Iran: au moins 1.500 condamnés à mort exécutés en 2025, record “depuis plus de 35 ans”, selon une ONG

Au moins 1.500 condamnés à mort ont été exécutés en Iran en 2025, selon un décompte de l’ONG Iran Human Rights (IHR), qui affirme qu’il s’agit du chiffre annuel d’exécutions le plus élevé recensé par l’organisation depuis 35 ans. “Ce dont nous sommes sûrs, c’est que le nombre d’exécutions dépasse les 1.500. C’est un record. C’est …

Israël confirme interdire d’accès à Gaza 37 ONG étrangères

Israël a confirmé jeudi interdire d’accès à la bande de Gaza 37 organisations humanitaires internationales majeures, à qui il reproche de ne pas avoir communiqué la liste des noms de ses employés, exigée désormais officiellement à des fins de “sécurité”.Cette mesure fait craindre de nouveaux ralentissements dans la fourniture d’aide à Gaza, dévastée par deux …

Israël confirme interdire d’accès à Gaza 37 ONG étrangères Read More »

L’Arabie saoudite a exécuté 356 personnes en 2025, un nouveau record

L’Arabie saoudite a exécuté 356 personnes en 2025, selon un bilan établi jeudi par l’AFP, soit un nouveau record dans le royaume, l’un des pays au monde qui recourt le plus à la peine de mort.La monarchie conservatrice du Golfe applique la peine de mort à un rythme effréné, alimenté par sa campagne de lutte …

L’Arabie saoudite a exécuté 356 personnes en 2025, un nouveau record Read More »

La Bulgarie adopte l’euro, près de 20 ans après son entrée dans l’UE

La Bulgarie a adopté l’euro jeudi, devenant le 21e pays à choisir la monnaie unique européenne, près de 20 ans après avoir rejoint l’Union européenne.A minuit (22H00 GMT mercredi), le petit pays des Balkans, entré dans l’UE en 2007, a tiré un trait sur le lev, sa monnaie nationale en vigueur depuis la fin du …

La Bulgarie adopte l’euro, près de 20 ans après son entrée dans l’UE Read More »

Nigeria kicks off new tax regime vowing relief for low earnersThu, 01 Jan 2026 17:45:33 GMT

Nigeria on Thursday launched a new tax regime that officials said will expand the tax base, ease the tax burden on low-income earners and small businesses, and streamline collection and administration. The new system, based on four bills signed into law in June, came into effect despite calls for a delay by the opposition which alleged …

Nouvelle cyberattaque contre La Poste: les sites de nouveau accessibles

Les sites de La Poste et de La Banque postale étaient de nouveau accessibles jeudi en fin d’après-midi, alors qu’une cyberattaque les avaient paralysés une grande partie de la journée, un nouvel incident quelque jours après une précédente attaque massive qui avait fortement perturbé le suivi des colis pendant la période de Noël.D’après une page internet du groupe, ce nouvel incident, qui concernait de nombreux services en ligne liés à La Poste, comme le suivi des colis, le coffre-fort numérique Digiposte ou l’application de La Banque postale, a débuté jeudi vers 03H30 et s’est achevé vers 17H00.Comme la semaine dernière, le groupe a évoqué auprès de l’AFP une attaque d’une “ampleur inédite”. Il s’agissait d’une attaque par déni de service: les pirates multiplient volontairement les requêtes vers les serveurs d’un service pour les saturer, ce qui les rend inaccessibles aux utilisateurs lambda.”Depuis ce (jeudi) matin, plusieurs milliards de tentatives de connexion par seconde sont dirigées vers les systèmes d’information de La Poste”, a ainsi indiqué le groupe.C’est le même modus operandi que la précédente attaque qui avait fortement perturbé l’accès à plusieurs services de La Poste, dont le suivi de la livraison des colis, à partir du lundi 22 décembre et pendant plusieurs jours.Cette attaque avait été revendiquée par un groupe de hackers prorusses, NoName057(16), responsable de multiples opérations visant principalement l’Ukraine mais aussi ses alliés, dont la France.Après une plainte de La Poste, une enquête a été ouverte par le parquet de Paris, confiée à la Direction générale de la sécurité intérieure (DGSI) et à l’unité nationale cyber.- Un groupe connu d’Europol -Les attaques par déni de service, souvent désignées par leur acronyme en anglais DDoS, ne sont pas des intrusions dans les systèmes d’information. Les pirates n’ont donc pas accès à des données sensibles. Elles ont pour unique conséquence de nuire au service attaqué.Elles peuvent notamment faire appel à un réseau de machines piratées, qui multiplient la force de frappe et saturent les serveurs visés.Cette précédente attaque n’avait pas empêché la distribution des colis et des courriers par La Poste, dont 2 millions pour la seule journée du 24 décembre.L’accès au site et à l’application de La Banque postale avait été rétabli plus rapidement que le suivi des colis. Début décembre, l’autorité bancaire européenne avait mis en garde contre l’instabilité géopolitique qui créait pour les banques du continent des risques opérationnels, notamment les attaques par déni de service.Dans une opération qui avait impliqué une douzaine de pays, les agences Europol et Eurojust avaient annoncé en juillet qu’elles avaient arrêté deux personnes, en France et en Espagne, liées au groupe de hackers NoName057(16).Sept mandats d’arrêt contre des suspects résidant en Russie avaient également été émis, avait précisé Europol.Le groupe de hackers avait notamment visé des infrastructures importantes en Europe, comme des fournisseurs d’électricité et de transports publics.

