India ready to rev up chipmaking, industry pioneer says

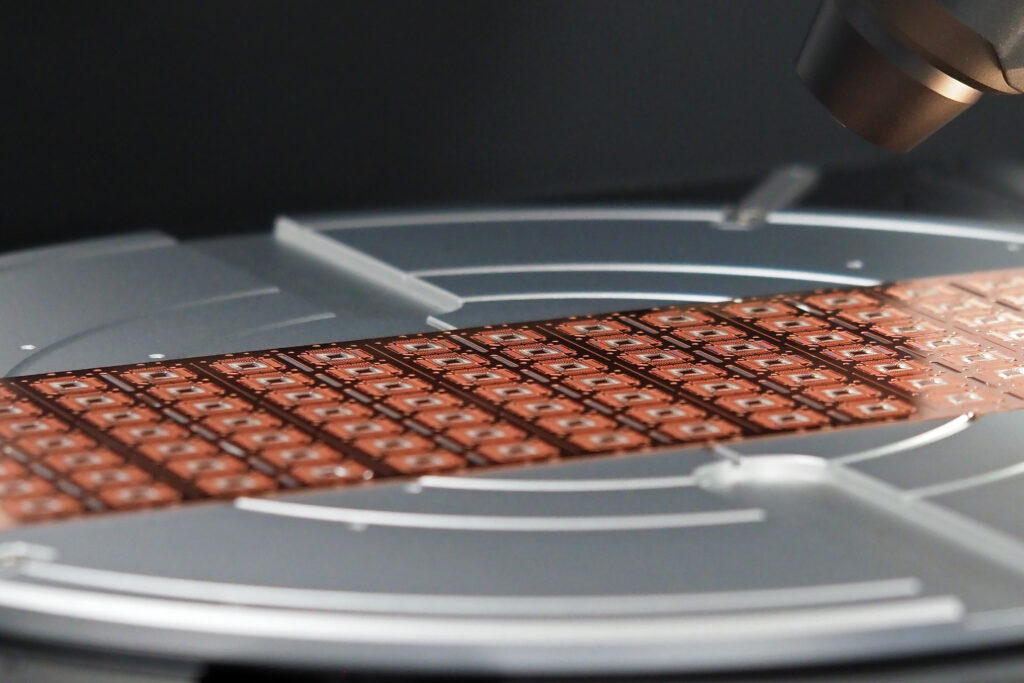

When Prime Minister Narendra Modi declared India’s “late entry” into the global semiconductor race, he pinned hopes on pioneers such as Vellayan Subbiah to create a chip innovation hub.The chairman of CG Power, who oversees a newly commissioned semiconductor facility in western India, is seen as one of the early domestic champions of this strategic sector in the world’s fastest-growing major economy.”There has been more alignment between the government, policymakers, and business than I’ve ever seen in my working history,” Subbiah, 56, told AFP.”There’s an understanding of where India needs to go, and the importance of having our own manufacturing.”As US President Donald Trump shakes global trade with tariffs and hard-nosed transactionalism, Modi has doubled down on self-reliance in critical technologies.New Delhi, which flagged its push in 2021, has this year approved 10 semiconductor projects worth about $18 billion in total, including two 3-nanometre design plants, among the most advanced.Commercial production is slated to begin by the end of the year, with the market forecast to jump from $38 billion in 2023 to nearly $100 billion by 2030.Subbiah, whose CG Power is one of India’s leading conglomerates, predicts “over $100 billion, if not more”, will flow into the industry across the value chain in the next five to seven years.He said “symbiotic” public-private partnerships were “very exciting”.-‘Ability to accelerate’-Chips are viewed as key to growth and a source of geopolitical clout.India says it wants to build a “complete ecosystem”, and break the global supply chain dominance by a few regions.The government has courted homegrown giants such as Tata, alongside foreign players like Micron, to push design, manufacturing and packaging in joint ventures.CG Semi, a joint venture with CG Power, plans to invest nearly $900 million in two assembly and test plants, as well as to push its design company.”We are looking to design chips, so that we can own the (intellectual property) too — which is very important for India,” said Subbiah, a civil engineer by training with an MBA from the University of Michigan.Still, critics say India is decades late starting, and remains far behind chip leaders in Taiwan, the Netherlands, Japan and China.”First we have to recognise there is a gap,” Subbiah said, noting Taiwan’s TSMC has a 35-year head start. But he insists India’s scale and talent pool — the world’s most populous nation with 1.4 billion people — gives it “a significant ability to accelerate” production.- ‘More complicated’-Modi this month said that “20 percent of the global talent in semiconductor design comes from India”.But wooing talent who sought opportunities abroad back to India remains a challenge, even after Trump’s restrictions on the H-1B skilled worker visa programme, heavily used by Indians.India, the world’s fifth-largest economy, still struggles with bureaucratic inertia and a lack of cutting-edge opportunities.Subbiah acknowledged that his own venture employs about 75 expatriates.”That’s not the way we want to grow. We want to grow with Indians,” he said, calling for policies to lure back overseas talent. “How do we bring these people back?”But the path is tougher than in 2021, when New Delhi first pushed for chip self-sufficiency.While India has secured semiconductor and AI investment pledges from partners such as Japan — which pledged $68 billion in August — Trump is expected to be less willing than past US leaders to back ventures that build Indian capacity.”The geopolitical situation overall has become more complicated,” Subbiah said.Yet he remains upbeat for the long run.”There are only going to be two really low-cost ecosystems in the world: one is China, and the other is going to be India,” he said.”You’re going to see the centre of gravity move towards these ecosystems, if you start thinking about a 25-30 year vision”.