ChatGPT va instaurer un contrôle parental, annonce OpenAI

L’entreprise américaine OpenAI a annoncé mardi qu’elle allait instaurer un mécanisme de contrôle parental pour son outil d’intelligence artificielle ChatGPT, après que des parents américains ont accusé fin août cet agent conversationnel d’avoir encouragé leur enfant à se suicider. “Dans le mois à venir, les parents pourront lier leur compte avec celui de leur adolescent” et “contrôler la façon dont ChatGPT répond à leur adolescent avec des règles de comportement du modèle”, a déclaré OpenAI dans un billet de blog.D’après l’entreprise, il sera aussi possible pour les parents d’être alertés en cas de détection d’une “détresse aiguë” dans les conversations de leur enfant et de contrôler les paramètres du compte.Cette annonce suit un précédent billet de blog publié fin août, dans lequel l’entreprise avait indiqué qu’elle préparait un mécanisme de contrôle parental.La veille, les parents d’un adolescent californien de 16 ans qui s’est suicidé avaient porté plainte contre OpenAI, accusant ChatGPT d’avoir fourni à leur fils des instructions détaillées pour mettre fin à ses jours et d’avoir encouragé son geste.”Nous continuons à améliorer la manière dont nos modèles reconnaissent et répondent aux signes de détresse mentale et émotionnelle”, a ajouté mardi l’entreprise dans son billet de blog.OpenAI a dit prendre d’autres mesures, attendues dans les 120 prochains jours. L’entreprise redirigera ainsi certaines “conversations sensibles” vers des modèles de raisonnement comme GPT-5-thinking, plus évolué.”Les modèles de raisonnement suivent et appliquent plus systématiquement les consignes de sécurité”, a précisé le groupe américain.

