Taiwan to keep production of ‘most advanced’ chips at home: deputy FM

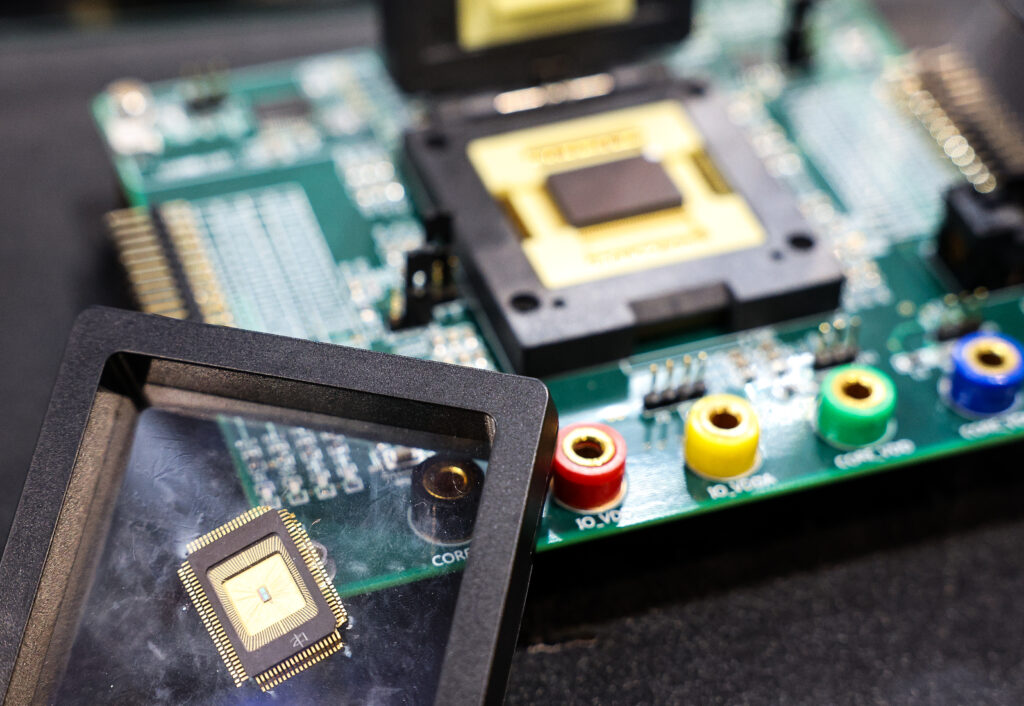

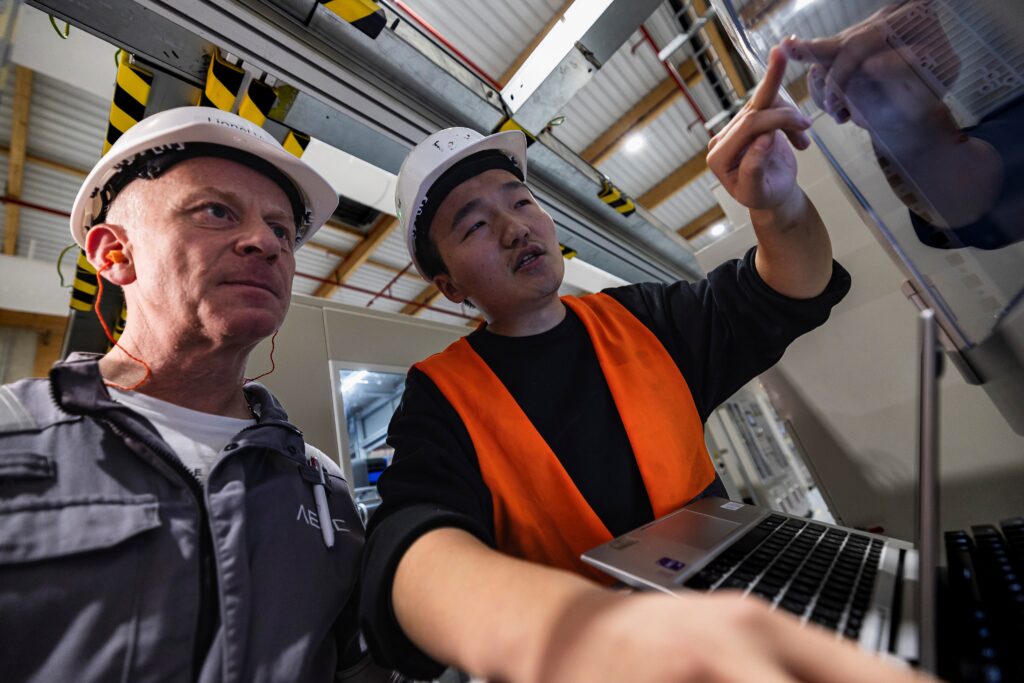

Taiwan plans to keep making the “most advanced” chips on home soil and remain “indispensable” to the global semiconductor industry, the deputy foreign minister told AFP, despite intense Chinese military pressure.The democratic island makes more than half of the world’s chips, and nearly all of the most advanced ones, that power everything from smartphones to AI data centres.Its dominance of the industry has long been seen as a “silicon shield” protecting it from an invasion or blockade by China — which claims the island is part of its territory — and an incentive for the United States to defend it.But the threat of a Chinese attack has fuelled concerns about potential disruptions to global supply chains and has increased pressure for more chip production beyond Taiwan’s shores.”We will try to maintain the most advanced technology in Taiwan, and to be sure that Taiwan continues to play an indispensable role” in the semiconductor ecosystem, Deputy Foreign Minister Francois Chih-chung Wu told AFP in an interview Wednesday. “I think it’s the same logic for every country, even countries not under such a very complicated geopolitical situation.”China has ramped up military pressure on Taiwan in recent years, deploying on an almost daily basis fighter jets and warships around the island. Taiwan has responded by increasing defence spending to upgrade its military equipment and improve its ability to wage asymmetric warfare. – ‘Core interest’ -The island does not have enough land, water or energy to accommodate the fabrication plants, or fabs, needed to meet soaring demand for chips, “so step by step we enlarge our investment in the world, but still linking with Taiwan”, said Wu, who was previously the representative to France.Taiwan’s TSMC, the world’s largest chipmaker, has already invested in fabs in the United States, Japan and Germany.And earlier this year the firm pledged to spend an additional US$100 billion on US chip plants, as President Donald Trump threatened to impose tariffs on overseas-made semiconductors.However, replicating TSMC’s factories in the United States is full of challenges, said Wu, citing Taiwan’s “very special culture to make the semiconductors very well”.The best way to reduce risks to the chip industry was not to move fabs abroad but to “prevent the war”, Wu said.US Secretary of Commerce Howard Lutnick said recently he had proposed to Taiwan a 50-50 split in chip production, an idea that Taipei rejected.While Washington is Taiwan’s most important security backer, some of Trump’s comments about the island and flip-flopping on Ukraine have raised doubts over his willingness to defend it. Wu, however, expressed confidence that the United States, as well as Europe, would respond to a Chinese attack on Taiwan in order to protect their “national interest” in the region.”It just happens that your interest and Taiwan’s interest we share together,” Wu said. Those interests, he said, included the semiconductor industry but also peace, and freedom of navigation in the Taiwan Strait, which is a key international shipping route. “I think Donald Trump understands better and better, day by day, the strategic importance of Taiwan… and will defend American interests in his own way,” Wu said.”We are the core interest of China, but we are also a core interest of the US.”