US sinks international deal on decarbonising ships

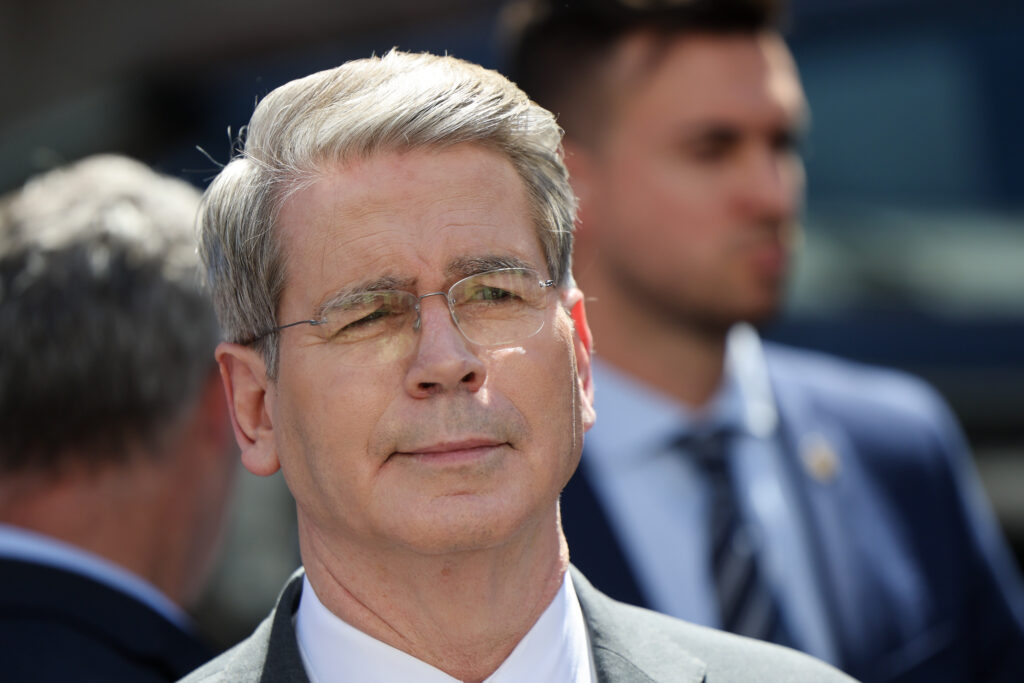

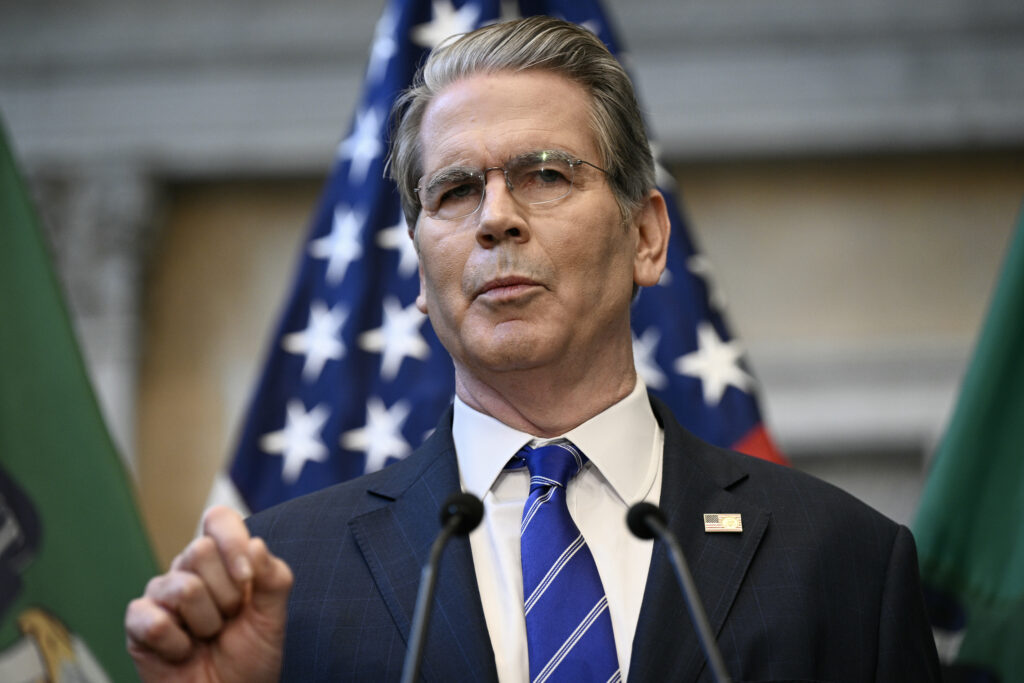

An international vote to approve cutting maritime emissions was delayed by a year Friday in a victory for the United States, which opposes the carbon-cutting plan.The London-based International Maritime Organization (IMO), a United Nations body that governs shipping, voted in April for a global pricing system to help curb greenhouse gases.But a vote Friday on whether to formally approve the deal was delayed until next year after US President Donald Trump threatened sanctions against countries backing the plan.Increased divisions, notably between oil-producing nations and non-oil producers, emerged this week at meetings leading up to Friday’s vote.Delegates instead voted on a hastily arranged resolution to postpone proceedings, which passed by 57 votes to 49.Trump had said Thursday that the proposed global carbon tax on shipping was a “scam”, after the United States withdrew from IMO negotiations in April.A Russian delegate described the proceedings as “chaos” as he addressed the plenary Friday after talks had lasted into the early hours.Russia had joined major oil producers Saudi Arabia and the United Arab Emirates in voting against the carbon-reduction measure in April, saying it would harm the economy and food security.IMO Secretary-General Arsenio Dominguez, representing 176 member states, said Friday that he hoped there would be no repeat of how the week’s discussions had gone.”It doesn’t help your organisation, it doesn’t help yourself,” he told delegates. A European Union source told AFP that “many countries have changed their minds under pressure from the United States.A spokesman for UN chief Antonio Guterres called it “a missed opportunity for member states to place the shipping sector on a clear, credible path towards net zero emissions”.The International Chamber of Shipping, representing more than 80 percent of the world’s fleet, also expressed disappointment.”Industry needs clarity to be able to make the investments needed to decarbonise the maritime sector,” its Secretary General Thomas Kazakos said in a statement.