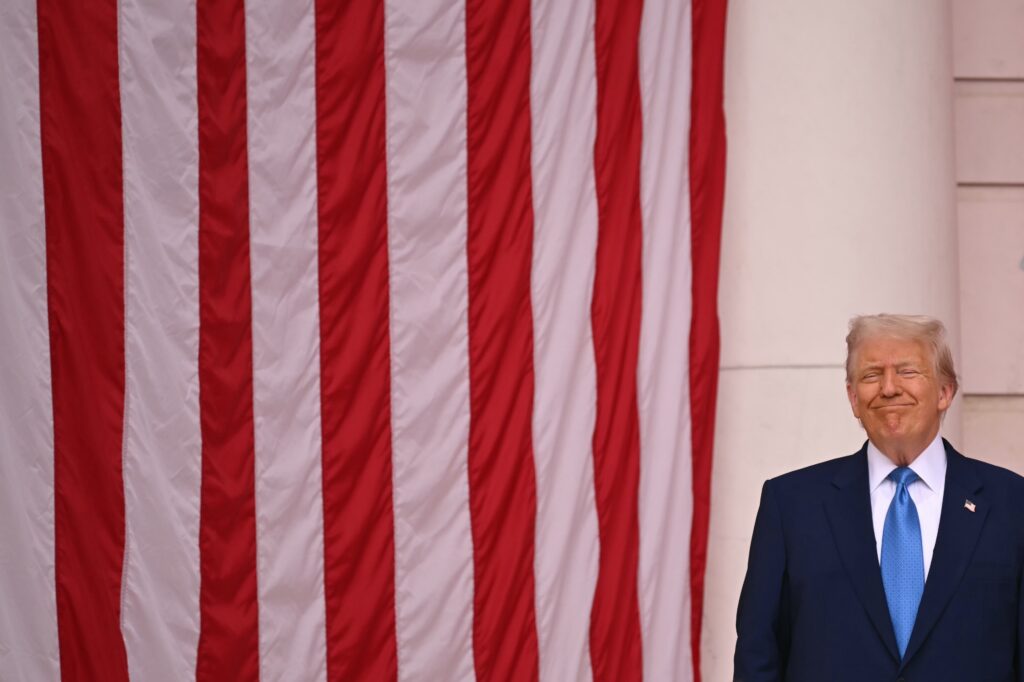

SE Asian nations express ‘deep concern’ over US tariffs

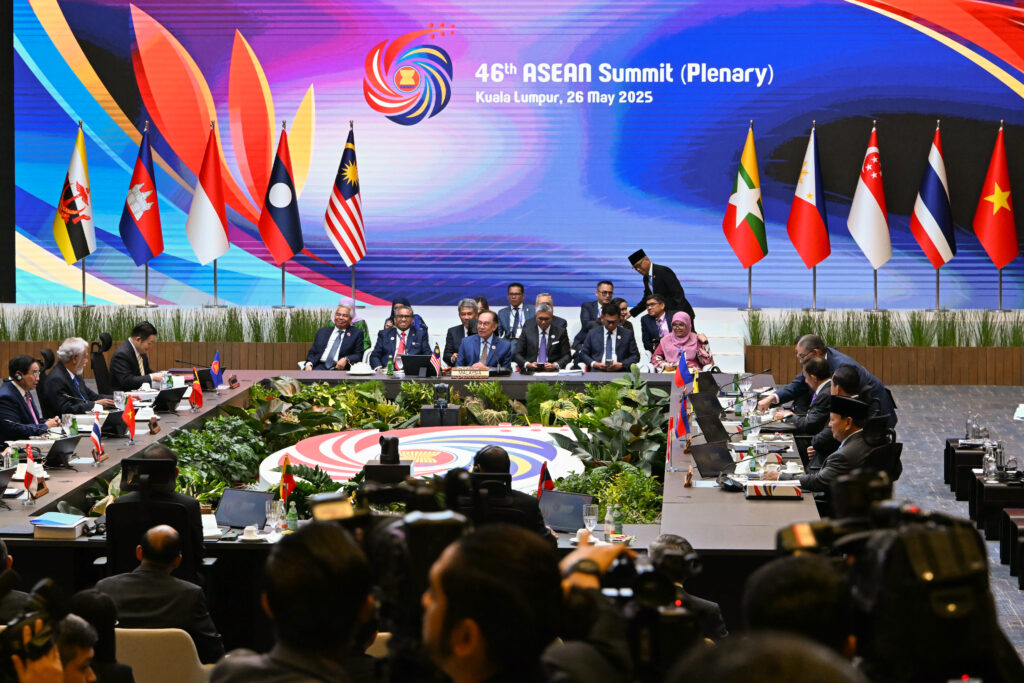

Southeast Asian leaders expressed “deep concern” over US tariffs Tuesday, as they held a summit with China and Gulf states hailed as “a response to the call of the times” in a geopolitically uncertain world. The trade-dependent economies are looking to insulate themselves after US President Donald Trump blew up global trade norms by announcing a slew of levies targeting countries around the world, then paused most for 90 days.The Association of Southeast Asian Nations (ASEAN) released a statement on Tuesday night expressing “deep concern over… the imposition of unilateral tariff measures, which pose complex and multidimensional challenges to ASEAN’s economic growth, stability, and integration”. In another statement, the bloc stressed “our strongest resolve to stand together” in the face of the levies, and pledged to expand cooperation with other partners. Earlier in the day Malaysia, which holds the bloc’s rotating chairmanship, hosted the inaugural summit between ASEAN, China and the Gulf Cooperation Council (GCC) — a regional bloc made up of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates. Chinese Premier Li Qiang told the meeting that “against the backdrop of a volatile international situation”, the summit was “a pioneering work of regional economic cooperation”.”This is not only a continuation of the course of history, but also a response to the call of the times,” he said. ASEAN has traditionally served as “a middleman of sorts” between developed economies like the United States, and China, said Chong Ja Ian from the National University of Singapore (NUS).With Washington looking unreliable these days, “ASEAN member states are looking to diversify”.”Facilitating exchanges between the Gulf and People’s Republic of China is one aspect of this diversification,” he said.