Dairy giant New Zealand endures butter price shock

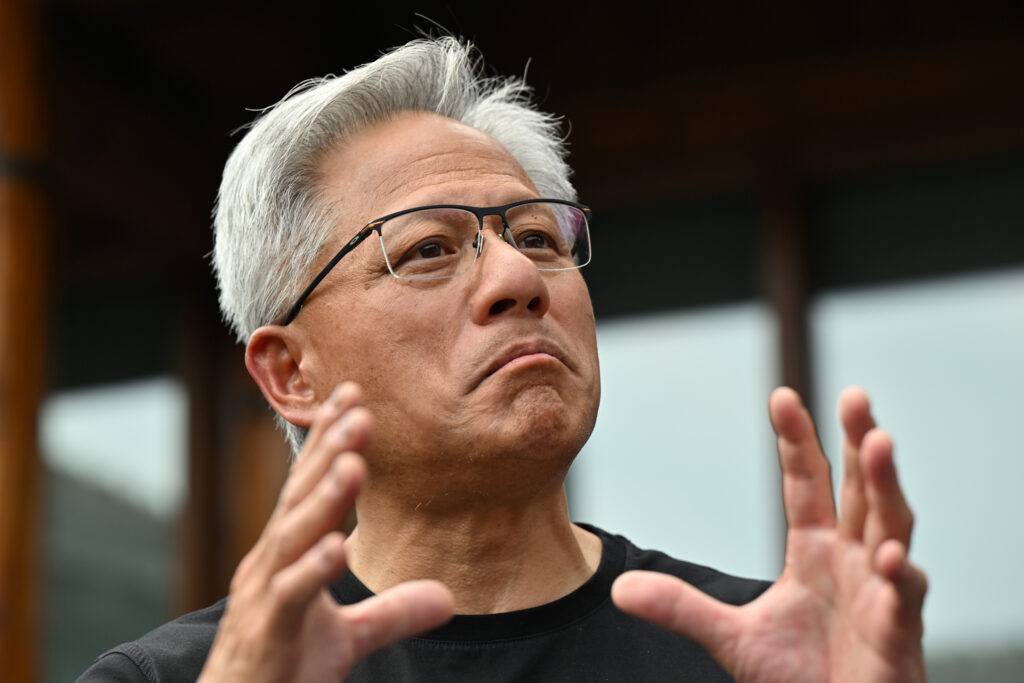

Butter prices have soared in dairy export giant New Zealand, latest figures showed Thursday, with local supplies cut short as the industry chases fatter profits overseas.The dairy price shock spreads as far as cheese and milk, leading one economist to suggest locals face the grim prospect of cereal without milk if they want to save money.Butter prices leapt 46.5 percent in the year to June to an average of NZ$8.60 (US$5.09) for a 500-gram (1.1-pound) block, according to official data from Stats New Zealand.Milk prices surged 14.3 percent over the same period, while cheese shot up 30 percent.High dairy prices have hit the headlines in New Zealand, with media outlet Stuff reporting that “exorbitant” prices are unlikely to “melt away” any time soon.Wholesale and retail store Costco restricted butter sales to a maximum of 30 blocks per customer in June, but still sold out, according to the New Zealand Herald.The prices are hurting consumers, said independent economist Brad Olsen, chief executive of Infometrics.”At the moment, I’m going with any other alternative I can find,” Olsen said of butter prices.”I’d also say, the cheap option for breakfast at the moment seems to be to try cereal without the milk.”The phenomenon was driven by international prices and demand, Olsen said.- Creaming off profits -Butter supplies had failed to keep up with rising demand over the past two years, he said.”New Zealand exports the vast majority of our dairy products. So if you’re a company that’s exporting butter, you’ve got to make a decision. Do you sell it at the international price overseas, or do you sell it cheaper in New Zealand?” the economist said.”No business is going to sell it cheaper… if they can get a better price overseas.”But while New Zealand consumers were feeling the price pinch, the overall economy was benefiting as exporters creamed off larger profits from sales overseas.”The sort of returns that our farmers and the primary sector more broadly are getting, and the economic benefit that brings, is actually far more substantial,” Olsen said. “It’s an extra NZ$4.6 billion (US$2.7 billion) that has been flowing into the economy from the higher dairy payout. That’s a significant boost.”New Zealand butter lovers are actually faring better than some, he said, adding they still pay 46 percent less than Americans.