Trump warns no country ‘off the hook’ on tariffs

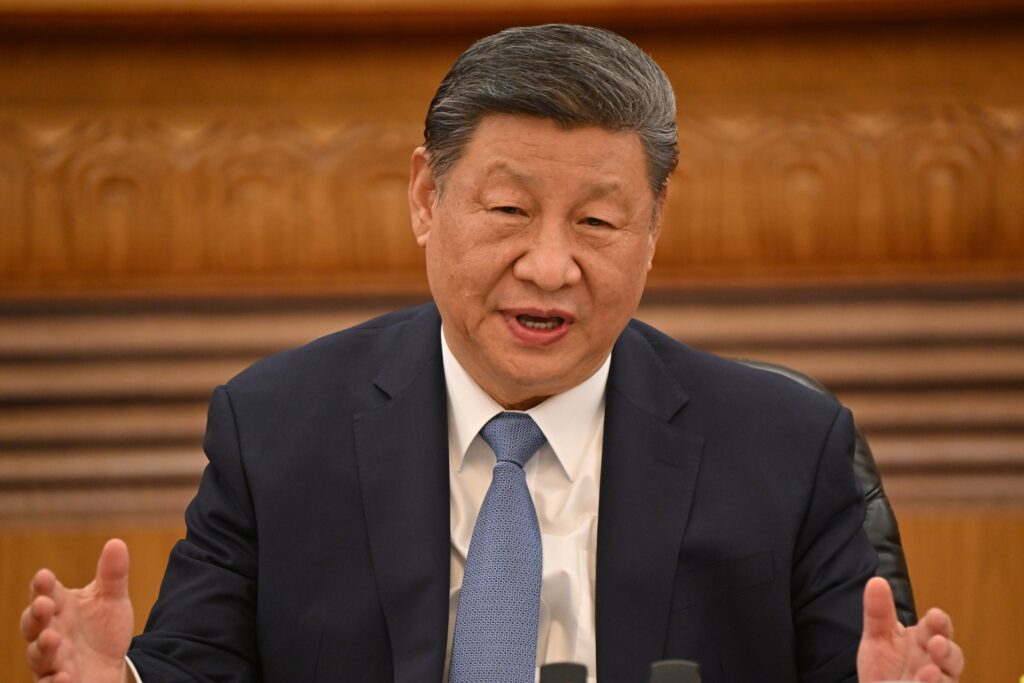

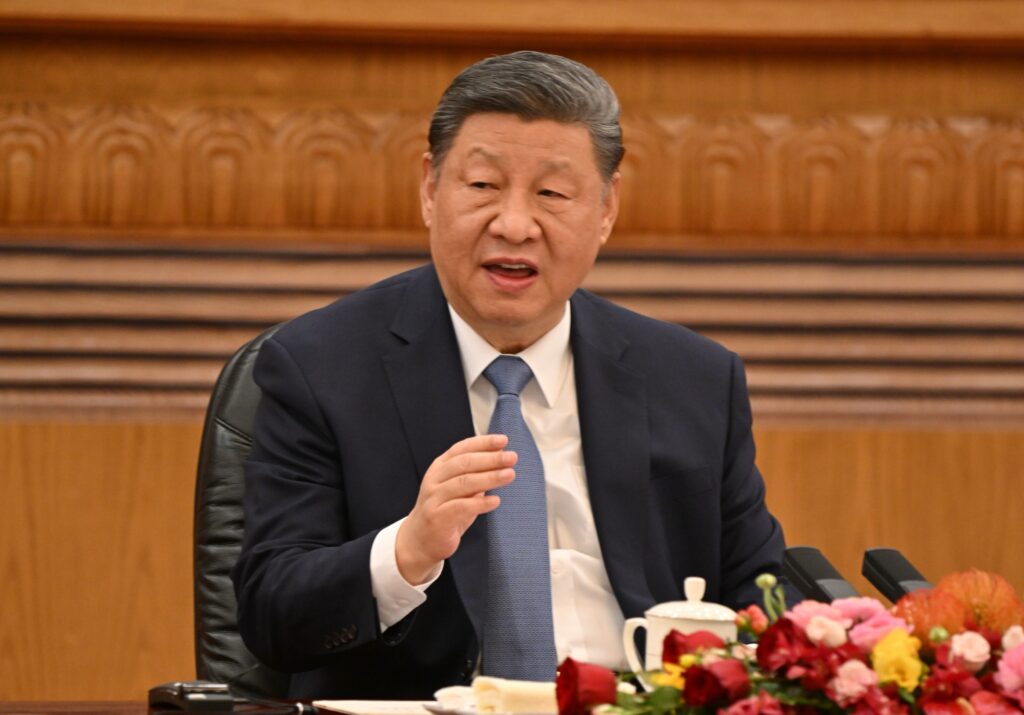

US President Donald Trump warned Sunday that no country would be “getting off the hook” on tariffs, as his administration suggested exemptions seen as favoring China would be short-lived.The world’s two largest economies have been locked in a fast-moving, high-stakes game of brinkmanship since Trump launched a global tariff assault that particularly targeted Chinese imports.Tit-for-tat exchanges have seen US levies imposed on China rise to 145 percent, and Beijing setting a retaliatory 125 percent band on US imports.The US side had appeared to dial down the pressure slightly on Friday, listing tariff exemptions for smartphones, laptops, semiconductors and other electronic products for which China is a major source.Trump and some of his top aides said Sunday that the exemptions had been misconstrued and would only be temporary as his team pursued fresh tariffs against many items on the list. “NOBODY is getting ‘off the hook’… especially not China which, by far, treats us the worst!” he posted on his Truth Social platform.Earlier, Beijing’s Commerce Ministry had said Friday’s move only “represents a small step” and insisted that the Trump administration should “completely cancel” the whole tariff strategy.Chinese President Xi Jinping warned Monday — as he kicked off a tour of Southeast Asia with a visit to manufacturing powerhouse Vietnam — that protectionism “will lead nowhere”.Writing in an article published in a Vietnamese newspaper, Xi urged the two countries to “resolutely safeguard the multilateral trading system, stable global industrial and supply chains, and open and cooperative international environment.”He also reiterated Beijing’s line that a “trade war and tariff war will produce no winner.”Asian stock markets rose Monday after Trump’s announcement of the tariff exemptions.- Short-lived relief? -Washington’s new exemptions will benefit US tech companies such as Nvidia and Dell as well as Apple, which makes iPhones and other premium products in China.The relief could, however, be short-lived with some of the exempted consumer electronics targeted for upcoming sector-specific tariffs on goods deemed key to US national defense networks.On Air Force One