Ukraine: Moscou accuse Kiev d’avoir tué 24 personnes avec des drones pendant les fêtes du nouvel an

La Russie a accusé jeudi l’Ukraine d’avoir mené pendant la nuit du nouvel an une attaque de drones dans la région de Kherson ayant fait au moins 24 morts, tandis que Kiev a fait état de plus de 200 drones russes lancés contre ses infrastructures énergétiques.Ces attaques, dès les premières heures de 2026, ont eu lieu alors que l’issue des pourparlers en cours pour mettre fin au conflit est toujours incertaine. De nouvelles rencontres diplomatiques sont notamment attendues samedi et mardi.Dans la partie de la région ukrainienne de Kherson contrôlée par l’armée russe, Moscou a affirmé que Kiev avait attaqué avec des drones un café et un hôtel dans le village de Khorly, situé au bord de la mer Noire, pendant les célébrations du nouvel an.Le gouverneur de la région de Kherson nommé par Moscou, Vladimir Saldo, a affirmé sur Telegram qu’au moins 24 personnes avaient été tuées et des “dizaines d’autres” blessées. Il a également publié des images où sont visibles plusieurs cadavres carbonisés.La diplomatie russe a accusé Kiev de “torpiller consciemment toute tentative de recherche de solutions pacifiques au conflit” en menant ses attaques de drones.Les autorités ukrainiennes n’ont pour l’heure pas réagi à ces accusations. – Nouvelles rencontres attendues -Pour sa part, le président ukrainien, Volodymyr Zelensky, a accusé jeudi la Russie d’entamer la nouvelle année “en poursuivant la guerre” déclenchée en 2022 par son attaque à grande échelle de l’Ukraine.Il affirmé que Moscou avait lancé plus de 200 drones dans la nuit de nouvel an, en visant des infrastructures énergétiques en Ukraine.Dans son allocution quotidienne, il a néanmoins affirmé que des rencontres pour tenter de faire avancer les négociations sont toujours prévues dans les prochains jours.Samedi, une réunion doit se tenir en Ukraine avec des conseillers à la sécurité d’Etats européens alliés de Kiev. Une équipe américaine y participera par visioconférence, a indiqué M. Zelensky, précisant que quinze pays avaient confirmé leur participation, ainsi que des représentants de l’UE et de l’Otan.Puis une rencontre entre des responsables militaires est attendue lundi pour discuter des “garanties de sécurité” que peuvent apporter à l’Ukraine ses alliés pour dissuader Moscou de l’attaquer à nouveau.”Sur le plan politique, presque tout est prêt, et il est important de régler chaque détail du fonctionnement des garanties dans les airs, sur terre et en mer si nous parvenons à mettre fin à la guerre”, a affirmé M. Zelensky.Un sommet avec des chefs d’Etat occidentaux est par ailleurs toujours prévu mardi, a poursuivi le président ukrainien, sans donner plus de détails sur le lieu de cette rencontre. Il avait précèdemment affirmé qu’elle pourrait se tenir en France.Dans ses voeux du nouvel an, Volodymyr Zelensky a estimé qu’un accord avec la Russie était “prêt à 90%”, prévenant néanmoins que les 10% restants allaient déterminer le “destin de la paix”.Son homologue russe Vladimir Poutine, lors de son allocution pour la nouvelle année, a lui exhorté ses compatriotes à croire en la “victoire”.- Crainte d’un blocage -En début de semaine, la Russie a accusé l’Ukraine d’avoir lancé une attaque de drones contre une résidence de Vladimir Poutine, située entre Moscou et Saint-Pétersbourg, dans la nuit de dimanche à lundi. Kiev a qualifié cette accusation de “mensonge” et estimé qu’elle visait à servir de prétexte pour de nouvelles frappes contre Kiev et à saper les pourparlers diplomatiques.Le Kremlin avait prévenu mardi que “les conséquences” de cette attaque se traduiraient par “un durcissement de la position de négociation” de la Russie. Alors que cette guerre, la plus sanglante en Europe depuis la Deuxième guerre mondiale, dure depuis bientôt presque quatre ans, les bombardements et les combats sur le front se poursuivent sans relâche.Sur l’ensemble de 2025, la Russie a tiré 54.592 drones longue portée et 1.958 missiles lors de frappes nocturnes contre l’Ukraine, selon une analyse des données ukrainiennes réalisée par l’AFP.Ces bombardements ciblent principalement les infrastructures gazières et électriques ukrainiennes. Comme les hivers précédents, des coupures de courant tournantes ont été instaurées dans toutes les régions du pays afin de pallier les pénuries d’électricité dues aux frappes. En représailles, Kiev mène des frappes contre des dépôts pétroliers et des raffineries russes pour tenter de tarir la rente des hydrocarbures qui finance l’effort de guerre du Kremlin.

