Dow surges above 50,000 for first time as US stocks regain mojo

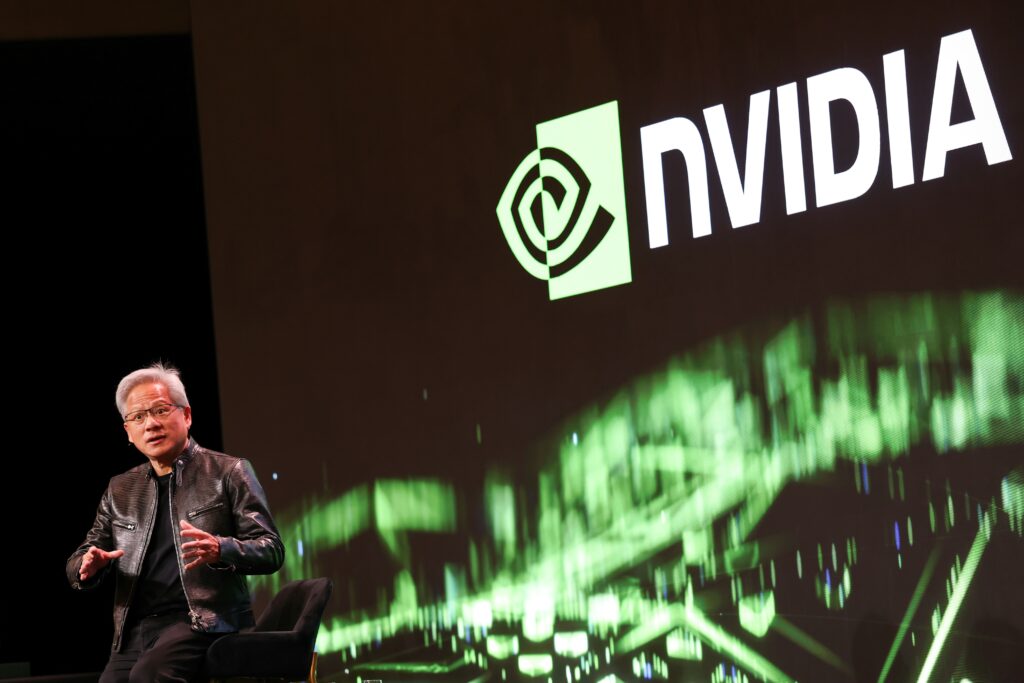

The Dow surged above 50,000 points for the first time Friday, shrugging off worries connected to artificial intelligence companies while traders focused on the prospects for US growth and Federal Reserve interest rate cuts.The index, the oldest of the three major US equity indices, powered to the landmark level shortly before 1930 GMT, retreated a bit below 50,000 points and then pushed even higher to close the day near session highs.It ended at 50,115.67, up more than 1,200 points, or 2.5 percent.The 50,000 mark constitutes “a nice big number,” said Briefing.com analyst Patrick O’Hare. “What it really reflects is a market that’s broadening out and buying into the growth story.” The landmark in New York came on a mixed day for global stocks, while bitcoin and precious metals both won significant gains, extending a period of volatility across markets.US stocks had been under pressure this week, with the Nasdaq falling the last three sessions following big drops in software equities and some tech giants related to the AI push. On Friday, Amazon was the biggest loser on the Dow, falling 5.6 percent after announcing it planned $200 billion in capital spending in 2026 to build up AI capacities.While investors continue to worry Amazon and other AI “hyperscalers” may not see a sufficient return on massive investments, their plans will bolster infrastructure, banking and other sectors.Caterpillar, 3M, JPMorgan Chase, Goldman Sachs, Amgen and Nvidia all rose at least four percent Friday.The AI plans mean “massive amounts of money are going to be deployed and that filters out to other companies,” said O’Hare. Gina Bolvin, of Bolvin Wealth Management, said Friday’s gains showed “confidence is real” in terms of the outlook for earnings growth.”Equity investors are likely to be rewarded — but the path won’t be smooth,” Bovin said in a note. “Volatility should be expected. For investors, this is a reminder to stay intentional: lean into quality businesses with strong earnings power and be prepared for more rotation, not straight-line gains.”Earlier milestones for the Dow include when it hit 40,000 points in May 2024 and 30,000 points in November 2020.The index has risen fairly steadily for most of the last two and a half years with the exception of the period around Donald Trump’s April 2025 “Liberation Day” tariff proposals, which the president later walked back.”CONGRATULATIONS AMERICA,” Trump said in a social media post celebrating Friday’s benchmark. Elsewhere, both gold and silver rebounded after bruising drops on Thursday, joining bitcoin, which climbed back above $70,000 after dropping to around $60,000 the prior day.After steep losses Thursday, European markets all pushed higher, while Asian bourses were mixed.In company news, shares in Jeep maker Stellantis plunged over 24 percent in Paris after it warned of a 22-billion-euro ($26-billion) write-down due to misjudging the shift in demand to electric vehicles.Stellantis shares are now down around 80 percent over the past two years.Meanwhile, shares in British-Australian mining giant Rio Tinto finished flat in Sydney after it dropped merger talks with Swiss resources firm Glencore. The deal would have created the world’s biggest mining firm, worth about $260 billion.Rio Tinto’s London-listed stock edged 0.3 percent higher on Friday, while Glencore climbed 1.5 percent, clawing back some of the previous day’s losses.Toyota jumped two percent in Tokyo after hiking profit and sales forecasts for the current fiscal year despite the impact of US tariffs.- Key figures at around 2115 GMT -New York – Dow: UP 2.5 percent at 50,115.67 (close)New York – S&P 500: UP 2.0 percent at 6,932.30 (close)New York – Nasdaq Composite: UP 2.2 percent at 23,031.21 (close)London – FTSE 100: UP 0.6 percent at 10,369.75 (close) Paris – CAC 40: UP 0.4 percent at 8,273.84 (close)Frankfurt – DAX: UP 0.9 percent at 24,721.46 (close)Tokyo – Nikkei 225: UP 0.8 percent at 54,253.68 (close)Hong Kong – Hang Seng Index: DOWN 1.2 percent at 26,559.95 (close)Shanghai – Composite: DOWN 0.3 percent at 4,065.58 (close)Euro/dollar: UP at $1.1825 from $1.1777 on ThursdayPound/dollar: UP at $1.3615 from $1.3531Dollar/yen: UP at 157.09 yen from 157.04 yenEuro/pound: DOWN at 86.82 pence from 87.04 penceWest Texas Intermediate: UP 0.4 percent at $63.55 per barrelBrent North Sea Crude: UP 0.7 percent at $68.05 per barrelburs-jmb/nro