Sunday, Trump said tariffs on the semiconductors — which powers any major technology from e-vehicles and iPhones to missile systems — “will be in place in the not distant future.””Like we did with steel, like we did with automobiles, like we did with aluminum… we’ll be doing that with semiconductors, with chips and numerous other things,” he said. “We want to make our chips and semiconductors and other things in our country,” Trump reiterated, adding that he would do the same with “drugs and pharmaceuticals.”The US president said he would announce tariffs rates for semiconductors “over the next week,” while his commerce secretary, Howard Lutnick, said they would likely be in place “in a month or two.”The US president sent financial markets into a tailspin earlier this month by announcing sweeping import taxes on dozens of trade partners, only to abruptly announce a 90-day pause for most of them.China was excluded from the reprieve.The White House says Trump remains optimistic about securing a deal with China, although administration officials have made it clear they expect Beijing to reach out first.Trump’s trade representative Jamieson Greer told CBS “Face the Nation” on Sunday that “we don’t have any plans” for talks between the US president and his Chinese counterpart Xi.- China looks elsewhere -China has sought to present itself as a stable alternative to an erratic Washington, courting countries spooked by the global economic storm.Besides Vietnam, Xi will also visit Malaysia and Cambodia, seeking to tighten regional trade ties and with plans to meet his three Southeast Asian counterparts.The fallout from Trump’s tariffs — and subsequent whiplash policy reversals — has sent particular shockwaves through the US economy, with investors dumping government bonds, the dollar tumbling and consumer confidence plunging.Adding to the pressure on Trump, Wall Street billionaires — including a number of his own supporters — have openly criticized the tariff strategy as damaging and counterproductive.The White House insists the aggressive policy is bearing fruit, saying dozens of countries have already opened trade negotiations to secure a deal before the 90-day pause ends.”We’re working around the clock, day and night, sharing paper, receiving offers and giving feedback to these countries,” Greer told CBS.