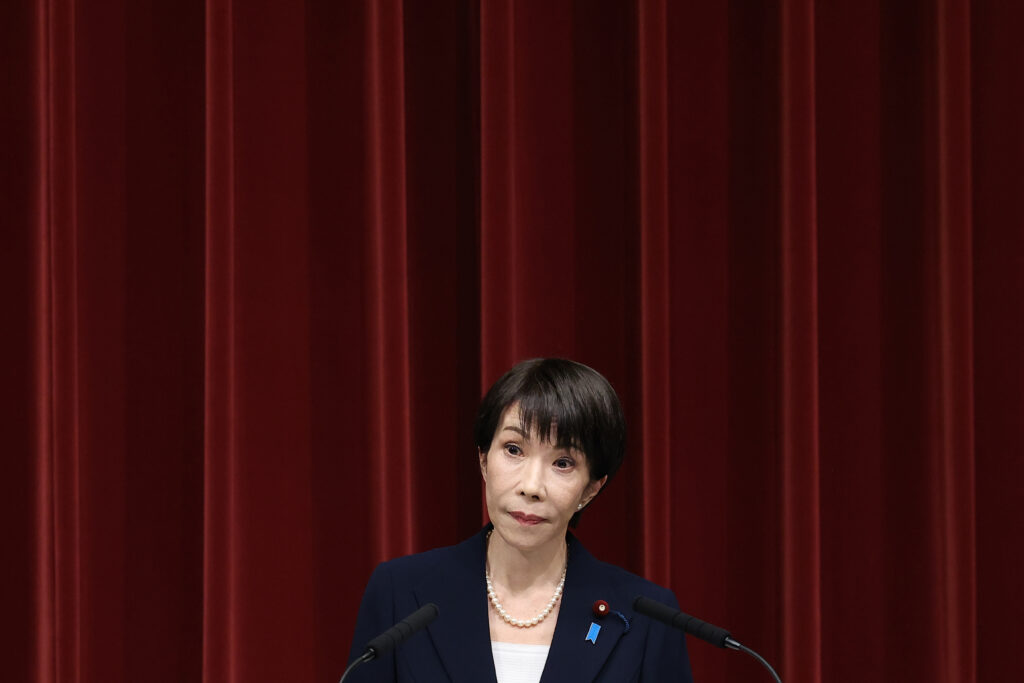

Ahead of a snap election in Japan, Prime Minister Sanae Takaichi has pledged to scrap a tax on food, but a lack of clear funding is unnerving markets and voters. As she announced the dissolution of parliament last week ahead of a February 8 vote, the ultra-conservative leader promised to exempt food products from an eight percent consumption tax for two years in response to soaring living costs. It’s a measure also strongly supported by opposition parties.But her comments immediately rattled the bond market, worried by the prospect of fiscal slippage, with yields on 30- and 40-year Japanese bonds jumping to record highs. That evoked fears of a repeat of the turmoil seen in Britain in 2022 when Prime Minister Liz Truss unveiled massive unfunded tax cuts that triggered a sharp spike in bond yields — eventually leading to her resignation. Takaichi is far from that point: markets calmed in the following days, and Japan’s modest budget deficit allows it to absorb shocks. “Japan is able to secure financing without relying on foreign money” thanks to its vast domestic savings, said Hideo Kumano, an economist at Dai-ichi Life. And unlike the UK at the time, it posts a sizeable current account surplus, he told AFP. Takaichi has repeatedly said Japan will post a primary budget surplus, which excludes the cost of servicing debts, for the first time in 28 years. A “Truss shock” is only one risk scenario, Kumano said, although the underlying danger “has been rising”.-‘Fiscal sustainability’-The tax break is expected to cost around 5 trillion yen ($32.8 billion) per year, but Takaichi has outlined no funding source or offsetting measures. Markets were already anxious over a colossal $135 billion stimulus package adopted at the end of 2025.That aims to support households through energy subsidies, even at the risk of inflating Japan’s gargantuan national debt, which is expected to exceed 230 percent of GDP in the fiscal year 2025-26.Under pressure, Takaichi defended her measure on Monday, saying she wanted to set up a public committee to discuss the issue, insisting she was paying “considerable attention to fiscal sustainability”.But a bigger majority in parliament could give her coalition free rein for expansionary fiscal policy. In the event of a landslide victory, UBS experts warned that Takaichi’s policies could even exceed market expectations and that renewed anxiety could push bond yields back up. In that case, “Takaichi may be forced to offset some of the expansionary fiscal measures announced recently with tightening elsewhere”, noted Marcel Thieliant, an economist at Capital Economics. The government could also opt to issue shorter-maturity debt, and, as a last resort, the Bank of Japan (BoJ) “could step up its bond purchases yet again”, he added. But it’s complicated. Any intervention in the bond market risks triggering a depreciation of the yen, making imports more expensive and putting further upward pressure on inflation.The foreign exchange market is already jittery. The yen has come under pressure amid renewed concerns over fiscal discipline, before it rebounded amid rumours of a possible joint Japan–US monetary intervention to boost its value. – ‘Election tactic’? -It’s unclear whether the tax break is even a vote-winner, although inflation is a top concern among voters.Consumer prices, excluding fresh food, rose 2.4 percent year-on-year in December.According to a poll published Monday by the Nikkei newspaper, 56 percent of those surveyed believe the promised tax exemption would not be effective against rising prices. “You can’t help wondering whether it’s just an election tactic,” Kanamu Kashima, a 23-year-old student, told AFP. The BoJ itself has slightly raised its inflation forecasts through 2027, pointing to pressure from labour shortages in the ageing country. That might lead to an increase in long-term yields, which adjust to these expectations. In the short term, Dai-ichi Life’s Kumano warned that structural reforms are being sidestepped. “A question must be asked about the real nature of the tax cut and… if it alone would do the job (of restoring the economy),” he said.”These policies are rather short-sighted.”