Britain’s Starmer ends China trip aimed at reset despite Trump warning

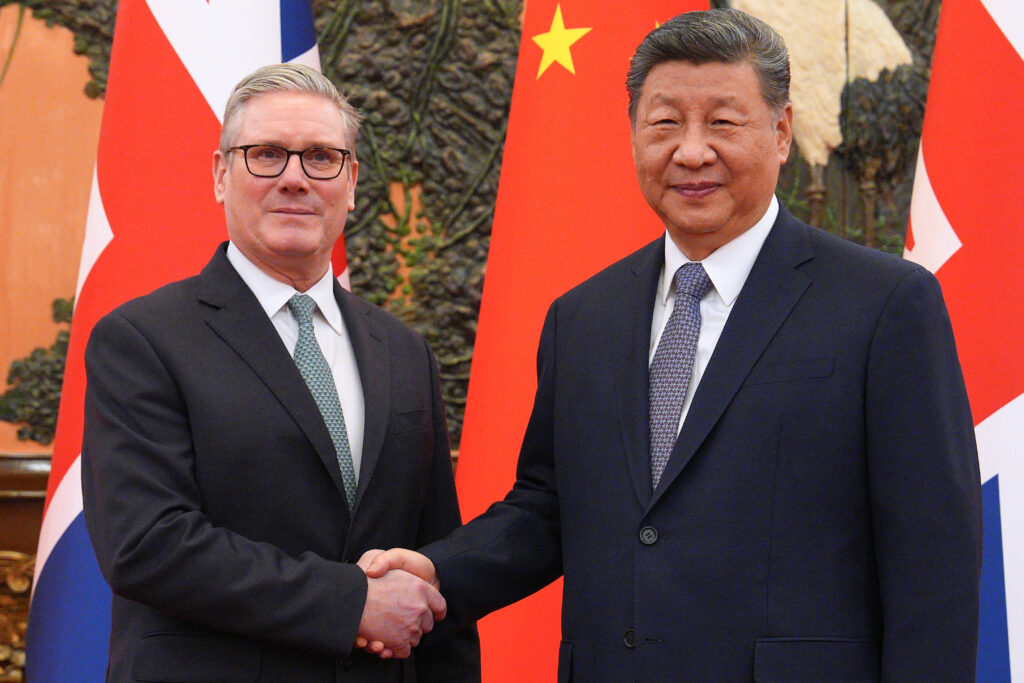

British Prime Minister Keir Starmer wrapped up a four-day trip to China on Saturday, after his bid to forge closer ties prompted warnings from US President Donald Trump.Starmer’s visit was the first to China by a British prime minister in eight years, following in the footsteps of other Western leaders looking to counter an increasingly volatile United States.Leaders from France, Canada and Finland have flocked to Beijing in recent weeks, recoiling from Trump’s bid to seize Greenland and tariff threats against NATO allies.Trump warned on Thursday it was “very dangerous” for Britain to be dealing with China.Starmer brushed off those comments on Friday, noting that Trump was also expected to visit China in the months ahead.”The US and the UK are very close allies, and that’s why we discussed the visit with his team before we came,” Starmer said in an interview with UK television.”I don’t think it is wise for the UK to stick its head in the sand. China is the second-largest economy in the world,” he said.Asked about Trump’s comments on Friday, Beijing’s foreign ministry said “China is willing to strengthen cooperation with all countries in the spirit of mutual benefit and win-win results”.Starmer met top Chinese leaders, including President Xi Jinping and Premier Li Qiang, on Thursday, with both sides highlighting the need for closer ties.He told business representatives from Britain and China on Friday that both sides had “warmly engaged” and “made some real progress”.”The UK has got a huge amount to offer,” he said in a short speech at the UK-China Business Forum at the Bank of China.He signed a series of agreements on Thursday, with Downing Street announcing Beijing had agreed to visa-free travel for British citizens visiting China for under 30 days, although Starmer acknowledged there was no start date for the arrangement yet.The Chinese foreign ministry said only that it was “actively considering” the visa deal and would “make it public at an appropriate time upon completing the necessary procedures”.He also said Beijing had lifted sanctions on UK lawmakers targeted since 2021 for their criticism of alleged human rights abuses against China’s Muslim Uyghur minority.”President Xi said to me that that means all parliamentarians are welcome”, Starmer said in an interview with UK television.He travelled from Beijing to economic powerhouse Shanghai, where he spoke with Chinese students at the Shanghai International College of Fashion and Innovation, a joint institute between Donghua University and the University of Edinburgh.On Saturday, Starmer visited a design institute and met with performing arts students alongside British actress Rosamund Pike, who spoke of her children’s experience learning Mandarin.Later on Saturday, Starmer will arrive in Tokyo for a meeting with Japanese counterpart Sanae Takaichi.- Visas and whisky -The visa deal could bring Britain in line with about 50 other countries granted visa-free travel, including France, Germany, Australia and Japan, and follows a similar agreement made between China and Canada this month.The agreements signed included cooperation on targeting supply chains used by migrant smugglers, as well as on British exports to China, health and strengthening a bilateral trade commission.China also agreed to halve tariffs on British whisky to five percent, according to Downing Street.British companies sealed £2.2 billion ($3 billion) in export deals and around £2.3 billion in “market access wins” over five years, and “hundreds of millions worth of investments,” Starmer’s government said in a statement.Xi told Starmer on Thursday that their countries should strengthen dialogue and cooperation in the context of a “complex and intertwined” international situation.Relations between China and Britain deteriorated from 2020 when Beijing imposed a national security law on Hong Kong and cracked down on pro-democracy activists in the former British colony.However, China remains Britain’s third-largest trading partner, and Starmer is hoping deals with Beijing will help fulfil his primary goal of boosting UK economic growth.British pharmaceutical group AstraZeneca said on Thursday it would invest $15 billion in China through 2030 to expand its medicines manufacturing and research.And China’s Pop Mart, makers of the wildly popular Labubu dolls, said it would set up a regional hub in London and open 27 stores across Europe in the coming year, including up to seven in Britain.