La Chine et les États-Unis parlent relations commerciales pour faire baisser la tension

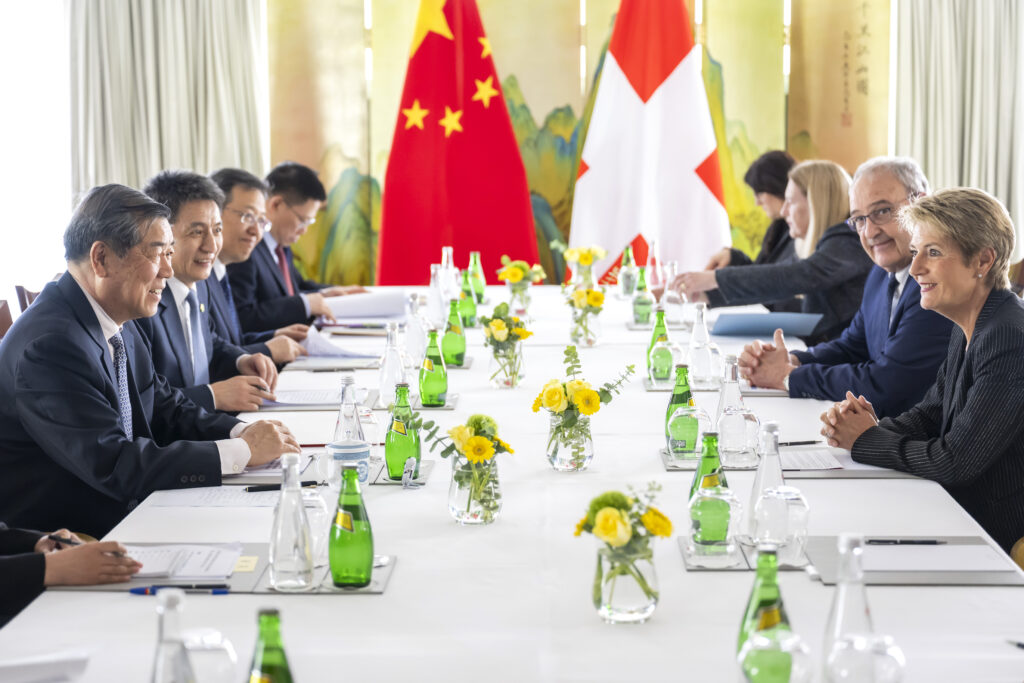

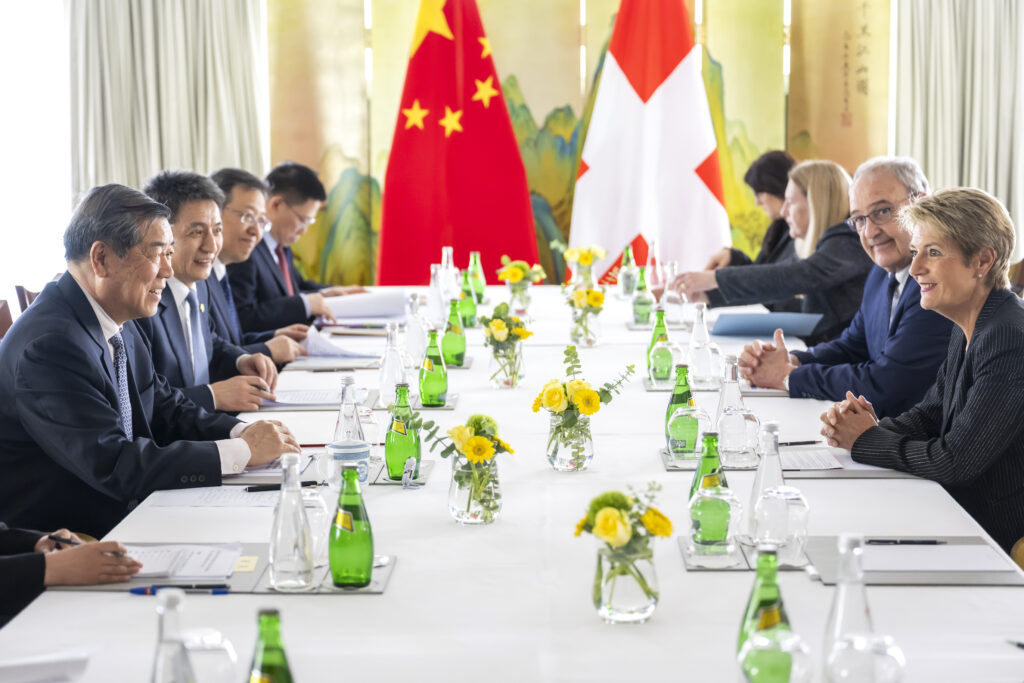

Les premières discussions commerciales entre les États-Unis et la Chine depuis le déclenchement de la guerre commerciale par Donald Trump se déroulent samedi à Genève pour essayer de faire baisser des tensions qui mettent à mal les deux premières économies mondiales.Signe de l’importance des enjeux, les deux capitales ont envoyé des représentants de haut rang au bord du lac Léman : le Secrétaire américain au Trésor Scott Bessent, le Représentant au Commerce Jamieson Greer et le vice-Premier ministre chinois He Lifeng.En début d’après-midi, rien n’avait filtré des discussions qui se tiennent depuis le milieu de matinée de samedi dans la villa cossue du Représentant permanent de la Suisse auprès des Nations unies à Genève. Le lieu discret, aux volets bleu ciel, est niché près d’un grand parc de la ville sur la rive gauche. Après une pause à l’heure du déjeuner, les délégations s’y sont retrouvées aux alentours de 14H30 (12H30 GMT), ont constaté des journalistes de l’AFP. Il est prévu que les discussions se poursuivent dimanche.- Désescalade -La veille de la rencontre, Donald Trump a fait un geste en suggérant d’abaisser à 80% les droits de douane punitifs qu’il a lui-même imposés sur les produits chinois. “Le président aimerait régler le problème avec la Chine. Comme il l’a dit, il aimerait apaiser la situation”, a assuré vendredi soir le secrétaire au Commerce Howard Lutnick sur Fox News.Le geste reste symbolique, car à ce niveau les droits de douane ne seraient toujours pas supportables pour la plupart des exportations chinoises vers les États-Unis.Depuis son retour à la Maison-Blanche en janvier, Donald Trump a fait des droits de douane une arme politique. Il a imposé une surtaxe de 145% sur les marchandises venant de Chine, en plus des droits de douane préexistants. Pékin, qui a promis de combattre “jusqu’au bout” les surtaxes de Donald Trump, a riposté avec 125% de droits de douane sur les produits américains. Résultat: les échanges bilatéraux sont pratiquement à l’arrêt et les marchés ont connu de violents soubresauts.Les discussions organisées à Genève sont donc “un pas positif et