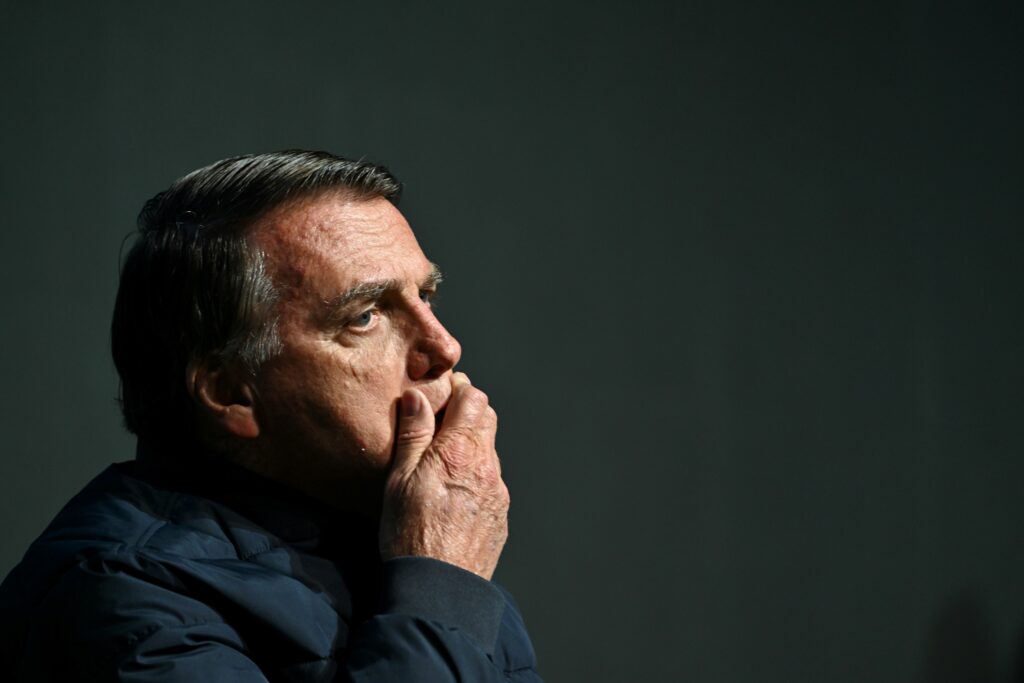

Procès Bolsonaro au Brésil: la Cour suprême entre dans la phase finale

La Cour suprême du Brésil a débuté mardi ses débats en vue du verdict dans le procès historique de l’ex-président Jair Bolsonaro, qui risque plus de 40 ans de prison pour présumée tentative de coup d’Etat, malgré les pressions de Donald Trump.Dans l’enceinte solennelle du tribunal de Brasilia, l’audience a été ouverte par le juge Cristiano Zanin, a constaté un journaliste de l’AFP.Il a ensuite passé la parole au rapporteur du procès, Alexandre de Moraes, juge puissant et clivant ciblé par de lourdes sanctions financières de l’administration Trump.”Le Brésil se trouve aujourd’hui avec une démocratie forte, des institutions indépendantes, une économie en croissance et une société civile active”, a lancé le juge Moraes en préambule.Le leader d’extrême droite Jair Bolsonaro, 70 ans, qui présida le plus grand pays d’Amérique latine de 2019 à 2022, doit être fixé sur son sort d’ici au 12 septembre, avec sept co-accusés, dont plusieurs anciens ministres et militaires haut gradés.Comme annoncé par sa défense, l’ancien chef d’Etat ne s’est pas rendu au tribunal. Seul co-accusé aperçu dans la salle, l’ancien ministre de la Défense Sergio Nogueira a lancé à son arrivée : “Je crois en la justice”.Le parquet accuse M. Bolsonaro d’être le chef d’une “organisation criminelle” ayant conspiré pour assurer son “maintien autoritaire au pouvoir”, en dépit de sa défaite face au président actuel de gauche Luiz Inacio Lula da Silva lors du scrutin de 2022.Assigné à résidence depuis début août et inéligible jusqu’en 2030, il clame son innocence et se dit victime d’une “persécution politique”, à un peu plus d’un an de l’élection présidentielle de 2026.Son procès est au cœur d’une crise sans précédent entre le Brésil et les Etats-Unis.Invoquant une “chasse aux sorcières” contre son allié, le président américain Donald Trump a imposé depuis le 6 août une surtaxe punitive de 50% sur une part des exportations brésiliennes.- Sécurité renforcée -Avec ce procès dont les audiences finales doivent s’étaler sur cinq jours, c’est la première fois qu’un ancien chef de l’Etat brésilien doit répondre de telles accusations.Un rendez-vous historique, quarante ans après la fin de la dictature militaire (1964-1985), dont les responsables n’ont jamais été traduits en justice.A Brasilia, la sécurité a été renforcée sur l’emblématique place des Trois-Pouvoirs, où se côtoient palais présidentiel, Parlement et Cour suprême.Agents armés et chiens renifleurs contrôlent l’entrée du tribunal, ont constaté des journalistes de l’AFP.Les autorités ont annoncé “une surveillance continue avec des équipements de dernière génération, y compris des drones dotés de caméras thermiques”.C’est sur cette place que, le 8 janvier 2023, des milliers de sympathisants bolsonaristes avaient saccagé les lieux de pouvoir, réclamant une intervention militaire pour déloger Lula.Alors aux Etats-Unis, M. Bolsonaro est accusé par le parquet d’avoir été l’instigateur des émeutes.Le projet putschiste incluait aussi, selon l’accusation, un décret d’état de siège et un plan pour assassiner Lula, son vice-président élu Geraldo Alckmin et le juge Alexandre de Moraes.- Amnistie -L’audience de mardi est entrée dans le vif du sujet avec la lecture par ce magistrat d’un rapport résumant les principaux points du dossier. Le procureur prendra ensuite la parole, suivi des avocats de chacun des huit accusés.Le juge Moraes et quatre de ses collègues voteront ensuite pour aboutir au verdict d’ici à la semaine prochaine.L’ancien chef de l’Etat est notamment accusé de tentative de coup d’Etat et d’abolition violente de l’Etat démocratique de droit. Il risque jusqu’à 43 ans de prison.En cas de condamnation, qu’il pourra contester en appel, il “est possible” qu’il soit envoyé aussitôt en prison, selon une source de la Cour suprême.Si ses alliés estiment que Jair Bolsonaro est pratiquement condamné d’avance, ils misent sur l’approbation au Parlement d’une amnistie pour lui éviter la prison.Une condamnation devrait cependant relancer la course à sa succession à droite.Avec une popularité renforcée par les attaques américaines, Lula, 79 ans, affiche déjà son intention de briguer un nouveau mandat, se posant en champion de la “souveraineté” brésilienne.Il a lui-même été incarcéré en 2018-2019 pour corruption passive et blanchiment. Sa condamnation a ensuite été annulée pour vice de forme.