Iran: trois morts dans des manifestations contre la vie chère en Iran

Des affrontements localisés entre manifestants et forces de l’ordre ont fait trois morts jeudi en Iran, selon les médias locaux, les premiers depuis le début de cette mobilisation contre la vie chère.Le mouvement est parti dimanche de la capitale Téhéran, où des commerçants ont fermé boutique pour protester contre l’hyperinflation, la dépréciation de la monnaie et le marasme économique, avant de gagner des universités et le reste du pays.Jeudi, des heurts ont été signalés dans des villes moyennes de dizaines de milliers d’habitants.A Lordegan (sud-ouest), deux civils ont été tués, écrit l’agence Fars.Selon cette source, “des manifestants ont commencé à jeter des pierres sur les bâtiments administratifs, dont le gouvernorat, la mosquée, la mairie et des banques”, et la police a fait usage de gaz lacrymogène.Elle fait état “d’importants dégâts” et de l’arrestation de plusieurs personnes qualifiées de “meneurs”. Ces protestations ne sont toutefois pas comparables à ce stade avec le mouvement qui avait secoué l’Iran fin 2022, après la mort de Mahsa Amini, une jeune Iranienne arrêtée pour un voile prétendument mal ajusté. – “En enfer” -Plus tôt jeudi, un membre des forces de l’ordre avait été tué au cours d’affrontements cette fois à Kouhdasht (ouest). Agé de 21 ans et membre du Bassidj, “il défendait l’ordre public”, a précisé la télévision d’Etat, citant le gouverneur local, qui a fait état de “jets de pierres” et de 13 blessés parmi les policiers.Les forces du Bassidj sont des milices de volontaires islamistes, affiliées aux Gardiens de la Révolution, l’armée idéologique de la République islamique.Le président Massoud Pezeshkian a sonné jeudi la mobilisation de son gouvernement: “d’un point de vue islamique (…), si nous ne résolvons pas le problème des moyens de subsistance des gens, nous finirons en enfer”, a-t-il déclaré dans un discours retransmis à la télévision, en précisant que ce terme renvoyait à un châtiment religieux. Mercredi, un bâtiment gouvernemental avait été attaqué dans le sud de l’Iran à Fassa, alors que la quasi-totalité du pays avait été mise en congé, sur décision des autorités, qui ont invoqué le froid et des économies d’énergie.Elles n’ont fait officiellement aucun lien avec les manifestations. L’Iran est au début d’un week-end prolongé qui s’achèvera dimanche.Le pouvoir a dès le début du conflit tenté de jouer l’apaisement, reconnaissant les “revendications légitimes” liées aux difficultés économiques. Et des médias iraniens parlent cette fois de manifestants alors qu’ils les avaient qualifiés d’émeutiers lors des précédents mouvements.Mais la justice a mis en garde contre toute tentative d’instrumentalisation pour semer le chaos et promis la “fermeté”.- “Moment Tiananmen” -“Toute tentative” visant à transformer ce mouvement “en un outil d’insécurité, de destruction des biens publics ou de mise en oeuvre de scénarios conçus à l’étranger sera inévitablement suivie d’une réponse (…) ferme”, a prévenu le procureur général, Mohammad Movahedi-Azad. En début de semaine, une vidéo montrant une personne assise au milieu d’une rue de Téhéran face à des policiers à moto était devenue virale sur les réseaux sociaux, certains y voyant le symbole d’un “moment Tiananmen”. La télévision d’Etat a accusé jeudi ces images d’être mises en scène pour “créer un symbole”, et diffusé une vidéo prétendument tournée depuis un autre angle par une caméra embarquée d’un policier.Assise en tailleur, le manifestant reste impassible, tête basse, avant de recouvrir sa tête de son blouson alors que derrière lui une foule court pour s’éloigner de nuages de gaz lacrymogène.Mercredi soir, l’agence de presse Tasnim a fait état de l’arrestation de sept personnes décrites comme affiliées aux “groupes hostiles à la République islamique basés aux Etats-Unis et l’Europe”.Tasnim a accusé ces personnes d’avoir pour “mission de transformer en violence les manifestations” dans le pays, sans préciser quand ni où ces interpellations se sont produites.La monnaie nationale, le rial, a perdu depuis un an plus d’un tiers de sa valeur face au dollar, tandis qu’une hyperinflation à deux chiffres fragilise déjà depuis des années le pouvoir d’achat des Iraniens, dans un pays asphyxié par des sanctions internationales liées au programme nucléaire iranien.Le taux d’inflation était en décembre de 52% sur un an, selon le Centre de statistiques d’Iran, un organisme officiel.

