Dazzling Chinese AI debuts mask growing pains

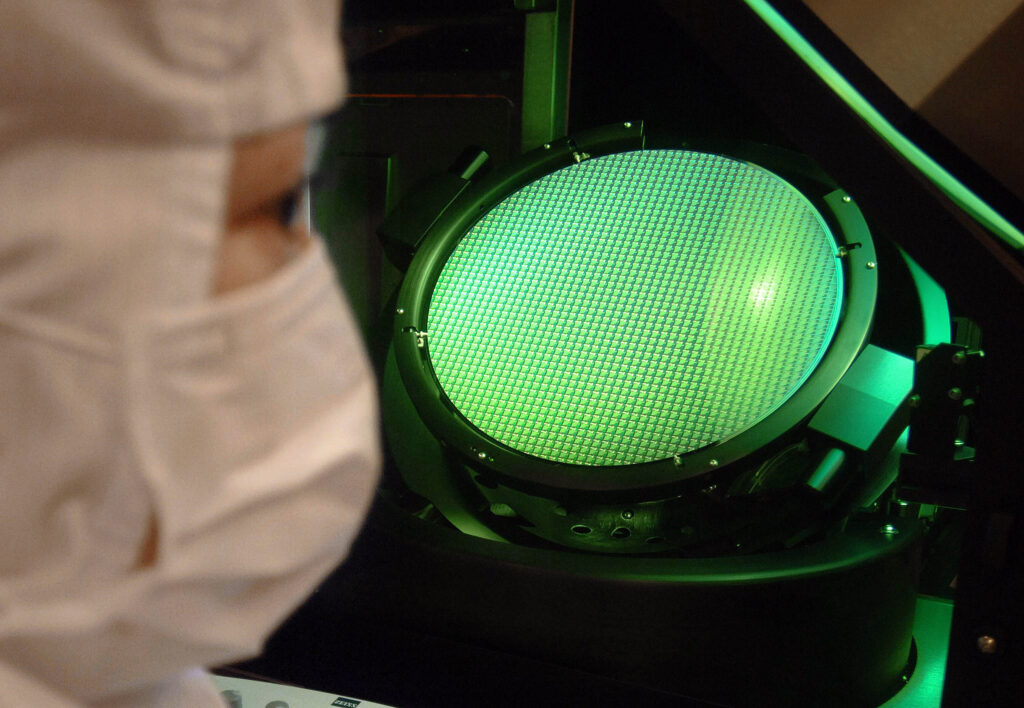

Investor confidence in Chinese AI startups is riding high, but obstacles to their long-term success range from US export controls to the puzzle of how to become profitable.This month, two leading players in China’s artificial intelligence industry, Zhipu AI and MiniMax, made dazzling debuts on the Hong Kong stock exchange.The pair are part of a wave of rapidly growing Chinese “AI tigers” spurred by another startup, DeepSeek, whose low-cost AI model, on par with US rivals, stunned the world a year ago.But Zhipu AI’s co-founder Tang Jie warned later that despite the achievements of Chinese companies in large open-source AI models, the gap with the United States “may actually be widening”.DeepSeek and other top Chinese AI providers have focused on free, open-source technology — a strategy that can attract users fast but brings in less cash than private, closed systems.”Large-scale models in the US are still mostly closed-source… we need to acknowledge challenges and gaps we face,” Tang said at a conference in Beijing.Geopolitical struggles could also hold Chinese AI back.US export sanctions on advanced microchips used to train and run AI systems, as well as precision chipmaking equipment, have been cited as a key constraint by top industry figures.”The challenge isn’t just technology,” Nick Patience, practice lead for AI at tech research group Futurum,told AFP.”It’s the high cost of computing under sanctions and the delicate balance of innovating within a strict regulatory framework.”- ‘Burning cash’ -Shares in Zhipu AI, a major provider of chatbot tools to Chinese businesses, have soared 80 percent since it went public.MiniMax, which targets the consumer market with its multimedia AI tools, has seen even stronger gains.Their IPOs came ahead of any such move from OpenAI, the San Francisco-based startup behind the phenomenally popular ChatGPT.Although OpenAI’s value has ballooned in funding rounds to a staggering $500 billion, it does not expect to be profitable before 2029 owing to huge outlays to build the computing infrastructure it relies on.Zhipu AI and Minimax are also logging increasing losses while costs, including for training new AI models, rise.Both are “burning cash faster than they can generate sustainable revenue streams”, analyst Poe Zhao, founder of Hello China Tech, told AFP.US restrictions bar the most advanced, energy-efficient AI chips on the market, made by US company Nvidia, from sale in China.Using domestic chipsets, Chinese AI developers need two to four times more computational power to train their models, according to Lian Jye Su, chief analyst at Omdia.Zhao and other analysts call 2026 a critical test for the global AI sector as it chases elusive monetisation prospects.Whether companies “can move beyond coding and unlock real commercial value” is vital to their survival, Zhao said.- Industrial uses -Koda Chen said his firm Suanova Technology, which provides and invests in computing power for Chinese AI companies, has identified opportunities in finance and healthcare.He sees this year as a “turning point” for China’s AI businesses to achieve profitability in more sectors.”Clients are developing payment habits, and products are gaining customer stickiness,” the Suanova CEO said.China is handing out massive subsidies to support AI innovation and its industrial policies also illustrate its ambition to compete with the United States in the sector.Beijing this month announced plans to deploy three to five general-purpose large AI models in manufacturing by 2027.The government said it also planned to strengthen supplies of computing power.These moves show the country is serious about AI driving the real-world economy, Futurum’s Patience said.China “is trying to build the AI-powered factory of the world”, he said.The large language model market in China, still in its early stages, is estimated to grow to $14.5 billion by 2030, according to consultancy Frost and Sullivan, with the future unit price of computing power expected to decline.China’s engineering talent base and the lower cost of generating electricity there work in its favour, said Tang Heiwai, an economics professor at the University of Hong Kong.”These factors would grant China greater resilience in development than the United States as an AI superpower”, he said.