Procès Bolsonaro au Brésil: la Cour suprême entre dans la phase finale

La Cour suprême du Brésil a débuté mardi ses débats en vue du verdict dans le procès historique de l’ex-président Jair Bolsonaro, qui risque plus de 40 ans de prison pour présumée tentative de coup d’Etat, malgré les pressions de Donald Trump.Dans l’enceinte solennelle du tribunal de Brasilia, l’audience a été ouverte par le juge Cristiano Zanin, a constaté un journaliste de l’AFP.Il a ensuite passé la parole au rapporteur du procès, Alexandre de Moraes, juge puissant et clivant ciblé par de lourdes sanctions financières de l’administration Trump.”Le Brésil se trouve aujourd’hui avec une démocratie forte, des institutions indépendantes, une économie en croissance et une société civile active”, a lancé le juge Moraes en préambule.Le leader d’extrême droite Jair Bolsonaro, 70 ans, qui présida le plus grand pays d’Amérique latine de 2019 à 2022, doit être fixé sur son sort d’ici au 12 septembre, avec sept co-accusés, dont plusieurs anciens ministres et militaires haut gradés.Comme annoncé par sa défense, l’ancien chef d’Etat ne s’est pas rendu au tribunal. Seul co-accusé aperçu dans la salle, l’ancien ministre de la Défense Sergio Nogueira a lancé à son arrivée : “Je crois en la justice”.Le parquet accuse M. Bolsonaro d’être le chef d’une “organisation criminelle” ayant conspiré pour assurer son “maintien autoritaire au pouvoir”, en dépit de sa défaite face au président actuel de gauche Luiz Inacio Lula da Silva lors du scrutin de 2022.Assigné à résidence depuis début août et inéligible jusqu’en 2030, il clame son innocence et se dit victime d’une “persécution politique”, à un peu plus d’un an de l’élection présidentielle de 2026.Son procès est au cœur d’une crise sans précédent entre le Brésil et les Etats-Unis.Invoquant une “chasse aux sorcières” contre son allié, le président américain Donald Trump a imposé depuis le 6 août une surtaxe punitive de 50% sur une part des exportations brésiliennes.- Sécurité renforcée -Avec ce procès dont les audiences finales doivent s’étaler sur cinq jours, c’est la première fois qu’un ancien chef de l’Etat brésilien doit répondre de telles accusations.Un rendez-vous historique, quarante ans après la fin de la dictature militaire (1964-1985), dont les responsables n’ont jamais été traduits en justice.A Brasilia, la sécurité a été renforcée sur l’emblématique place des Trois-Pouvoirs, où se côtoient palais présidentiel, Parlement et Cour suprême.Agents armés et chiens renifleurs contrôlent l’entrée du tribunal, ont constaté des journalistes de l’AFP.Les autorités ont annoncé “une surveillance continue avec des équipements de dernière génération, y compris des drones dotés de caméras thermiques”.C’est sur cette place que, le 8 janvier 2023, des milliers de sympathisants bolsonaristes avaient saccagé les lieux de pouvoir, réclamant une intervention militaire pour déloger Lula.Alors aux Etats-Unis, M. Bolsonaro est accusé par le parquet d’avoir été l’instigateur des émeutes.Le projet putschiste incluait aussi, selon l’accusation, un décret d’état de siège et un plan pour assassiner Lula, son vice-président élu Geraldo Alckmin et le juge Alexandre de Moraes.- Amnistie -L’audience de mardi est entrée dans le vif du sujet avec la lecture par ce magistrat d’un rapport résumant les principaux points du dossier. Le procureur prendra ensuite la parole, suivi des avocats de chacun des huit accusés.Le juge Moraes et quatre de ses collègues voteront ensuite pour aboutir au verdict d’ici à la semaine prochaine.L’ancien chef de l’Etat est notamment accusé de tentative de coup d’Etat et d’abolition violente de l’Etat démocratique de droit. Il risque jusqu’à 43 ans de prison.En cas de condamnation, qu’il pourra contester en appel, il “est possible” qu’il soit envoyé aussitôt en prison, selon une source de la Cour suprême.Si ses alliés estiment que Jair Bolsonaro est pratiquement condamné d’avance, ils misent sur l’approbation au Parlement d’une amnistie pour lui éviter la prison.Une condamnation devrait cependant relancer la course à sa succession à droite.Avec une popularité renforcée par les attaques américaines, Lula, 79 ans, affiche déjà son intention de briguer un nouveau mandat, se posant en champion de la “souveraineté” brésilienne.Il a lui-même été incarcéré en 2018-2019 pour corruption passive et blanchiment. Sa condamnation a ensuite été annulée pour vice de forme.