constructif vers la désescalade”, a estimé la directrice générale de l’Organisation mondiale du commerce (OMC) Ngozi Okonjo-Iweala à la veille des discussions.La présidente du pays hôte Karin Keller-Sutter en a appelé aux forces surnaturelles. “Hier (jeudi), le Saint-Esprit était à Rome. Il faut espérer qu’il descende maintenant à Genève pour le week-end”, a-t-elle espéré vendredi, en référence à l’élection du pape Léon XIV. – Export en hausse -Le vice-Premier ministre chinois semble arriver à la table des discussions avec un atout. Pékin a annoncé vendredi un bond de 8,1% de ses exportations en avril, un chiffre quatre fois supérieur aux prévisions des analystes, mais les exportations vers les États-Unis ont chuté de près de 18%. Si l’on en croit les Chinois, ce sont aussi les Américains qui ont demandé à avoir ces discussions. Donald Trump “ne va pas unilatéralement abaisser les droits de douane sur la Chine. On doit aussi voir des concessions de leur part”, a averti sa porte-parole, Karoline Leavitt.”Un résultat possible des discussions en Suisse serait un accord pour suspendre la plupart, voire la totalité, des droits de douane imposés cette année et cela pendant la durée des négociations” bilatérales, déclare à l’AFP Bonnie Glaser, qui dirige le programme Indo-Pacifique du German Marshall Fund, un cercle de réflexion à Washington.Spécialiste de l’économie chinoise à l’Asia Society Policy Institute, organisation basée aux États-Unis, Lizzi Lee s’attend à un éventuel “geste symbolique et provisoire”, qui pourrait “apaiser les tensions, mais pas régler les désaccords fondamentaux”.Sur le plan “pratique”, cela coince aussi, selon Bill Reinsch, expert du Center for Strategic and International Studies.Donald Trump veut rencontrer son homologue Xi Jinping, “trouver un accord avec lui, et qu’ensuite leurs subordonnés règlent les détails”, décrit-il à l’AFP, alors que les Chinois “veulent que tous les sujets soient réglés avant une réunion” des deux présidents.Xu Bin, professeur à l’école de commerce international Chine Europe (CEIBS) de Shanghaï ne s’attend pas à ce que les droits de douane reviennent à un “niveau raisonnable”: “Même si cela descend, ce sera probablement de moitié, et, là encore, ce sera trop haut pour avoir des échanges commerciaux normaux.”