Stocks rise as Trump delays tariffs deadline

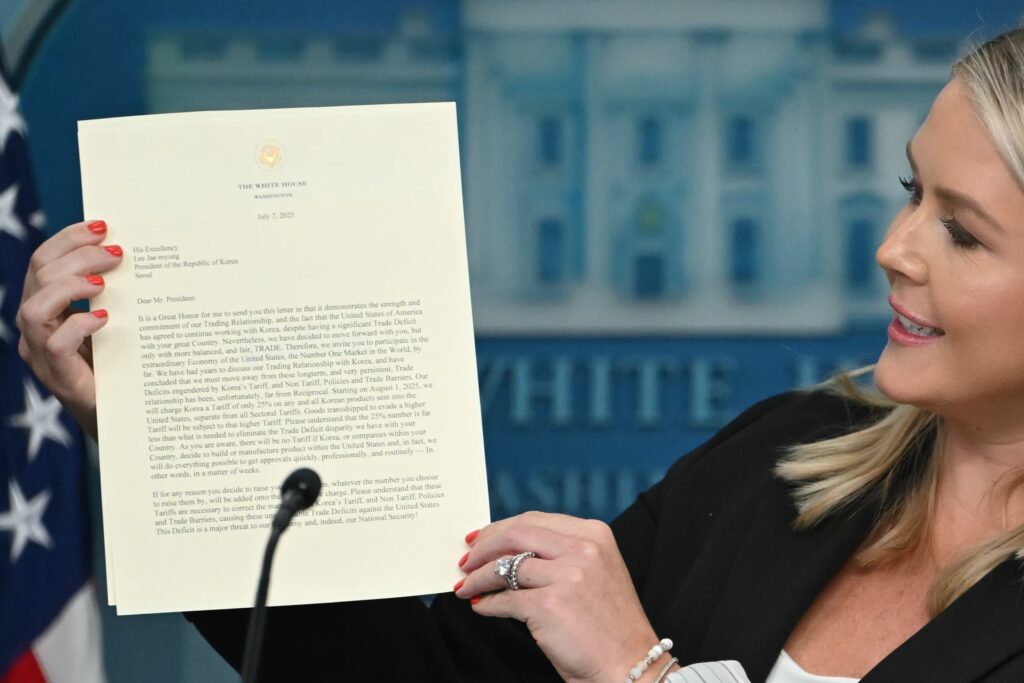

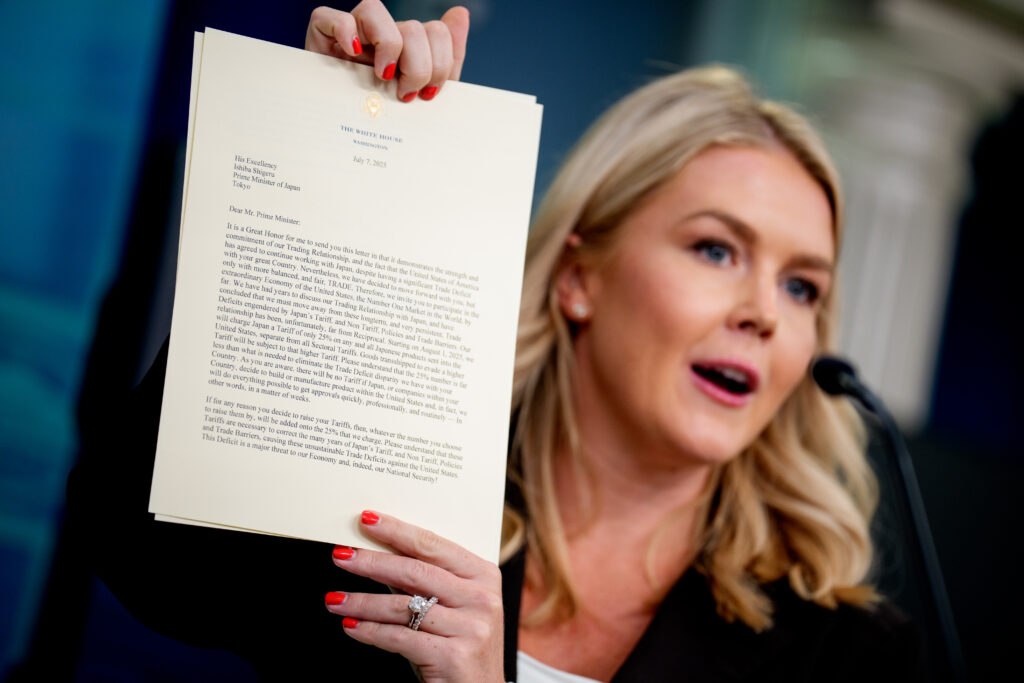

Major stock markets mostly rose Tuesday after President Donald Trump extended his tariffs deadline and hinted at a further pushback, though uncertainty over US trade policy capped gains.Shortly before the three-month pause on his “Liberation Day” tariffs was set to expire, Trump said he would give governments an extra three weeks to hammer out deals to avoid sky-high levies on exports to the world’s biggest economy.”The Trump administration’s latest announcements on tariffs offered some relief to financial markets,” noted AJ Bell investment analyst Dan Coatsworth.”On the flipside, this only extends the uncertainty with markets likely to spend the next three weeks trying to guess the ultimate outcome.”The dollar traded mixed against main rivals and oil prices dropped.Trump has sent out letters to more than a dozen countries — including top trading partners Japan and South Korea — setting out what he intends to charge should they not reach agreements by August 1, which replaces Wednesday’s deadline.Investors tentatively welcomed the delay amid hopes officials will be able to reach deals with Washington, with some observers seeing the latest move by the president as a negotiation tactic.The letters said Japan and South Korea would be hit with 25-percent tariffs, while Indonesia, Bangladesh, Thailand, South Africa and Malaysia faced duties ranging from 25 percent to 40 percent.When asked if the new deadline was set in stone, the president said: “I would say firm, but not 100 percent firm.”And asked whether the letters were his final offer, he replied: “I would say final — but if they call with a different offer, and I like it, then we’ll do it.”While Wall Street’s three main indices ended down Monday — with the S&P 500 and Nasdaq back from record highs — leading Asian and European stock markets rose.Wendy Cutler, vice president at the Asia Society Policy Institute, said the levies on Japan and South Korea “will send a chilling message to others”.”Both have been close partners on economic security matters,” she said, adding that companies from both countries had made “significant manufacturing investments in the US in recent years”.- Key figures at around 1030 GMT -London – FTSE 100: UP 0.2 percent at 8,823.12 pointsParis – CAC 40: FLAT at 7,722.91Frankfurt – DAX: UP 0.4 percent at 24,165.13Tokyo – Nikkei 225: UP 0.3 percent at 39,688.81 (close)Hong Kong – Hang Seng Index: UP 1.1 percent at 24,148.07 (close)Shanghai – Composite: UP 0.7 percent at 3,497.48 (close)New York – Dow: DOWN 0.9 percent at 44,406.36 (close)Euro/dollar: UP at $1.1732 from $1.1710 on MondayPound/dollar: DOWN at $1.3585 from $1.3602Dollar/yen: UP at 146.29 yen from 146.13 yenEuro/pound: UP at 86.34 pence from 86.09 penceWest Texas Intermediate: DOWN 0.4 percent at $67.67 per barrelBrent North Sea Crude: DOWN 0.2 percent at $69.45 per barrel