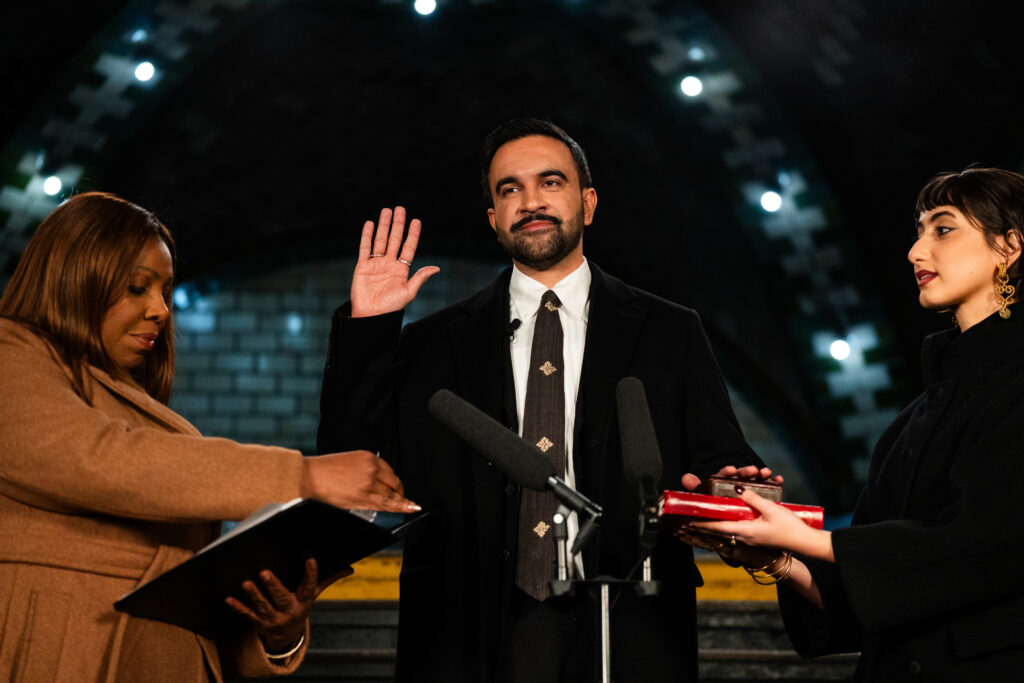

Leftist Mamdani begins first day as New York mayor

Zohran Mamdani, the young star of the US left, started his first day as New York mayor on Thursday for a term sure to see him cross swords with President Donald Trump.The 34-year-old Democrat — virtually unknown a year ago — was officially sworn in as mayor of the largest city in the United States just past midnight as New Yorkers rang in the new year. New York’s first Muslim mayor took the oath of office during a private ceremony at a decommissioned subway stop under City Hall. Later on Thursday, Mamdani is scheduled to take part in a larger, ceremonial inauguration with speeches from left-wing allies Senator Bernie Sanders and congresswoman Alexandria Ocasio-Cortez. Around 4,000 ticketed guests are expected to attend the event outside City Hall. Mamdani’s team has also organized a block party that it says will enable tens of thousands of people to watch the ceremony at streetside viewing areas along Broadway.”This is truly the honor and the privilege of a lifetime,” Mamdani told reporters after taking the official oath in the first minutes of New Year’s Day. – Ambitious agenda -But it remains to be seen if Mamdani, a self-described democratic socialist, can deliver on his ambitious agenda, which envisions rent freezes, universal childcare and free public buses.Once an election is over, “symbolism only goes so far with voters. Results begin to matter a whole lot more,” New York University lecturer John Kane said.How Trump behaves could be decisive. The Republican, himself a New Yorker, has repeatedly criticized Mamdani, but the pair held surprisingly cordial talks at the White House in November.Lincoln Mitchell, a political analyst and professor at Columbia University, said the meeting “couldn’t have gone better from Mamdani’s perspective.”But he warned their relationship could quickly sour. One flashpoint might