L’après-Bayrou dans toutes les têtes, Macron réunit les chefs du camp gouvernemental

Emmanuel Macron a réuni mardi les chefs du camp gouvernemental pour un déjeuner de crise à six jours d’une probable chute de François Bayrou, sur fond d’appels pour une nouvelle dissolution de l’Assemblée nationale ou une démission du chef de l’Etat.Le Premier ministre, qui se soumettra lundi à un vote de confiance devant les députés qui semble perdu d’avance, est arrivé à l’Elysée à la mi-journée, ont constaté des journalistes de l’AFP. Gabriel Attal (Renaissance), Edouard Philippe (Horizons) et Bruno Retailleau (Les Républicains), les chefs des partis qui soutiennent le gouvernement, ont rejoint le duo exécutif pour cette réunion, selon l’entourage de plusieurs participants. Leur “socle commun”, déjà fragile, est lui-même tiraillé, et Emmanuel Macron entend probablement s’assurer de sa solidité.Le président de la République l’a répété à plusieurs reprises: législatives ou présidentielle anticipées ne sont pas à son ordre du jour. Mais plus l’échéance approche, plus la question est sur toutes les lèvres. Et son entourage ne cache pas qu’une dissolution n’est pas exclue en cas de nouveau blocage.En attendant, François Bayrou a repris mardi matin ses rencontres avec les partis politiques pour tenter d’arracher la confiance lundi. Place publique de Raphaël Glucksmann puis le Rassemblement national ont été reçus mais “le miracle n’a pas eu lieu”, a résumé le patron du parti à la flamme Jordan Bardella, rendant la chute du gouvernement quasi-inéluctable. La gauche et l’extrême droite, voire certains LR, rejettent en bloc le plan budgétaire qui prévoit un effort de 44 milliards d’euros en 2026, alors que le taux d’intérêt de la dette française à 30 ans a dépassé 4,5%, une première depuis 2011. A gauche, si La France insoumise plaide sans relâche pour le départ d’Emmanuel Macron, Ecologistes et socialistes tentent d’organiser une nouvelle alliance.Il faut “qu’on se mette dans une pièce et qu’on prépare la suite”, “qu’il y ait une dissolution, qu’il y ait une nomination de quelqu’un plutôt de la gauche et des écologistes ou de quelqu’un d’autre”, ou qu’il y ait “une destitution”, a exhorté lundi soir la patronne des Écologistes Marine Tondelier.Après avoir offert samedi ses services pour prendre la relève, le premier secrétaire du PS, Olivier Faure, a répété vouloir “un Premier ministre de gauche, avec un projet de gauche et qui soumette ses propositions au Parlement” car “une dissolution ne changera rien aux équilibres”.- “Petits arrangements” -De l’autre côté de l’échiquier, le RN met en scène ses préparatifs pour des législatives anticipées. Marine Le Pen et Jordan Bardella ont réclamé mardi dans la cour de Matignon une “dissolution ultra-rapide”. “Plus tôt on retournera aux urnes, plus tôt la France aura un budget”, a déclaré le président du RN. De fait, le parti lepéniste pense pouvoir “avoir une majorité absolue” à l’Assemblée, a assuré mardi son vice-président Sébastien Chenu. Mais c’est au sein du “socle commun”, des macronistes jusqu’à la droite LR qui gouvernent ensemble tant bien que mal depuis un an, que la question divise le plus.Symbole de cette ligne de crête, le président des LR et puissant ministre de l’Intérieur, Bruno Retailleau, défend le vote de confiance contre “les incendiaires qui voudraient allumer la mèche de ce qui pourrait être demain une explosion financière et budgétaire”. Mais certains députés LR ont l’intention de voter contre et leur patron, Laurent Wauquiez, pousse pour une consultation des adhérents du parti. Le locataire de Beauvau ne cache pas ses réserves sur certaines mesures budgétaires, comme la suppression de deux jours fériés. Opposé à une nouvelle dissolution, Bruno Retailleau l’est également à une démission du président. “Ça fragiliserait nos institutions”, a-t-il plaidé lundi. Mais au sein de LR, des voix comme celles de l’ex-ministre Jean-François Copé, ou de la présidente de la région Ile-de-France Valérie Pécresse l’appellent au contraire de leurs vœux. Dans cette cacophonie semblant précéder un épilogue aux airs de déjà-vu lors de la chute du gouvernement de Michel Barnier en décembre, l’opinion aura-t-elle le dernier mot ? C’est en tout cas le souhait des syndicats, au premier rang desquels la CGT, qui appelle à la mobilisation les 10 et 18 septembre.”Nous voulons reprendre les choses en main: ce n’est plus possible que notre avenir se décide avec des petits arrangements politiciens ou avec des passages en force, comme veut toujours le faire Emmanuel Macron”, a prévenu sa secrétaire générale Sophie Binet sur France 2.

