Affaire Legrand/Cohen: Cohen pas en faute, selon le comité d’éthique de France Télévisions

Le comité d’éthique de France Télévisions a jugé vendredi que le journaliste Patrick Cohen n’était pas en faute dans la séquence vidéo le montrant au restaurant avec son confrère Thomas Legrand et des dirigeants du Parti socialiste, qui leur a valu des accusations de connivence.”Rien ne permet (…) d’affirmer, au vu de cette séquence, que Patrick Cohen ait d’autres objectifs que l’exercice de son métier”, conclut le comité d’éthique dans un avis mis en ligne sur le site du groupe public.Filmée en juillet dans un restaurant parisien, la séquence a été diffusée le 5 septembre par le média conservateur L’Incorrect.On y voit Thomas Legrand, chroniqueur à Libération et France Inter, et Patrick Cohen, chroniqueur qui intervient également sur France Inter et sur C à vous (France 5), échanger avec Pierre Jouvet, secrétaire général du PS et Luc Broussy, président du conseil national du PS.Au cours de cette discussion, où est aussi évoquée la stratégie de la gauche en vue de la présidentielle de 2027, M. Legrand déclare: “Nous, on fait ce qu’il faut pour (Rachida) Dati, Patrick (Cohen) et moi”. Cette phrase, qui a pu être interprétée comme un parti pris à l’encontre de la ministre sortante de la Culture, a provoqué une salve de critiques envers les deux journalistes, aussi bien du côté des Républicains, que du Rassemblement national et de La France insoumise. Sans s’exprimer sur le fond de ces propos, le Comité d’éthique de France Télévisions “constate” que Patrick Cohen n’y “réagit pas”. “Il garde le silence, sans davantage éclairer cette séquence, au demeurant tronquée et montée, et qu’il serait indispensable et utile de découvrir dans sa totalité”, poursuit le comité.Dans son avis, il juge toutefois “crucial que l’audiovisuel public, et, en son sein, France Télévisions soient particulièrement attentifs au pluralisme des opinions, notamment dans ses magazines d’information, au respect des règles fondamentales de déontologie et à la nécessaire impartialité des professionnels qui interviennent sur ses antennes”.Après cette affaire, le régulateur de l’audiovisuel (Arcom) doit bientôt auditionner Delphine Ernotte Cunci et Sibyle Veil, respectivement présidentes de France Télévisions et Radio France.Thomas Legrand a renoncé mardi à son émission hebdomadaire sur France Inter, mais continuera d’intervenir à l’antenne de cette radio.

Les Pays-Bas boycotteront l’Eurovision 2026 si Israël participe

Les Pays-Bas boycotteront l’Eurovision l’an prochain si Israël y participe, a annoncé vendredi l’association de l’audiovisuel public néerlandaise Avrotros, invoquant la guerre à Gaza et les “interférences” d’Israël lors de la dernière édition du concours de chansons.”La participation d’Avrotros à l’Eurovision 2026 ne sera pas possible aussi longtemps qu’Israël restera au sein de l’UER (l’Union européenne de radio-télévision)”, a indiqué le communiqué de l’audiovisuel public néerlandais. Au contraire, “si l’UER décide de ne pas admettre Israël, Avrotros sera heureux de participer l’an prochain”, ajoute-t-il.La radio-télévision néerlandaise s’ajoute à une liste de pays qui menacent de se retirer de la compétition l’an prochain, prévue à Vienne en Autriche, pays victorieux cette année.Jeudi, l’Irlande, sept fois vainqueur à l’Eurovision, a fait part de son intention de ne pas concourir au côté d’Israël. En mai, le Premier ministre espagnol Pedro Sanchez avait déjà estimé qu’Israël devait être exclu de la compétition à l’avenir.Avrotros a justifié sa décision par les “sérieuses violations de la liberté de la presse” commises par les Israéliens à Gaza, selon son communiqué. Elle accuse aussi Israël d’avoir commis “des interférences prouvées lors de la dernière édition, se livrant à une instrumentalisation politique de l’événement”.Le concours est organisé par l’Union européenne de radio-télévision (UER), la première alliance mondiale de médias de service public, fondée en 1950, en coopération avec ses membres dans plus de 35 pays.

