ritz, bijou parisien situé juste à côté du ministère de la Justice français sur la célèbre place Vendôme, et détenu par Mohamed Al-Fayed. Elle était censée l’aider, comme assistante, à gérer ses affaires, après la mort de son fils Dodi Al-Fayed et de la princesse Diana. Une mission prestigieuse.Sauf qu’à l’entretien d’embauche au Ritz, les questions sont restées “focalisées” sur son apparence. On lui a même fait remarquer qu’elle était le “sosie” de l’épouse d’Al-Fayed. Le Ritz l’a ensuite envoyée à Londres. “J’avais apporté mon CV.” Mohamed Al-Fayed “n’était pas intéressé par ça. Il ne m’a posé que des questions personnelles”. “J’ai aussi subi un examen gynécologique obligatoire, où je pense avoir été droguée.”S’en sont suivies plusieurs rencontres avec Mohamed Al-Fayed, au schéma répétitif. Elle était placée de longues heures sans instruction, dans une pièce. Puis Mohamed Al-Fayed entrait.Aujourd’hui, Kristina Svensson décrit des agressions sexuelles et des tentatives de viols au cours desquelles “il riait”.- “Micros et caméras” – Pourquoi être restée? “J’espérais qu’avec le temps, il allait voir que je n’étais pas intéressée par lui et qu’il allait me prendre au sérieux”, a-t-elle expliqué à la police. “J’étais étrangère, sans famille ni réseau dans le pays, ni aucune connaissance de droit du travail, et je n’avais personne sur qui compter financièrement si je démissionnais.”A posteriori, Kristina Svensson se compare à “un produit de luxe parmi d’autres”, que Mohamed Al-Fayed voulait posséder. “Une poupée sur une étagère”, bien surveillée. Le personnel “l’avertissait” qu’il y avait “micros et caméras partout au Ritz”, tandis que dans la villa de Saint-Tropez, elle affirme qu’une gouvernante lui avait recommandé de bloquer la porte de sa chambre la nuit.Sollicité, le Ritz s’est dit “profondément attristé par les témoignages et les allégations d’abus” qu’il “considère avec le plus grand sérieux, et se tient prêt à coopérer pleinement avec les autorités judiciaires”.”La sécurité et le bien-être de nos collaborateurs, visiteurs et clients constituent notre priorité absolue”, ajoute le palace parisien.De son côté, Harrods a salué “le courage de toutes les femmes qui prennent la parole”, dont “les témoignages mettent en lumière l’ampleur des abus commis par Mohamed Al-Fayed et soulèvent à nouveau de graves allégations à l’encontre de son frère”.Le grand magasin les “encourage” à présenter des demandes d’indemnisation dans le cadre du dispositif qu’il a mis en place – “plus de 50 survivantes” ont, à ce jour, été dédommagées.La police londonienne a aussi assuré à l’AFP avoir “considérablement changé” ses “méthodes de travail” et “placer” désormais “les victimes au coeur de (son) action” et notamment des investigations, “en cours”, sur ceux qui auraient pu aidé Mohamed Al Fayed.Pour les avocates des deux femmes, les témoignages dessinent les contours encore obscurs d’un “système puissant”, ressemblant en de “nombreux points” à celui mis en place, à la même époque, par le criminel sexuel Jeffrey Epstein entre Paris et les Etats-Unis.”Comme chez Epstein, il y a chez les Fayed une consommation frénétique de jeunes femmes et un système organisé pour se les procurer. Le schéma est le même: sélection de jeunes femmes vulnérables, transport, hébergement, isolement et l’argent, qui sert à intimider ou à noyauter”, explique Eva Joly.Si les faits pourraient être prescrits, des enquêtes sont parfois ouvertes pour rechercher d’éventuelles victimes non prescrites. Et l’avocate d’assurer: “On n’en est qu’au début de la reconstitution du puzzle en France.”

L’Iran met en garde Washington contre “toute exigence excessive” dans les pourparlers