L’après-Bayrou dans toutes les têtes, Macron réunit les chefs du camp gouvernemental

Emmanuel Macron a réuni mardi les chefs du camp gouvernemental pour un déjeuner de crise à six jours d’une probable chute de François Bayrou, sur fond d’appels pour une nouvelle dissolution de l’Assemblée nationale ou une démission du chef de l’Etat.Le Premier ministre, qui se soumettra lundi à un vote de confiance devant les députés qui semble perdu d’avance, est arrivé à l’Elysée à la mi-journée, ont constaté des journalistes de l’AFP. Gabriel Attal (Renaissance), Edouard Philippe (Horizons) et Bruno Retailleau (Les Républicains), les chefs des partis qui soutiennent le gouvernement, ont rejoint le duo exécutif pour cette réunion, selon l’entourage de plusieurs participants. Leur “socle commun”, déjà fragile, est lui-même tiraillé, et Emmanuel Macron entend probablement s’assurer de sa solidité.Le président de la République l’a répété à plusieurs reprises: législatives ou présidentielle anticipées ne sont pas à son ordre du jour. Mais plus l’échéance approche, plus la question est sur toutes les lèvres. Et son entourage ne cache pas qu’une dissolution n’est pas exclue en cas de nouveau blocage.En attendant, François Bayrou a repris mardi matin ses rencontres avec les partis politiques pour tenter d’arracher la confiance lundi. Place publique de Raphaël Glucksmann puis le Rassemblement national ont été reçus mais “le miracle n’a pas eu lieu”, a résumé le patron du parti à la flamme Jordan Bardella, rendant la chute du gouvernement quasi-inéluctable. La gauche et l’extrême droite, voire certains LR, rejettent en bloc le plan budgétaire qui prévoit un effort de 44 milliards d’euros en 2026, alors que le taux d’intérêt de la dette française à 30 ans a dépassé 4,5%, une première depuis 2011. A gauche, si La France insoumise plaide sans relâche pour le départ d’Emmanuel Macron, Ecologistes et socialistes tentent d’organiser une nouvelle alliance.Il faut “qu’on se mette dans une pièce et qu’on prépare la suite”, “qu’il y ait une dissolution, qu’il y ait une nomination de quelqu’un plutôt de la gauche et des écologistes ou de quelqu’un d’autre”, ou qu’il y ait “une destitution”, a exhorté lundi soir la patronne des Écologistes Marine Tondelier.Après avoir offert samedi ses services pour prendre la relève, le premier secrétaire du PS, Olivier Faure, a répété vouloir “un Premier ministre de gauche, avec un projet de gauche et qui soumette ses propositions au Parlement” car “une dissolution ne changera rien aux équilibres”.- “Petits arrangements” -De l’autre côté de l’échiquier, le RN met en scène ses préparatifs pour des législatives anticipées. Marine Le Pen et Jordan Bardella ont réclamé mardi dans la cour de Matignon une “dissolution ultra-rapide”. “Plus tôt on retournera aux urnes, plus tôt la France aura un budget”, a déclaré le président du RN. De fait, le parti lepéniste pense pouvoir “avoir une majorité absolue” à l’Assemblée, a assuré mardi son vice-président Sébastien Chenu. Mais c’est au sein du “socle commun”, des macronistes jusqu’à la droite LR qui gouvernent ensemble tant bien que mal depuis un an, que la question divise le plus.Symbole de cette ligne de crête, le président des LR et puissant ministre de l’Intérieur, Bruno Retailleau, défend le vote de confiance contre “les incendiaires qui voudraient allumer la mèche de ce qui pourrait être demain une explosion financière et budgétaire”. Mais certains députés LR ont l’intention de voter contre et leur patron, Laurent Wauquiez, pousse pour une consultation des adhérents du parti. Le locataire de Beauvau ne cache pas ses réserves sur certaines mesures budgétaires, comme la suppression de deux jours fériés. Opposé à une nouvelle dissolution, Bruno Retailleau l’est également à une démission du président. “Ça fragiliserait nos institutions”, a-t-il plaidé lundi. Mais au sein de LR, des voix comme celles de l’ex-ministre Jean-François Copé, ou de la présidente de la région Ile-de-France Valérie Pécresse l’appellent au contraire de leurs vœux. Dans cette cacophonie semblant précéder un épilogue aux airs de déjà-vu lors de la chute du gouvernement de Michel Barnier en décembre, l’opinion aura-t-elle le dernier mot ? C’est en tout cas le souhait des syndicats, au premier rang desquels la CGT, qui appelle à la mobilisation les 10 et 18 septembre.”Nous voulons reprendre les choses en main: ce n’est plus possible que notre avenir se décide avec des petits arrangements politiciens ou avec des passages en force, comme veut toujours le faire Emmanuel Macron”, a prévenu sa secrétaire générale Sophie Binet sur France 2.