Les flamants roses migrateurs vieillissent mieux que les sédentaires, selon une étude

Les flamants roses migrateurs vieillissent mieux et vivent plus longtemps que ceux qui ne migrent pas, révèle une étude de la Tour du Valat, institut de recherche pour la conservation des zones humides méditerranéennes basé en Camargue, dans le sud-est de la France.Grâce à un programme de baguage d’une ampleur unique au monde, avec des dizaines de milliers d’oiseaux suivis depuis 44 ans, les chercheurs ont découvert que le vieillissement des flamants roses, dont l’espérance de vie peut atteindre 50 ans, dépendait de leur stratégie migratoire.Les flamants roses font en effet partie des espèces à la migration partielle, c’est-à-dire que certains, adultes, choisissent de migrer chaque hiver, tandis que d’autres, appelés “résidents”, restent toute l’année au même endroit.Si les flamants roses résidents, “bien installés dans les lagunes méditerranéennes”, s’en sortent mieux au début de leur vie, notamment car ils prennent moins de risques, ils commencent à vieillir dès l’âge de 20 ans, soit 40% plus rapidement que ceux qui migrent. Une différence qui s’explique ainsi: les oiseaux sédentaires se reproduisent plus tôt et plus souvent, et le “coût” pour leur santé de cette forte reproduction est finalement supérieur au “coût” énergétique d’une migration.L’étude publiée dans la revue “Proceedings of the National Academy of Science (PNAS)”, basée sur plus de 27.000 individus, a évalué deux critères: la reproduction des flamants – qui dure toute leur vie – et leur mortalité.Les flamants décident en général au début de leur vie adulte s’ils vont ou non migrer, explique à l’AFP Jocelyn Champagnon, directeur de recherches à la Tour du Valat et coauteur de l’étude.Ce comportement migratoire a évolué chez les flamants de Camargue depuis les années 60: “aujourd’hui beaucoup restent autour des sites de reproduction”. Un phénomène qui s’explique “à la fois du fait du réchauffement climatique – avant, les coups de froid hivernaux pouvaient entrainer une forte mortalité -, mais aussi du fait de l’attractivité du site de reproduction”.Les flamants, qui sont des animaux coloniaux, ont besoin d’être nombreux pour assurer le succès de la nidification, ajoute M. Champagnon.”Nous accumulons des preuves montrant que, au sein d’une même espèce, les individus ne vieillissent souvent pas au même rythme du fait de variations génétiques, comportementales, et environnementales”, explique de son côté Hugo Cayuela, un autre co-auteur, chercheur à l’Université d’Oxford. Le modèle de l’étude “sera intéressant à appliquer aussi chez d’autres espèces”, selon M. Champagnon.La population de flamants roses de Camargue, menacée dans les années 60, a bénéficié de mesures de conservation en Camargue et en Méditerranée et augmente d’année en année. Au printemps, plus de 50.000 individus sont recensés sur le pourtour méditerranéen français.

M. Lecornu “n’a pas donné de position” sur le sujet des retraites, selon Marylise Léon

Le nouveau Premier ministre Sébastien Lecornu qui a entamé une série de rendez-vous avec les partenaires sociaux “n’a pas donné de position” sur le sujet des retraites, a déclaré vendredi la secrétaire générale de la CFDT Marylise Léon, au sortir d’une rencontre avec M. Lecornu à Matignon.”Il n’a pas donné de position sur ce qu’il allait donner comme suite sur le sujet des retraites”, a déclaré Marylise Léon à la presse, en répétant que la CFDT était fermement opposée à une éventuelle réouverture du conclave lancé l’année dernière par François Bayrou, et qui avait échoué avant l’été. “Il n’y a pas eu de terrain d’atterrissage au moment de la fin du conclave, donc on ne reprend pas les discussions”, a-t-elle estimé.S’agissant de la préparation du budget, Mme Léon a estimé qu’il était “hors de question que ce soit le monde du travail qui paye la question de la réduction des déficits”.”Nous lui avons réaffirmé que nous étions plus que jamais motivés pour aller dans la rue, et que nous réussirons la mobilisation du 18 septembre”, a-t-elle dit.M. Lecornu “n’a pas démenti qu’il pourrait y avoir un certain nombre d’éléments, de travaux, sur une contribution des plus hauts revenus”, mais “selon quelles modalités, ça n’est pas encore complètement défini”, a précisé Mme Léon.”Ce qu’attendent les travailleurs et les travailleuses, c’est qu’il y ait des preuves” de la “rupture” annoncée par le nouveau Premier ministre, “et qu’on puisse avoir une démonstration qu’il y a véritablement un changement de méthode”, a-t-elle ajouté.La consultation des partenaires sociaux se poursuivra vendredi soir avec le Medef qui sera reçu à 19H45 par le nouveau Premier ministre. La secrétaire générale de la CGT, Sophie Binet, sera elle, reçue lundi à 11H00 à Matignon puis la CFTC à 14H30 et les deux organisations patronales CPME et U2P, respectivement lundi à 17H00 et mardi à 11H00.