be immigration raids as Trump wages an expanding crackdown on migrants across the United States.Mamdani has vowed to protect immigrant communities.Before the November vote, the president also threatened to slash federal funding for New York if it picked Mamdani, whom he called a “communist lunatic.”The mayor has said he believes Trump is a fascist.- New occupant of mayoral mansion -Mamdani’s private swearing-in to start his four-year term was performed by New York Attorney General Letitia James, who successfully prosecuted Trump for fraud.In a first for the city, Mamdani is using several Korans to be sworn in as mayor — two from his family and one that belonged to Puerto Rico-born Black writer Arturo Schomburg, The New York Times reported.The new job comes with a change of address as he swaps his rent-controlled apartment in the borough of Queens for Gracie Mansion, the luxurious mayor’s residence on Manhattan’s Upper East Side.Some had wondered if he would move to the official mansion given his campaigning on affordability issues. Mamdani said he was doing so mainly for security reasons.Born in Uganda to a family of Indian origin, Mamdani moved to New York at age seven and enjoyed an elite upbringing with only a relatively brief stint in politics, becoming a member of the New York State Assembly before being elected mayor.Compensating for his inexperience, he is surrounding himself with seasoned aides recruited from past mayoral administrations and former US president Joe Biden’s government.Mamdani has also opened dialogue with business leaders, some of whom predicted a massive exodus of wealthy New Yorkers if he won. Real estate leaders have debunked those claims.As a defender of Palestinian rights, he will have to reassure the city’s Jewish community — the largest in the US — of his inclusive leadership. Recently, one of his hires resigned after it was revealed she had posted antisemitic tweets years ago.