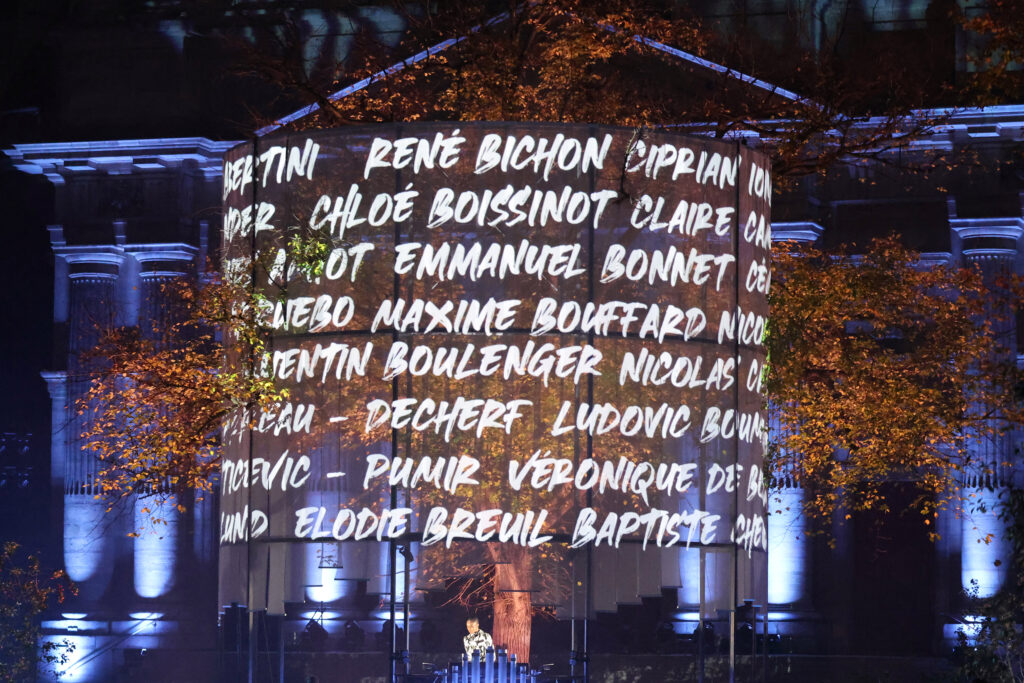

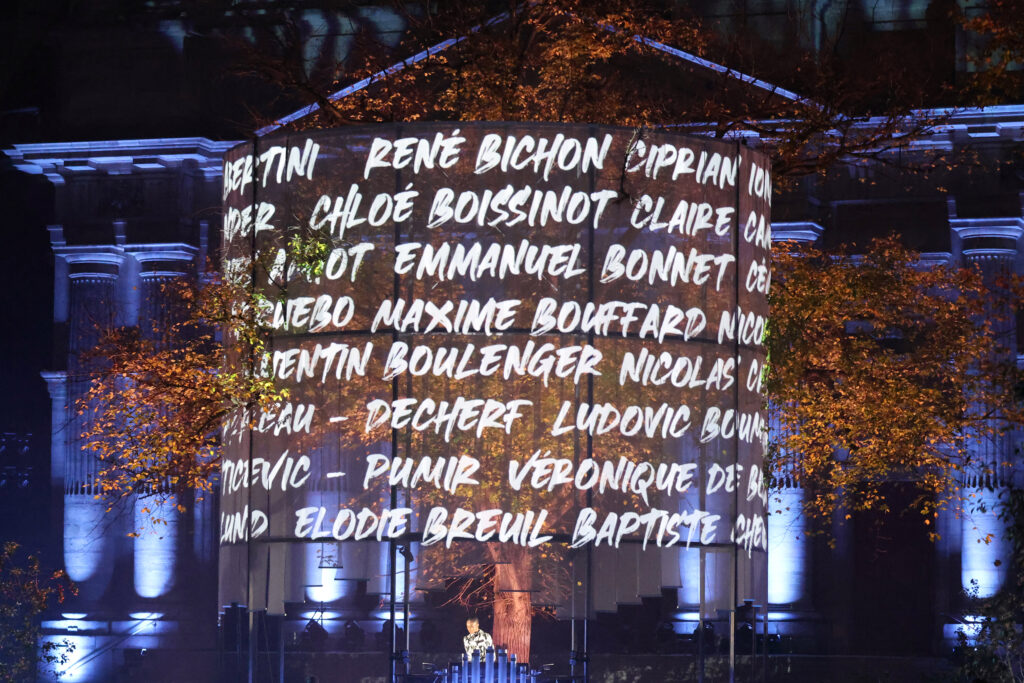

Au jardin mémoriel du 13 novembre 2015, des intervenants de cette nuit d’horreur ont égrené solennellement les noms des 132 morts à Paris et Saint-Denis, dix ans après ces attentats jihadistes, Emmanuel Macron évoquant la douleur “insensée, injuste, insupportable” des victimes. A la nuit tombée, les cloches de Notre-Dame et d’églises parisiennes ont sonné vers 18H00, marquant le début de l’hommage national, où la musique était omniprésente. La chanson d’AC/DC “Hells Bells”, jouée en version instrumentale, a lancé officiellement la cérémonie, avec une projection lumineuse représentant Marianne, des larmes bleues et rouges coulant sur ses joues. Puis se fut le “Requiem des lumières” du compositeur Victor Le Masne, avec le chœur de Radio France. Symbole fort, le chanteur des Eagles of death metal, groupe de hard rock qui se produisait au Bataclan ce soir de novembre 2015, a chanté “You’ll never walk alone” (“Tu ne marcheras jamais seul”) avec le Choeur du 13, une chorale de rescapés.Des personnes intervenues ce funeste soir du vendredi 13 novembre 2015, ont également égrené, dans un silence total, pendant près de dix minutes, le nom des 132 personnes -dont deux suicides de rescapés- dont la vie fut volée.- “Paris ne sombre pas” -Dans son discours, Emmanuel Macron a annoncé la décoration prochaine de la Légion d’honneur des policiers intervenus au Bataclan, réclamée par les associations de victimes.Le président de la République a décrit la douleur “insensée, injuste, insupportable” des victimes du 13-Novembre et de leurs proches.Dix ans après une année 2015 marquée aussi par les attaques contre Charlie Hebdo et l’Hyper-Cacher, M. Macron a souligné que “quand les terroristes veulent frapper la démocratie et la liberté, c’est la France et Paris d’abord qu’ils prennent pour cible”. Mais “la République a tenu”. Et le président d’affirmer que la Nation se portait “garante” de tout faire afin d'”empêcher toute nouvelle attaque”.Le vendredi 13 novembre 2015, des commandos téléguidés par le groupe Etat islamique (EI) ont visé le stade de France, à Saint-Denis, des terrasses de bar et restaurants, et la salle de concert du Bataclan à Paris, assassinant 130 personnes et blessant des centaines d’autres. Une nuit d’horreur restée dans la mémoire de nombreux Franciliens.”Une tuerie perpétrée par des jihadistes dont beaucoup sont