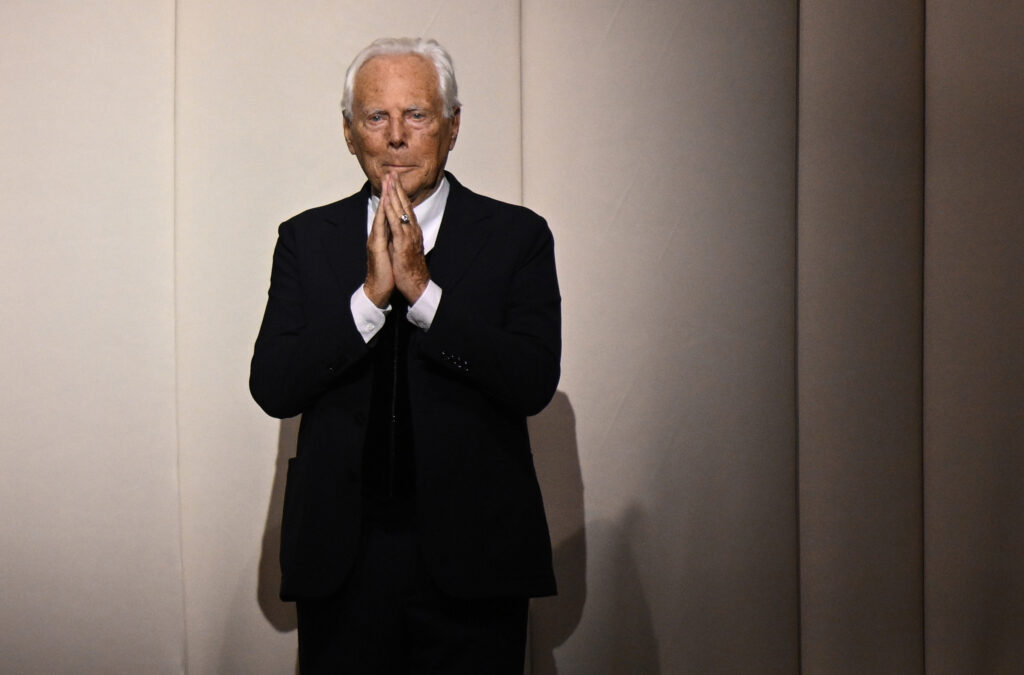

Armani va être cédé à un géant du luxe, selon le testament du styliste

Giorgio Armani a demandé à ses héritiers de céder à moyen terme son empire à un géant du luxe comme LVMH ou L’Oréal, selon le testament du styliste qui était pourtant resté hautement indépendant toute sa vie. Le couturier italien, décédé le 4 septembre à 91 ans, a chargé la fondation qui hérite de sa société “de céder une participation de 15%” à un géant du monde de la mode “entre 12 et 18 mois après l’ouverture du testament” intervenue jeudi, selon ce document publié vendredi par la presse italienne.Il a souhaité que ces parts soient cédées “en priorité” au groupe de luxe LVMH, au géant des lunettes EssilorLuxottica, au numéro un mondial des cosmétiques L’Oréal ou à d’autres sociétés de même standing du monde de la mode, surtout celles avec lesquelles Armani “collabore déjà”.Le groupe Armani, dont les activités vont de la haute couture aux hôtels, pèse plusieurs milliards d’euros.L’Oréal, qui possède la licence Armani pour les parfums et cosmétiques depuis 1988, a indiqué à l’AFP étudier “avec grande considération cette perspective qui s’inscrit dans le cadre de notre longue histoire commune”.EssilorLuxottica va aussi l’étudier “attentivement”, a commenté un porte-parole de la société dans la presse italienne, “fier de l’estime” que le styliste a montré pour le groupe.L’actionnaire retenu aura ensuite la possibilité de prendre le contrôle du groupe, un des derniers restés indépendants dans le luxe, en acquérant entre 30 et 54,9% du reste du capital. – Compagnon et neveux -Le compagnon et bras droit de Giorgio Armani, Leo Dell’Orco, ainsi que ses deux neveux, seront chargés de faire ces choix capitalistiques, en tant qu’actionnaires de la fondation Armani. Si cette vente – prévue trois à cinq ans après l’ouverture du testament – ne se réalisait pas, le styliste a demandé que sa société soit cotée en Bourse.Le styliste a demandé par ailleurs que la fondation gère la société “de manière éthique, avec intégrité morale et correction”, et insiste sur “la recherche d’un style essentiel, moderne, élégant et discret”, et “l’attention à l’innovation, à l’excellence, à la qualité et au raffinement du produit”.La direction du groupe Armani a confirmé vendredi la publication du testament, ajoutant que “le premier devoir” de la fondation “sera de proposer le nom du nouveau directeur général” du groupe.Selon le groupe, il est “clair que l’intention de M. Armani de garantir la continuité stratégique, la cohésion de l’entreprise et la stabilité financière pour un développement à long terme est confirmée à chaque étape (du testament), conformément à ce qu’il avait maintes fois partagé avec la presse et ses plus proches collaborateurs”.La fondation ne détiendra jamais moins de 30% du capital, agissant ainsi comme garant permanent du respect des principes fondateurs”, a précisé Armani.Jeudi à Milan, dans le quartier du luxe, un immense panneau publicitaire avec un