- Trump ‘outraged’ -Since returning to power in January, Trump has reversed Washington’s course on climate change and encouraged fossil fuel use by deregulation.”I am outraged that the International Maritime Organization is voting in London this week to pass a global Carbon Tax,” Trump wrote on his Truth Social platform Thursday. “The United States will NOT stand for this Global Green New Scam Tax on Shipping,” he added, telling countries to vote against it.Washington threatened to impose sanctions, visa restrictions and port levies on those supporting the Net Zero Framework (NZF), the first global carbon-pricing system.Major oil-producer Saudi Arabia also called for Friday’s vote to be postponed.”We agree with the United States that it’s important that these conversations are brought to light,” a Saudi representative said.Ahead of this week’s London gathering, a majority 63 IMO members that in April voted for the plan had been expected to maintain their support and to be joined by others to formally approve the NZF.Argentina, which in April abstained from the vote, now opposes the deal. Leading up to Friday’s decision, China, the EU, Brazil, Britain and several other members of the IMO reaffirmed their support.The NZF requires ships to progressively reduce carbon emissions from 2028 or face financial penalties.Shipping accounts for nearly three percent of global greenhouse gas emissions, according to the IMO.The plan would charge ships for emissions exceeding a certain threshold, with proceeds used to reward low-emission vessels and support countries vulnerable to climate change.If the global emissions pricing system were adopted, it would become difficult to evade, even for the United States.IMO conventions allow signatories to inspect foreign ships during stopovers and even detain non-compliant vessels.burs-pml/js/rlp