Le chef de la diplomatie iranienne Abbas Araghchi a mis en garde vendredi les Etats-Unis contre “toute exigence excessive” dans leurs discussions, atténuant l’optimisme affiché la veille à l’issue d’une nouvelle session de pourparlers à Genève.Ces discussions indirectes, qui doivent se poursuivre dans les prochains jours selon l’Iran, apparaissent comme celles de la dernière chance pour éviter une confrontation militaire après un important déploiement américain au Moyen-Orient.Washington a notamment déployé deux porte-avions dont le Gerald Ford, le plus grand au monde, qui a quitté jeudi une base navale en Crète.Le Haut-Commissaire des Nations unies aux droits de l’homme, Volker Türk, s’est dit vendredi “extrêmement inquiet du risque d’escalade militaire régionale”.- “Eviter toute erreur d’appréciation” -Lors d’un appel avec son homologue égyptien Badr Abdelatty, Abbas Araghchi “a déclaré que le succès (de l’option diplomatique) reposait sur le sérieux et le réalisme de l’autre partie, mais aussi sur le fait d’éviter toute erreur d’appréciation et exigence excessive”, selon les propos rapportés par la diplomatie iranienne. Le diplomate iranien, qui mène les pourparlers pour Téhéran, n’a pas précisé à quelles demandes il faisait référence.Les Etats-Unis ont à plusieurs reprises insisté sur une interdiction totale d’enrichissement d’uranium par l’Iran, une “ligne rouge” pour Téhéran qui défend son droit au nucléaire civil.L’administration Trump souhaite aussi que tout accord porte sur les missiles balistiques de l’Iran, perçus comme une menace existentielle par son allié israélien.L’Iran refuse d’aborder cette question et le chef de la diplomatie américaine, Marco Rubio, a estimé que cela posait “un très gros problème”.Le président Trump avait accusé mardi l’Iran de disposer de “missiles qui peuvent menacer l’Europe” et les bases militaires américaines, et d’oeuvrer à en concevoir des plus puissants, capables “d’atteindre bientôt les Etats-Unis”. Téhéran, qui affirme avoir limité la portée de ses missiles à 2.000 km, a dénoncé de “gros mensonges”.D’après un rapport parlementaire américain daté de 2025, l’arsenal iranien peut atteindre des cibles allant jusqu’à 3.000 kilomètres, soit loin du territoire des Etats-Unis.Une troisième session de pourparlers s’est tenue jeudi près de Genève à la résidence de l’ambassadeur d’Oman, pays médiateur.M. Araghchi avait fait état “de très bons progrès” lors de cette session, “la plus intense à ce jour”, disant que les deux parties avaient abordé “très sérieusement les éléments d’un accord, tant dans le domaine nucléaire que dans celui des sanctions” américaines qui pèsent sur l’Iran.Selon lui, une prochaine session se tiendra “très bientôt, peut-être dans moins d’une semaine”.Des discussions “entre équipes techniques” auront lieu au préalable lundi à Vienne en Autriche, avec “l’aide d’experts” de l’Agence internationale de l’énergie atomique (AIEA).- “Progrès significatifs” -Le médiateur omanais a également parlé “de progrès significatifs”, via son chef de la diplomatie Badr al-Busaidi.Donald Trump avait lancé le 19 février un ultimatum de “10 à 15 jours” pour décider si un accord était possible ou s’il allait recourir à la force. Washington veut empêcher l’Iran de se doter de l’arme nucléaire, une crainte des Occidentaux alimentant de longue date les tensions avec la République islamique qui dément nourrir de telles ambitions.Selon le Wall Street Journal, l’équipe de négociateurs américains, comprenant l’émissaire Steve Witkoff et le gendre de Donald Trump, Jared Kushner, réclame un démantèlement des trois principaux sites nucléaires iraniens, Fordo, Natanz et Ispahan – ciblés par des frappes américaines en juin – et la remise aux Etats-Unis des stocks d’uranium enrichi du pays. Les deux pays ennemis avaient renoué le dialogue le 6 février à Oman, avant de se retrouver le 17 – déjà en Suisse. De précédents pourparlers avaient été interrompus par la guerre déclenchée en juin 2025 par Israël contre l’Iran, à laquelle Washington s’était brièvement joint.Les nouvelles tensions sont apparues après la répression dans le sang, en janvier, d’un vaste mouvement de contestation d’Iraniens auxquels Donald Trump avait promis de venir “en aide”.De nouveaux rassemblements ont eu lieu ces derniers jours dans des universités.

Laits infantiles: la toxine céréulide identifiée chez un bébé ayant été hospitalisé en France

