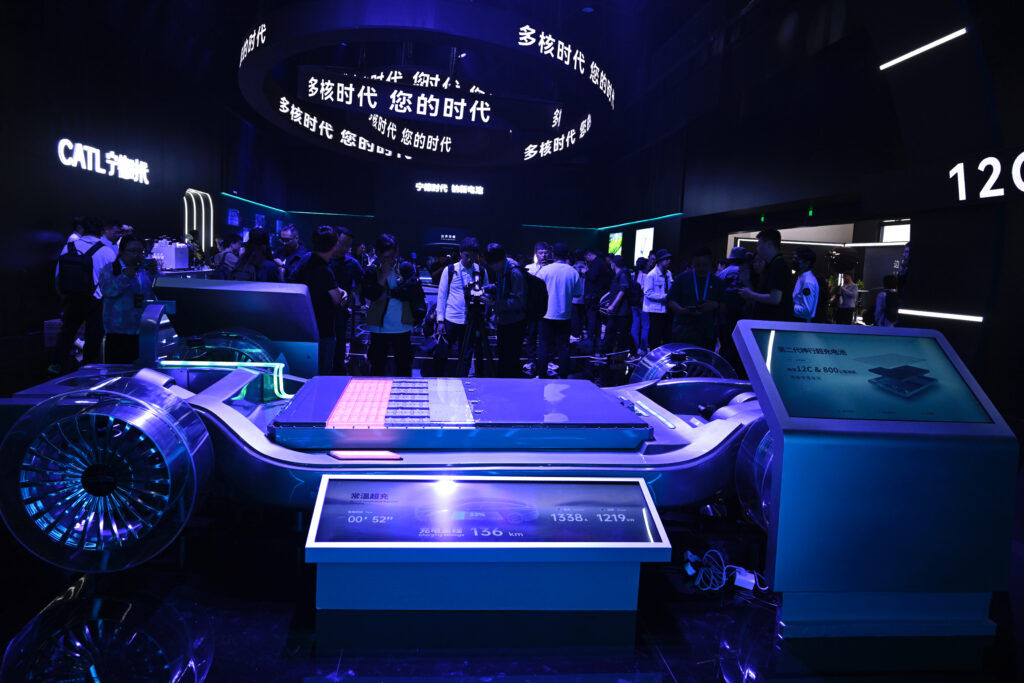

The world’s largest auto expo opened its doors Wednesday in Shanghai, showcasing the new electric world order even as mounting trade barriers risk dampening China’s global ambitions.With nearly 1,000 exhibitors present, foreign carmakers are raring to show they can keep pace with the ultra-competitive Chinese firms that dominate the sector’s electric frontier.Beijing’s historic backing of EV and hybrid development has seen the domestic market flourish, with firms on Wednesday taking the opportunity to demonstrate cutting edge technology and sophisticated design. “(Chinese brands) are really on the forefront of pushing the technology now, and have been for a few years,” said Stefan Rosen, the head of design for Lynk & Co, a joint venture between China’s Geely and Volvo. “I know that (foreign firms) are trying to catch up… but I would say still the industry is led through China,” he told AFP. Huge crowds gathered at domestic champion BYD’s booth as it unveiled five new Ocean series cars, as well as a luxury SUV under its sub-brand Yangwang, and a concept sports car under another, Denza. BYD has enjoyed a giddy few months of surging sales after annual revenue surged in 2024, eclipsing its rival, US titan Tesla, which is not present at the show.Others exhibiting range from state-owned behemoths, startups such as Nio and Li Auto, tech giants with skin in the game such as Huawei, and consumer electronics-turned-car company Xiaomi.Blaring press conferences touted advancements in fast charging, intelligent driving systems, and personalised luxury as influencers, journalists and business people wandered through the vast exhibition centre.- ‘In China for China’ -Vying to shore up sliding sales in a market they used to dominate, German companies on Wednesday pitched themselves as building cars “in China for China”.Volkswagen, the largest foreign group operating in the country, unveiled a series of new electric vehicles and a driver assistance system developed especially for the Chinese digital ecosystem. The group says it will launch more than 20 electric and hybrid models for the country by 2027. At the BMW booth, a foreign executive conducted a conversation in Mandarin with an AI assistant, before CEO Oliver Zipse rolled onstage in a futuristic white SUV from the upcoming “Neue Klasse” series.A separate version specifically tailored for China will be launched next year. “At BMW we will continue to advocate for… open markets,” Zipse said, adding that “global challenges require global cooperation” in an apparent reference to the current trade turmoil set in motion by the administration of US President Donald Trump.Ola Kallenius, CEO of Mercedes-Benz, told media that in 32 years of working in the auto industry, “I don’t think I’ve experienced a higher level of complexity”. He blamed “the mix between being in the middle of a transformation, and… a shifting geopolitical and economic and trade landscape”. – Tricky tariff terrain -Beijing and Washington are at an impasse after Trump’s tariff policy triggered a tit-for-tat escalation between the world’s two largest economies, leading to staggeringly high levies on both sides.Since last year, Chinese carmakers have also faced extra duties from the European Union. “The tariff is having an impact on our business, mostly on profitability,” said Xpeng’s co-president Brian Gu.”But, you know, we have a long-term commitment. We need to find a way to compete.”Nio’s president Qin Lihong told AFP that for now, the firm had not tariff-adjusted European retail prices, meaning it had “essentially given up the majority of the margins”. Long-term planning, patience and letting go of “unrealistic expectations of significant short-term growth” was key, he added. For the market as a whole, exports to Russia and the Middle East have helped cushion the tariff impacts, consultancy AlixPartners said Tuesday. And several carmakers told AFP on Wednesday that North America was not a target for them. “We want to prioritise the most important markets, which we have already entered,” Xin Tianshu, CEO of Leapmotor International, said. However, there are other, internal speedbumps ahead. The cutthroat domestic market is likely to eventually defeat many of the country’s dozens of carmakers. More broadly, China’s post-pandemic recovery remains wobbly. Low domestic consumption is a persistent issue, while concerns have been raised about overcapacity.