- ‘Timely and calculated’ -China, which has borne the brunt of Trump’s tariffs, is also looking to shore up its other markets. China and ASEAN are already each other’s largest trading partners, and Chinese exports to Thailand, Indonesia and Vietnam surged by double digits in April — attributed to a re-routing of US-bound goods.Premier Li’s participation is “both timely and calculated”, Khoo Ying Hooi from the University of Malaya told AFP.”China sees an opportunity here to reinforce its image as a reliable economic partner, especially in the face of Western decoupling efforts.”ASEAN reiterated on Tuesday it would not impose retaliatory duties on the United States — in contrast to China. Beijing and Washington engaged in an escalating flurry of tit-for-tat levies until a meeting in Switzerland saw an agreement to slash them for 90 days.Chinese goods still face higher tariffs than most though. At dinner on Tuesday, Li urged ASEAN and the GCC to “persist in opening up”.- ‘Centrality’ -ASEAN has historically avoided choosing a side between the United States and China.China is only Southeast Asia’s fourth largest source of foreign direct investment, after the United States, Japan and the European Union, noted NUS’ Chong.At a press conference at the tail-end of the talks, Malaysian Prime Minister Anwar Ibrahim vowed ASEAN would continue engaging both Washington and Beijing.”The… ASEAN position is centrality,” Anwar said, adding “it makes a lot of sense to continue to engage and have reasonably good relations” with the United States”. Anwar said Monday he had written to request an ASEAN-US summit this year, with his foreign minister saying Washington had not yet responded.Closer alignment with Beijing presents problems of its own.On Monday, Philippines leader Ferdinand Marcos said there was an “urgent need” to adopt a legally binding code of conduct in the South China Sea.Beijing has territorial disputes with five ASEAN member states in the area, with China and the Philippines having engaged in months of confrontations in the contested waters.Anwar raised the South China Sea with Li and the Philippines, saying: “I’m not saying all issues can be resolved now but there was real positive engagement.”