portrait du créateur sur fond noir affichait ses derniers mots publics: “La marque que j’espère laisser est faite d’engagement, de respect et d’attention pour les gens et pour la réalité. C’est là que tout commence”.Giorgio Armani était devenu un des hommes les plus riches du monde et le quatrième plus riche d’Italie, avec un patrimoine estimé à 11,8 milliards de dollars, selon le magazine Forbes.Il dirigeait un empire comptant plus de 9.000 salariés fin 2023, pour un chiffre d’affaires de 2,3 milliards d’euros en 2024, selon le groupe. Plus de 600 magasins à travers le monde vendent les vêtements Armani sous plusieurs gammes: Giorgio Armani, Emporio Armani, A|X Armani Exchange ou encore EA7.La fondation aura 10% des parts de la société et le reste en nue propriété, avec 30% des droits de vote. Leo Dell’Orco aura 40% des droits de vote et les neveux du styliste, Silvana Armani et Andrea Camerana, 15% chacun.L’autre empire du styliste, la société foncière L’Immobiliare, a été légué à sa soeur Rosanna et à ses neveux Andrea et Silvana. Leo Dell’Orco garde cependant l’usufruit de ces nombreuses propriétés situées à Saint-Tropez en France, Saint-Moritz en Suisse, ou dans les îles d’Antigua et Pantelleria.

Afghan deputy PM visits earthquake hit area

Afghanistan’s deputy prime minister visited the country’s east on Friday, becoming the first member of the Taliban government to do so nearly two weeks after a powerful earthquake killed more than 2,200 people.Abdul Ghani Baradar, co-founder of the Taliban with Mullah Omar, visited the eastern province of Kunar where the worst damage was seen from the magnitude 6 earthquake on August 31, according to his office.In the Friday sermon that followed the disaster, the government’s religious authorities claimed the earthquake and its aftershocks were “divine punishment”, calling on Afghans to repent. Afghanistan, one of the poorest countries in the world, is wracked by a humanitarian crisis after decades of war. On Friday, Baradar called on “all officials to collect aid and distribute it transparently”.”Efforts are being made to rebuild destroyed homes and provide the necessary infrastructure to reduce damage from future natural disasters,” he said, according to his office. Thousands of families are now surviving in open fields or tents in mountainous rural areas. The United Nations said half of those who died were children.On Thursday evening, Foreign Minister Amir Khan Muttaqi assured diplomats that “441 flights” had delivered aid to villages cut off by landslides and rockfalls, and that the injured had been evacuated by helicopter. The UN is concerned about the risk of disease spreading among the victims but, like other international NGOs, it has been forced to reduce its assistance to Afghans due to cuts in aid spending.The UN is also battling segregation rules imposed by Taliban authorities on its staff, which led to the organisation suspending its assistance to the millions of Afghans expelled from neighbouring countries.