La toxine céréulide, au cœur de la vague actuelle de rappels de laits infantiles, a pour la première fois été identifiée chez un bébé français ayant été hospitalisé après consommation d’un produit impliqué, a annoncé vendredi le ministère de la Santé.Le ministère de la Santé a reçu un “premier résultat d’analyse de selles positif à la toxine céréulide”, rapporte la Direction générale de la santé, confirmant une information de la cellule investigation de Radio France mais précisant que cela ne permettait pas de conclure à un lien de cause à effet.L’affaire des laits infantiles a débuté en décembre, avec d’abord le rappel par Nestlé de dizaines de lots dans une soixantaine de pays à cause de la présence potentielle de céréulide, une toxine pouvant provoquer des vomissements dangereux chez un nouveau-né.Depuis, une cascade de rappels similaires a eu lieu dans le monde par des industriels comme Danone ou Lactalis, mais aussi de plus petits acteurs de ce marché en pleine croissance.Trois décès ont été signalés parmi des bébés ayant consommé des laits visés par les rappels en France, seul pays européen dans ce cas, ainsi qu’une dizaine d’hospitalisations. Mais aucun lien de cause à effet n’a encore été identifié, les autorités sanitaires françaises ayant d’ores et déjà prévenu qu’il pourrait être difficile d’établir une telle causalité.L’identification de céréulide chez un bébé français, après consommation d’un lait rappelé, marque néanmoins une première, et constitue un indice potentiel allant dans le sens d’une intoxication.”Ce résultat confirme que l’enfant concerné a été exposé à cette toxine”, dont la présence “est susceptible d’expliquer les symptômes observés”, reconnaît le ministère, se refusant toutefois à trancher pour une “imputabilité”. Cela “appartient aux experts compétents, notamment aux soignants ayant pris en charge l’enfant ainsi qu’aux spécialistes en toxicologie mobilisés dans le cadre des investigations”, assure-t-il.Le ministère ne communique pas les détails du cas. Selon Radio France, il s’agit d’un bébé hospitalisé pendant une nuit début février à Montpellier et ayant consommé un lait Gallia (Danone).À l’étranger, la présence de céréulide avait déjà été signalée voici une dizaine de jours en Belgique chez huit nourrissons, tous n’ayant témoigné que de symptômes légers.C’est en Belgique que sont centralisées les analyses réalisées dans le cadre de ce dossier. La France, notamment, adresse au laboratoire belge de santé publique les échantillons prélevés chez les bébés français, faute de laboratoire habilité sur le territoire à détecter cette toxine aux seuils identifiés comme à risque.

Laits infantiles: la toxine céréulide identifiée chez un bébé ayant été hospitalisé en France

La toxine céréulide, au cœur de la vague actuelle de rappels de laits infantiles, a pour la première fois été identifiée chez un bébé français ayant été hospitalisé après consommation d’un produit impliqué, a annoncé vendredi le ministère de la Santé.Le ministère de la Santé a reçu un “premier résultat d’analyse de selles positif à la toxine céréulide”, rapporte la Direction générale de la santé, confirmant une information de la cellule investigation de Radio France mais précisant que cela ne permettait pas de conclure à un lien de cause à effet.L’affaire des laits infantiles a débuté en décembre, avec d’abord le rappel par Nestlé de dizaines de lots dans une soixantaine de pays à cause de la présence potentielle de céréulide, une toxine pouvant provoquer des vomissements dangereux chez un nouveau-né.Depuis, une cascade de rappels similaires a eu lieu dans le monde par des industriels comme Danone ou Lactalis, mais aussi de plus petits acteurs de ce marché en pleine croissance.Trois décès ont été signalés parmi des bébés ayant consommé des laits visés par les rappels en France, seul pays européen dans ce cas, ainsi qu’une dizaine d’hospitalisations. Mais aucun lien de cause à effet n’a encore été identifié, les autorités sanitaires françaises ayant d’ores et déjà prévenu qu’il pourrait être difficile d’établir une telle causalité.L’identification de céréulide chez un bébé français, après consommation d’un lait rappelé, marque néanmoins une première, et constitue un indice potentiel allant dans le sens d’une intoxication.”Ce résultat confirme que l’enfant concerné a été exposé à cette toxine”, dont la présence “est susceptible d’expliquer les symptômes observés”, reconnaît le ministère, se refusant toutefois à trancher pour une “imputabilité”. Cela “appartient aux experts compétents, notamment aux soignants ayant pris en charge l’enfant ainsi qu’aux spécialistes en toxicologie mobilisés dans le cadre des investigations”, assure-t-il.Le ministère ne communique pas les détails du cas. Selon Radio France, il s’agit d’un bébé hospitalisé pendant une nuit début février à Montpellier et ayant consommé un lait Gallia (Danone).À l’étranger, la présence de céréulide avait déjà été signalée voici une dizaine de jours en Belgique chez huit nourrissons, tous n’ayant témoigné que de symptômes légers.C’est en Belgique que sont centralisées les analyses réalisées dans le cadre de ce dossier. La France, notamment, adresse au laboratoire belge de santé publique les échantillons prélevés chez les bébés français, faute de laboratoire habilité sur le territoire à détecter cette toxine aux seuils identifiés comme à risque.