nés, comme nous, en France et en Europe”, a rappelé Arthur Dénouveaux, rescapé du Bataclan et président de l’association “Life for Paris”. “Fidèle à sa devise, nous ne sombrons pas, Paris ne sombre pas”, a déclaré la maire de Paris Anne Hidalgo, en référence à la devise en latin de la capitale, “Fluctuat Nec Mergitur” (Il est battu par les flots, mais ne sombre pas). “Il y a dix ans, c’est la société qui a fait front, tous unis”, s’est souvenu Philippe Duperron, président de l’association “13onze15”, dont le fils Thomas a été tué au Bataclan. “Merci pour cette cérémonie d’hommage où le rock prend sa place si symbolique”.- Foule de rescapés -Un peu plus tôt jeudi, une foule de rescapés, de familles et d’officiels s’est rassemblée sur le lieu le plus meurtrier des attaques jihadistes, le Bataclan.Des membres de la BRI, le visage masqué, sont présents en nombre, dix ans après avoir donné l’assaut contre les jihadistes retranchés dans la salle de concert. Devant les portes de la salle de concert, chacun attendait son tour pour s’en approcher: certains se croisent, se reconnaissent, s’embrassent, se prennent longuement dans les bras ou échangent un petit mot de réconfort, avant de déposer à leur tour une fleur, une bougie, un signe de mémoire.Devant chacun des lieux frappés lors de cette funeste soirée, Arthur Dénouveaux et Philippe Duperron ont déposé des gerbes de fleurs, avant qu’Emmanuel Macron et Anne Hidalgo ne fassent de même, avant d’observer à chaque fois une minute de silence.Près des terrasses parisiennes, dans les Xe et XIe arrondissements, où 39 vies ont été fauchées au total, dont 21 devant la seule Belle Equipe, le silence règne, les yeux des personnes présentes sont embués de larmes. – Absence “immense” -Les commémorations ont débuté le matin par une cérémonie au stade de France, avec la famille de Manuel Dias, première victime du 13-Novembre. “Nous n’oublierons jamais; on nous dit de tourner la page dix ans après, mais l’absence est immense”, a dit dans un discours poignant sa fille, Sophie Dias. A Paris, le jardin mémoriel est fait de grandes stèles et de blocs de granit, évoquant la géographie des différents lieux visés.Place de la République, où un mémorial improvisé rendait hommage aux victimes il y a dix ans, des fleurs, bougies et mots entouraient de nouveau le pied de la statut de Marianne et un écran géant diffusait jeudi la cérémonie. abo-juc-mby-pab-etr-fff-ch-vid/mat/cbn