Deux jours après le crime, le meurtrier de Charlie Kirk toujours introuvable

Le meurtrier du jeune militant conservateur américain Charlie Kirk demeurait introuvable vendredi, malgré la gigantesque chasse à l’homme enclenchée depuis mercredi pour retrouver l’auteur d’un assassinat qui a choqué un pays profondément polarisé.Le gouverneur républicain de l’Utah (ouest), Spencer Cox, a exhorté la population à aider les autorités à capturer “cet être humain malveillant”, soulignant que la peine de mort serait requise à son encontre.La police a annoncé une récompense pouvant aller jusqu’à 100.000 dollars pour toute information en lien avec l’enquête. Jusqu’à présent, plus de 7.000 signalements ont été reçus par la police.Les autorités ont publié des photos et des vidéos du suspect: un jeune homme svelte, habillé d’un tee-shirt sombre à manches longues avec un drapeau américain sur le torse, jean et lunettes de soleil, casquette bleue sur le crâne et chaussures de sport aux pieds.Sur une vidéo mise en ligne par le FBI, on voit une personne identifiée comme le suspect courant sur un toit après le tir et sautant avec adresse jusqu’au sol. On le voit ensuite traverser une rue très fréquentée et disparaître dans une zone boisée, où les enquêteurs ont ensuite trouvé un fusil de chasse 30-06 Mauser.Porte-drapeau de la jeunesse trumpiste désormais vu comme un “martyr” par la droite américaine, Charlie Kirk a été tué mercredi d’une balle dans le cou alors qu’il participait à un débat public dans une université de l’Utah.Si l’identité et les motivations du meurtrier sont toujours inconnues, le FBI a évoqué un acte “ciblé.”Donald Trump, qui avait dès mercredi mis en cause la responsabilité de la “gauche radicale”, appelle désormais à la retenue.- Trump appelle à la non violence -“Il militait pour la non violence. C’est de cette manière que je voudrais que les gens répondent”, a déclaré jeudi le président républicain, après avoir annoncé qu’il remettrait à la victime de 31 ans la médaille présidentielle de la Liberté, la plus haute distinction civile américaine, à titre posthume.Sur la chaîne conservatrice Fox News, un commentateur influent a affirmé que le meurtre de Charlie Kirk montrait que le camp conservateur était attaqué. “Que nous l’acceptions ou non, ils sont en guerre contre nous”, a-t-il assuré en visant implicitement les progressistes.Le meurtre de Charlie Kirk a pourtant été unanimement condamné par tout le spectre politique américain.”Charlie est devenu un martyr de la liberté d’expression”, estime Carson Caines, un étudiant en informatique rencontré par l’AFP sur le campus de l’université au lendemain du drame. A 23 ans, ce jeune mormon “très en colère”, qui a forgé sa conscience politique avec les vidéos de Charlie Kirk, avoue avoir eu envie de “réagir physiquement” mais “refuse d’alimenter le cycle de la violence”.A travers les Etats-Unis, des veillées funèbres ont été organisées pour rendre hommage au militant.Sur le campus d’Orem, plusieurs centaines de personnes portant des casquettes rouges MAGA (“Make America great Again”, le slogan de Donald Trump) et tenant des drapeaux américains se sont rassemblées et ont prié à la mémoire du défunt.”Cela semble toujours insensé que cela soit arrivé”, affirme Jonathan Silva, 35 ans, à l’AFP. “C’est totalement surréaliste”.Sa femme Angelina, 27 ans, a expliqué à l’AFP comment la polarisation politique violente a poussé le couple à remettre en question ses plans d’avoir un enfant. “Il semble un peu désespéré d’essayer de fonder une famille et d’élever des enfants dans une société où il y a tant de haine et tant de division”.Le vice-président JD Vance, qui a salué en Charlie Kirk un “véritable ami”, a annulé sa venue aux commémorations du 11-Septembre à New York pour rencontrer la famille du défunt dans l’Utah.- Vance porte le cercueil -Illustration de la proximité qu’entretenait Charlie Kirk avec l’exécutif américain, JD Vance a, selon une vidéo partagée par la Maison Blanche, aidé à porter le cercueil sur quelques mètres pour l’amener à bord de son avion gouvernemental.L’appareil a ensuite gagné Phoenix, dans l’Arizona, siège de Turning point USA, le mouvement de jeunesse que Charlie Kirk avait cofondé en 2012.Les Etats-Unis ont connu une recrudescence de la violence politique ces dernières années.Donald Trump a lui-même été victime de deux tentatives d’assassinat lors de la dernière campagne électorale. Cette année, Melissa Hortman, élue démocrate au Parlement du Minnesota et son époux ont été tués et un autre élu local a été grièvement blessé.